|

| By Chris Graebe |

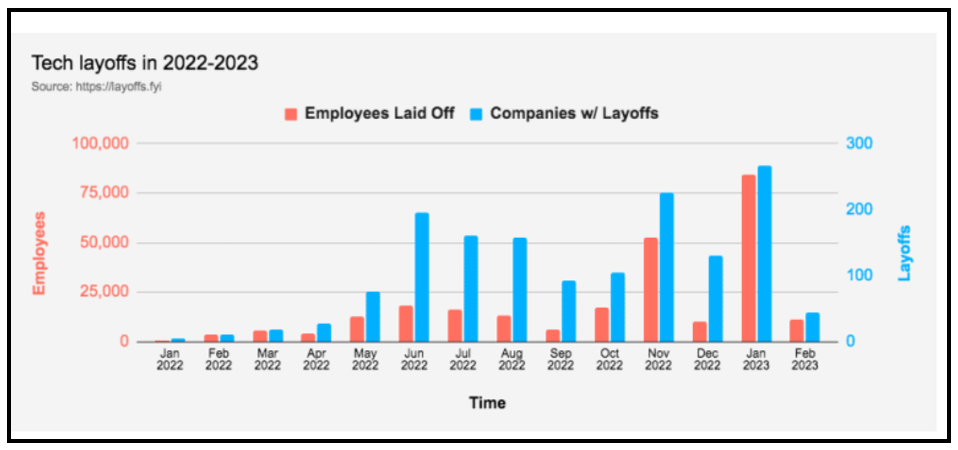

There has been a LOT of recent news about tech layoffs.

In 2023 alone, 93,000 workers in U.S.-based tech companies have lost jobs. That’s on top of 140,000 given pink slips last year, according to Crunchbase:

Click here to see full-sized image.

That’s mainly due to the fact that cash has been cheap to come by and there has been plenty of it. So, these tech giants have been staff-heavy for a while.

So, let's take a second and talk about the stock options that some of these former employees now own. You see, companies offer stock options — known as equity compensation plans — to their employees as part of their compensation for a while now.

Well, at tech companies, it's kind of the cherry on top of the employee benefits package. You get the option to earn or purchase said company's stock at a steep discount.

Best of both worlds, right? Well, that’s until there is a potential pending recession, and you get laid off. Some of these recently pink-slipped employees have a pretty easy path to liquidating those stocks on the open market, assuming they are fully vested and have access to them right away.

But how about those unfortunate folks who got let go from a private company and are holding a big bag of their former employer’s stock? What can they do?

Honestly, there are a limited number of options:

• They could do nothing and hold onto their shares. Or, if they have some extra capital and believe the startup will eventually go public, they could exercise any option they may have to scoop up shares at a discount before that option period expires.

• They may be able to transfer them to someone in their network like a friend or family member, but this can get a little tricky. And it definitely requires a securities lawyer to get involved.

• There might be a buy-back option from the startup. Now, someone might not like the terms they get in this current environment, but others might say, "Something is better than nothing."

Lastly, I want to talk about another. See, just like the portals and platforms we are used to in the Reg CF space, there are also platforms like Forge Global and Carta that make it possible for a former employee to sell their shares to private investors on these private secondary markets.

Essentially, the platforms help make these private shares available to the public while the company remains private.

Now, there are some regulations on who can purchase private shares off these platforms, such as:

• You must be an accredited investor. Also, smaller funds would be able to invest in these, as well.

• There is typically a minimum transaction amount of around $100,000.

• The value of the shares isn't really set like in an IPO or even a Reg CF, which means you could get a great deal or you could end up overpaying.

This is a unique way to pick up private shares in a company that hasn't gone public but still has some promising upside.

Now, time will tell how deep this stock liquidation will go and how strapped-for-cash some of these former employees are. I know I'll be watching how this all plays out and see which — if any — private companies see a significant number of private shares flood the private markets.

I’m also curious what you think! If you saw the private shares of a tech startup that seems to be a good deal, would you jump in it? Or are there too many unknowns for you? Click here and let me know.

And if you’re interested in the private equity deals that me and my team pick each quarter, you can join us over at Deal Hunters Alliance.

Until next time …

Happy Hunting,

Chris Graebe

Editor, Deal Hunters Alliance