|

| By Dawn Pennington |

Paramount leader Deng Xiaoping opened China’s economy to market forces in the 1970s and ’80s.

This is how China became the world’s second-biggest economy in virtually a single generation.

That economy grew at near-double-digit rates for 20 years.

Along the way, some 800 million of its people moved up into a middle-class standard of living.

Never in the history of human achievement have so many people’s lives improved so much in so short a time.

Those days are now long gone.

China got hammered hard by the 2008 Global Financial Crisis. And even harder by Covid.

Nobody knows for sure how many died. China’s Department of Civil Affairs stopped reporting funeral and cremation statistics.

Researchers study statistics that still are reported.

And those paint a grim picture.

Of the 1.4 billion population China once claimed, maybe 600 million to 800 million are actually alive today.

This is just one indicator that China’s once-high-flying economy appears to be circling a deflationary black hole.

Here’s another.

GDP deflator is the broadest measure of the prices of Chinese goods and services. It has now fallen for two consecutive years.

That’s the longest deflationary streak since official records began in 1993.

Then there’s China’s property market, which accounts for 70% of household wealth.

And it looks like it’s crashing on a scale that dwarfs America’s 2008 mortgage crisis.

Housing prices are down 30% and still falling. Average Chinese have already lost an estimated $18 trillion — with no end in sight.

This frightens a lot of folks.

As a result, more and more people who still have savings are scrambling to get their money safely outside the country.

Before the roof caves in.

Here’s some anecdotal evidence.

Several months ago, one of Shanghai’s richest families (worth an estimated $300 billion) executed an elaborate plan to secretly decamp and emigrate to Canada.

They did so without revealing their intentions to any friends or business associates.

Word only got out when smartphone videos — made by their moving company to document their work — leaked.

Those videos then exploded across Chinese social media.

That’s one of the higher-profile examples. But it’s part of a clear trend.

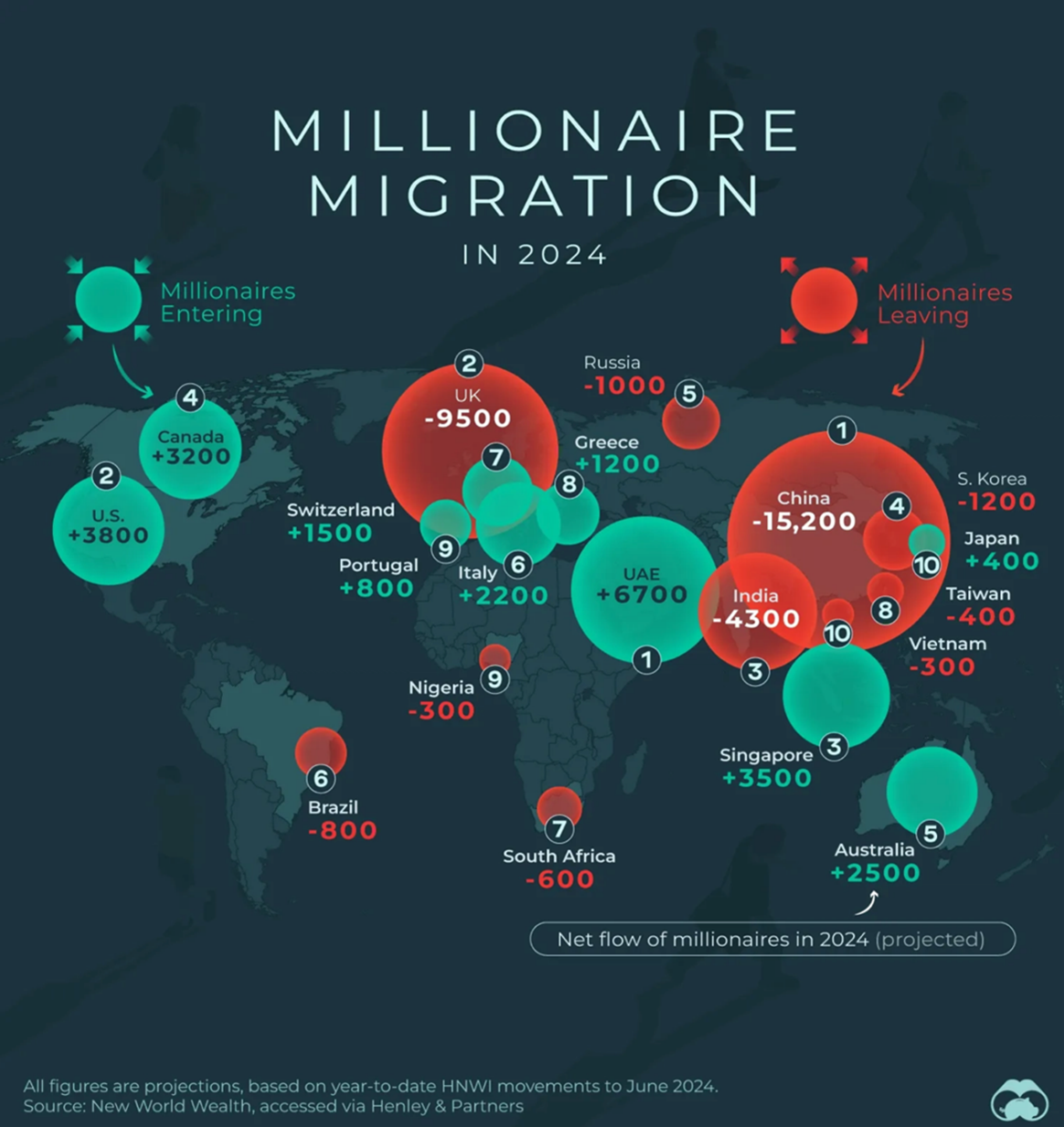

While the UAE and the U.S. are welcoming more millionaires …

China is hemorrhaging more millionaires than any other nation on earth.

The green circles (above) indicate capital inflows. The red circles, capital outflows.

And the world’s biggest red circle is China.

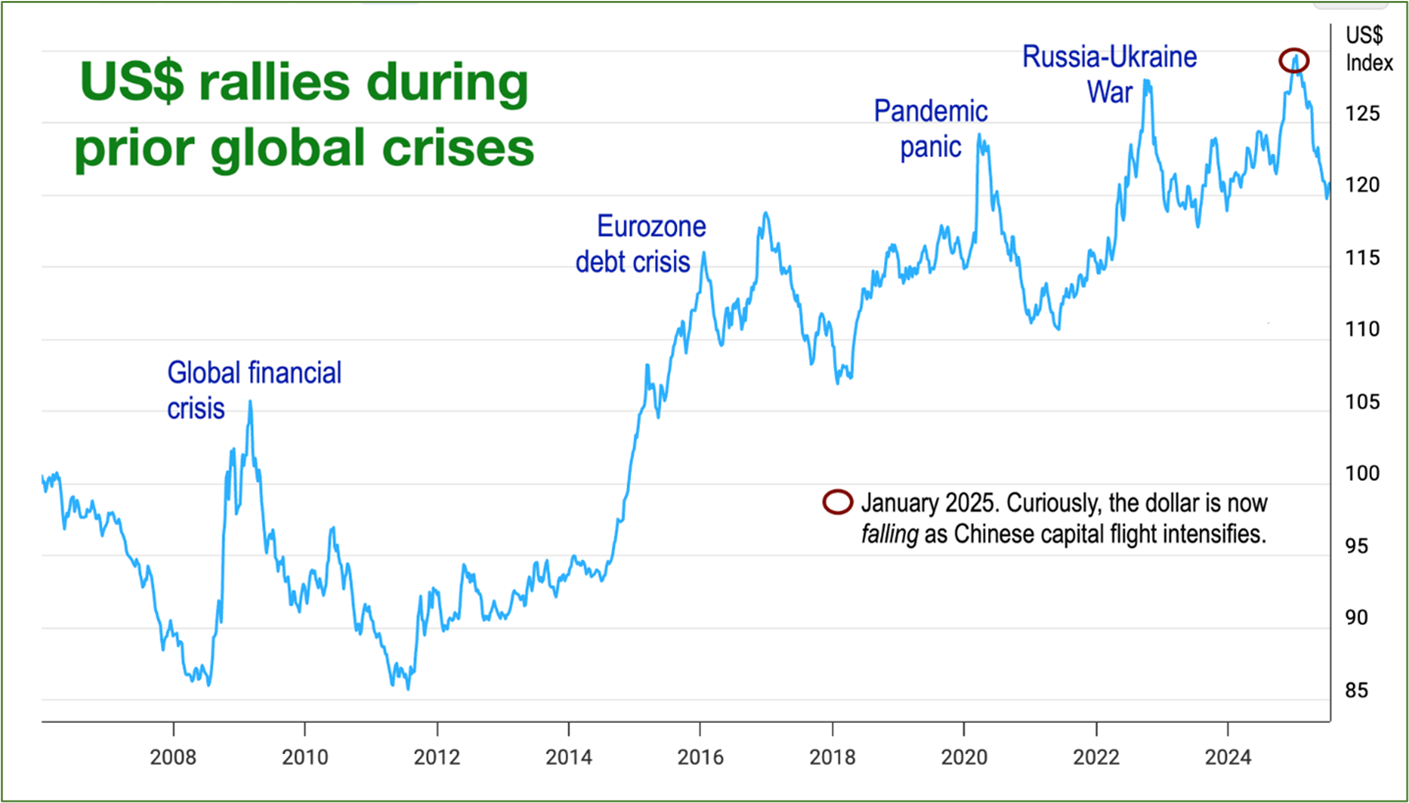

In times of crisis, nervous capital doesn’t chase yield. It craves safety.

In recent decades, this meant most of it flowed into U.S. dollars.

For example,

- The 2008 Global Financial Crisis,

- The Eurozone debt crisis,

- The COVID pandemic panic and

- The Russia-Ukraine war …

all coincided with notable U.S. dollar rallies.

This happened as worried investors sought the perceived stability of the U.S. financial system.

However, the greenback has basically been going down in 2025, just as Chinese capital flight intensifies.

So where is Chinese money going?

That’s not a question that’s easy to answer.

As far as Beijing is concerned, transferring more than $50,000 (per year) abroad without hard-to-get government approval qualifies as money laundering.

And that activity gets criminalized accordingly.

Because of this, many capital transfers are forced underground. This makes them almost impossible to identify and track.

One exit strategy is overpaying for imports.

Another is sending art or antiques to an overseas auction house, and never bringing sale proceeds back to China.

A third option is the one I want to bring to your attention.

Gold.

It’s physically in a form that offers a lot of wealth in a very small package.

Sure, if you move millions at once, you’ll start straining your back.

But it is a lot easier to move than most in this digital — and digitally traceable — world.

And it is popular in China!

In fact, according to this wild NYT story, “In the first three months of the year, Chinese investors bought roughly 124 metric tons of gold bars and coins, a 12% rise from the previous year.”

That demand adds up.

And along with Sean Brodrick’s other five gold drivers from yesterday, we should see new all-time highs in the precious metal’s price soon.

While you can join investors in China with gold bar and coin purchases, there’s a better way …

Watch it to the end to find out exactly what he recommends you buy AHEAD of the next stage of the gold rally.

To your health and wealth,

Dawn Pennington

Editorial Director