|

| By Chris Graebe |

Editor’s note: Today you’ll meet a venture capitalist who surprisingly took Paris by storm. You’ll also see how investors like you can get into an exciting new startup — that’s set to eat Elon Musk’s lunar lunch — long before VCs get their shot. Click here before midnight tonight before this opportunity takes off.

Team USA took home 126 medals from the 2024 Paris Olympic Games. It tied with China for the most golds.

And their paths to those 40 gold medals are as unique and compelling as their respective feats of physical strength and showmanship.

One of the most incredible stories to come out of Paris belongs to a venture capitalist-turned-gold-medalist.

Kristen Faulkner got her shot to compete as a last-minute replacement for the U.S. cycling team.

She may have arrived late to the party — she started cycling seven years ago and competed at her current age of 31.

But she ended up winning two gold medals in some of the most unexpected and talked-about performances of the year.

But it’s Kristen’s story as a venture capitalist by day and cyclist by hobby that can teach us a lot about life — and investing.

A Sense of Venture

Kristen Faulkner grew up in Homer, Alaska, a small fishing town with less than 6,000 people. After high school, she went to Harvard to study computer science.

There, she got into rowing. She competed for two-and-a-half years and finished second at the Junior World Rowing Championship.

After graduating in 2016, she worked from coast to coast. First at Bessemer Venture Partners in New York and then at Threshold Ventures in San Francisco.

As an associate investor, her job was to search for investment opportunities, conduct due diligence, attend board meetings and generally work toward bettering the firms’ portfolios.

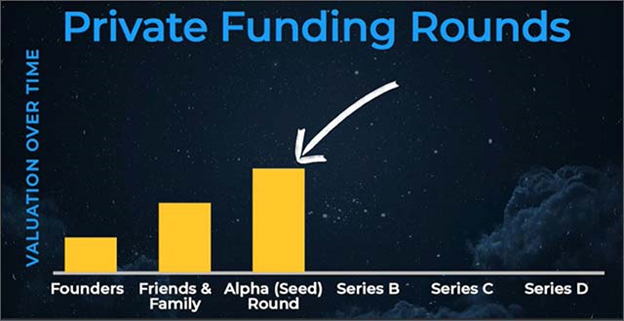

As many of you know, VCs invest in private companies that aren't traded on the regular stock market.

By the time a startup has reached the VC level of funding, a person of regular means can't invest.

Venture capitalists like Kristen are accredited investors who work as a part of a firm, funneling huge amounts of money into startups.

These startups have already passed through the angel investing stage of funding but haven't yet gone public, been acquired or had any other kind of exit.

Personally, as an alpha round investor, I only invest in startups during their earliest stages of funding — before the VCs get involved.

This is when the upside potential is the absolute highest, which allows me to get more equity per dollar spent.

At these early stages of funding, many companies offer rounds for non-accredited investors, allowing even the everyday investor to buy in — not just the big VC firms.

If you want to try your hand at startup investing, now is the best time ever. In the coming days, I’m revealing an investment opportunity in a revolutionary aerospace startup — before the VCs get their hands on it.

The best part is — this deal is open to just about anyone who wants to be part of it.

Click here to learn everything you need to know about this exciting new deal.

How Kristin Went

From Venture to Adventure

Kristen started cycling as a hobby in 2017, going for rides through Central Park in her spare time. She instantly fell in love with the sport.

Just three years later, while still working in venture capital, she went pro.

She balanced being a full-time athlete and a full-time investor for about a year before she decided to take a calculated risk and leave her lucrative venture capital career to pursue her dream of cycling.

Going into Paris in 2024, the U.S. women’s cycling team was full. Kristen hadn’t qualified for the team, just barely losing out after a second-place finish at the individual time trial national championships.

Shockingly, less than four weeks before the women’s individual road race, Team U.S. cyclist Taylor Knibb pulled out and Kristen was offered her spot.

It was the opportunity of a lifetime, and a dream come true. Her risk was paying off!

Fast forward to the big race …

With about three kilometers left to go of the 157.6 km event, Kristen found herself in the front pack of cyclists. In an incredible display of grit and endurance, she pushed ahead, breaking free from the rest of the group.

She was the first across the finish line, a full 58 seconds ahead of the next cyclist.

She won a gold medal, the first won by an American woman in the event in 40 years!

Three days later, Kristen competed alongside three of her fellow Team USA cyclists in the Team Pursuit event and won her second gold.

Kristen’s Philosophy

on Sports & Investing

Here’s a great quote from Kristen showing the mentality she brought from investing into cycling:

“If a VC thinks there’s a 50% chance the company is going to be successful, that doesn’t mean they go 50% all-in for the company. When you invest, assess the risk and make your decision, but then you go all-in. You don’t look back. You have to commit. I think that’s something that shaped me.”

This is a great philosophy to follow in life and as an investor.

Just like Kristen, if we want big changes, we need to take risks.

Want to be in the same place next year? Fine. Just stay on the same track.

Want to be better off next year? Great! But you will have to make a change.

If Kristen had been too risk-averse to leave her job and put all of her energy into cycling, she would never have won gold. Instead, she went all in.

Meanwhile, if you are too risk-averse with your portfolio, you may just beat inflation, but you won't significantly change your financial situation. No retail investor has ever built generational wealth off of blue-chip stocks, bonds and CDs alone.

This is why many choose to include startup investments in their portfolio. Early stage investing is the riskiest investment you can make — it also offers the highest possible rewards.

We all love the, “What if?” fantasies about investing in Facebook or Amazon before they went public. It’s one thing to talk about the fabulous wealth these and many more startups have made for their early investors — but are you taking the necessary risks to make that a reality?

Luckily, today, the barrier to entry for early stage investing is lower than ever. Just about anyone can take advantage of the high-risk, high-reward benefits of startups.

If you'd like to get in on the ground floor of an incredible investment opportunity in the projected $1.8 trillion space industry, click here.

I’ve had my boots on the ground and in their hangar — talking to the founders and doing due diligence. Now I’m just about ready to bring it to you.

Happy Hunting,

Chris Graebe