|

| By Tony Sagami |

There is so much quantitative tightening going on right now …

To quell the Silicon Valley Bank panic, President Biden and the Federal Reserve promised to protect all uninsured depositors.

In fact, the government invented a new emergency lending facility — the Bank Term Funding Program — to bail out Silicon Valley Bank and other distressed banks, like Signature Bank and First Republic.

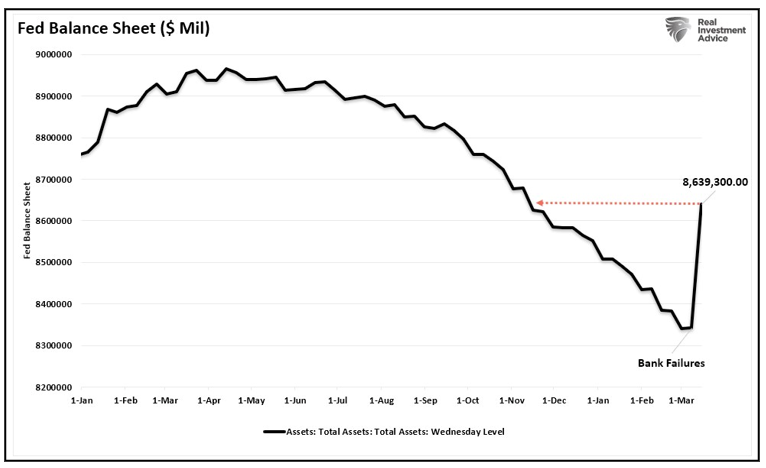

The result is that the Fed’s balance sheet increased by a whopping $297 billion last week to almost $8.7 trillion.

Guess what? That puts the Fed’s balance sheet not far from the previous all-time high.

What happened is the Fed bought billions of bonds on the open market to infuse money into the economy and reduce interest rates.

Normally, the Fed only expands its balance sheet to fight off recessions or an unexpected catastrophe.

Apparently, the Silicon Valley Bank failure qualifies as a catastrophe.

Desperate banks have borrowed about $300 billion from the Fed in the past week. Nearly half of that — $143 billion — went to Silicon Valley Bank and Signature Bank to pay off uninsured depositors.

On top of that, banks borrowed an additional $153 billion — an all-time record — from the Fed through a long-standing program called the discount window.

Banks can borrow from the discount window for up to 90 days, and $4–$5 billion is borrowed through this program in a normal week.

Click here to view full-sized image.

Here’s what is really going on.

When the economy falls into a recession, it rolls over in a very predictable pattern.

Investor optimism turns into pessimism, home prices fall, factory outputs shrink, corporate profits decline and unemployment increases.

All of the above has happened except for unemployment, as employment numbers remain strong. However, employment is a lagging indicator and the last shoe to drop.

So, fair warning … unemployment is about to spike.

Would You Like Fries with That, Sir?

Last week’s headline unemployment numbers looked strong with the creation of 311,000 new jobs. Well, 105,000 of those new jobs were low-paying jobs from the hospitality and leisure industry.

Those are not the type of jobs that Wall Street should get excited about.

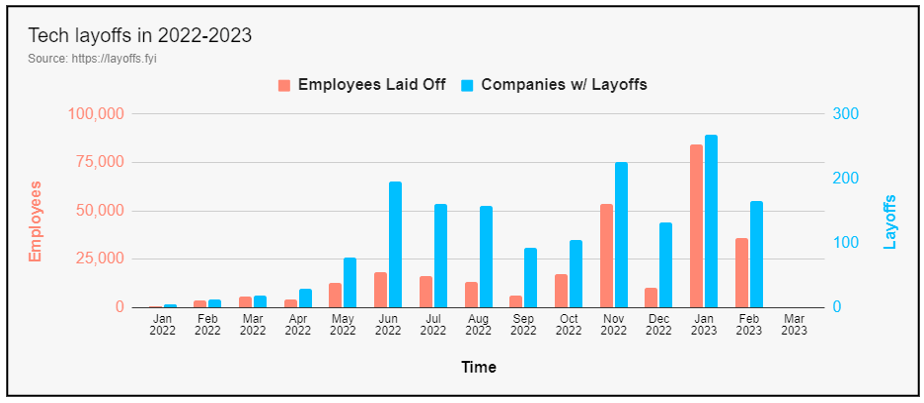

What Wall Street should be paying attention to is the job destruction going on in the tech world.

Here are the largest tech layoffs since November 2022:

Click here to view full-sized image.

More than 300,000 people have lost their jobs in the tech sector, more than double the number of tech layoffs during the bursting of the Dot-Com Bubble in 2001.

Click here to view full-sized image.

Last week, I wrote, “This is a time to purge your portfolio of high-volatility assets. Everybody loves upside volatility, but downside volatility is a portfolio killer.”

I am not saying that you should sell all your stocks. But what I am saying is you should swap your high-risk, high-volatility, high-beta stocks for low-beta, dividend-paying, blue-chip stocks.

To find out if any of your stocks are stock market powder kegs, just head on over to the Weiss ratings page to see what grade we give your stocks. Its highly accurate, unbiased and best of all, it’s free.

Anything rated below “B-” is not good enough in my book.

That’s it for today. I will be back with more soon.

All the best,

Tony

P.S. According to Weiss analyst Chris Graebe, the Silicon Valley Bank panic is already driving promising companies to for equity crowdfunding, an alternative funding source that allows regular, non-accredited investors to invest in early, pre-IPO companies. This presents a huge opportunity for Weiss members. On March 28, Chris is unveiling one such opportunity that is well positioned to disrupt a $100 billion industry. Click to learn more about how to claim an early stake.