|

| By Tony Sagami |

According to the latest retail spending report, Americans are back to their old spending ways.

The U.S. Department of Commerce reported that retail sales rose by an unexpectedly strong 0.7% in September, smashing the negative 0.2% decline Wall Street was expecting.

Plus, the August numbers were upwardly revised from a 0.7% increase to a 0.9% increase.

Ha, wait a minute! While these numbers seem strong on the surface, there’s a lot lurking beneath ...

For starters, the University of Michigan consumer sentiment survey just came in at 71.4 —below the 73.1 Wall Street was expecting and the second-worst reading in the past decade.

That sure doesn’t jive with the retail sales numbers!

So, what’s going on?

The answer is twofold:

Reason 1: Inflation

First, retail sales data are reported on a nominal basis, meaning they are NOT adjusted for price increases.

• It’s plain and simple ... inflation is the reason for the strong retail sales number.

The price of almost everything has gone up, which I’m sure you’ve noticed. So the strong retail numbers aren’t anything to get excited about. In fact, on an inflation-adjusted basis, retail sales actually shrank last month.

Here are two examples:

1. Grocery store sales rose by 0.7%, but Consumer Price Index (CPI) data show prices for food consumed at home rose by 1.2% in September.

2. The price of gasoline increased by 1.8% last month and accounted for a significant amount of those retail sales figures.

Yes, Americans are spending more … not because they want to, but because they have to due to inflation.

Reason 2: Service vs. Goods

This is very important, so pay attention: Retail sales are mostly made up of services like health care, hotels, restaurants, education, etc.

|

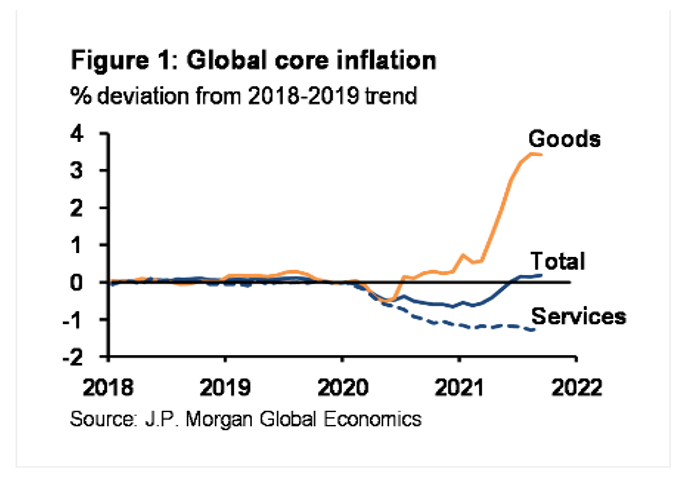

Since the onset of the COVID-19 pandemic, there’s been an incredible shift in consumer spending from services to goods, like food, autos, home electronics, commodities and housing.

These are things we need as opposed to things we want, like dining out, staying at hotels and getting pedicures.

The shift from discretionary to non-discretionary spending has been extraordinarily dramatic.

And the shift to goods is also one of the primary reasons behind supply chain disruptions and shortages. I wrote about this last week:

Here’s what’s most important: The growth baton is being passed from service stocks to production stocks. This is the key to making money in the stock market for the next few years.

Go back to the basics of “makers” and “takers.” The makers produce the things that we can’t live without, and the takers deliver them to the brick-and-mortar stores that we shop at.

That has big implications for investors:

• The Dow Jones Industrial Average (DJIA) will likely outperform the Nasdaq.

• Commodities are in high demand and prices are soaring. Look no further than aluminum, which is up more than 50% in the past year and at a 13-year high. Pssst: Gold and silver are commodities, too.

• The S&P 500 is made up of 11 sectors, and over the next 12 months, I believe you’ll make the most money in industrials, consumer staples, materials, real estate and energy.

One of the biggest mistakes I see investors making is that they’re chasing hot performance.

For the past decade, tech stocks have been the big winners and investors have piled into tech wunderkinds and paid little attention to risk and volatility.

• You see, everybody loves UPSIDE volatility because they make big gains. However, nobody likes DOWNSIDE volatility when the tide turns against them.

Bottom Line: Beware of overweight stocks that produce things and underweight stocks that provide services … especially service stocks that rely on things like eyeballs, page views and monthly active users.