|

| By Tony Sagami |

Lifetime politicians disgust me.

Washington, D.C., is full of corrupt idiots who do more harm than good … and letting them stay in power for around 30 to 40 or more years is insane.

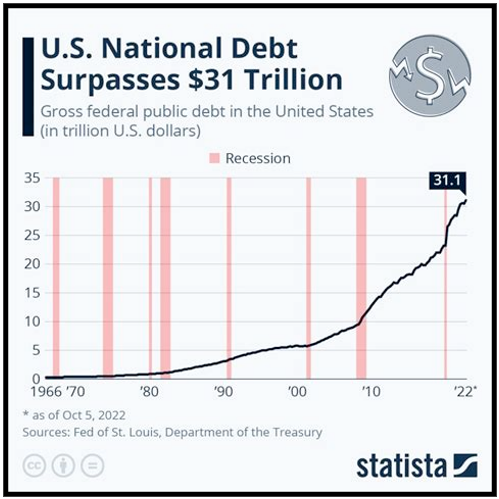

Prime example: Our national debt reached $31 trillion last month.

Click here to see full-sized image.

Yes, $31 TRILLION … which works out to about a quarter of a million dollars per U.S. taxpayer.

No other country on Earth comes close to spending as much money that it doesn’t have.

In fact, no nation in the history of the world has ever accumulated as much debt as the United States. Hell, nobody is even close.

That spend-a-thon has been gaining steam. Over the past fiscal year ending in September, the government added more than $1.136 trillion to our national debt. Yikes!

When President Biden was sworn in on Jan. 20, 2021, the U.S. national debt stood at $27.76 trillion. That's an increase of $2.5 trillion over the past year and an increase of $3.17 trillion during President Biden's tenure.

Sadly, nobody seems to care and acts like the size of our national debt doesn’t matter. Well, I’m here to tell you that debt nonchalance is about to change.

Spendthrift Insanity

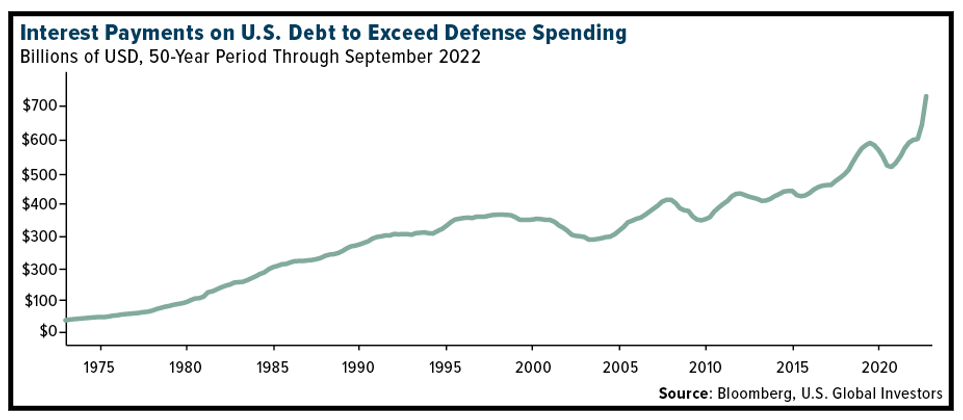

The Federal Reserve has been aggressively raising interest rates. There have been four 75 basis-point hikes so far this year, with another expected rate increase in December.

Those higher interest rates make mortgage rates, auto loans, credit card interest, business borrowing and the cost of servicing our national debt dramatically higher.

How much higher? Just the interest cost of serving our national debt is expected to pass $1 trillion this year! Plus, the carrying cost of our national debt will move from

the fifth-largest expense of the U.S. federal budget to as high as number two … only behind Social Security.

Click here to see full-sized image.

We will be paying more interest than our entire national defense budget. In Q3 of 2022, we spent $736 billion on interest compared to $714 billion for the national defense budget.

By law, the government can only borrow up to $31.4 trillion, and we are closing in fast on that limit. The national debt will hit $31.1 trillion this week and will hit the debt ceiling by January.

When will our unmanageable $31 trillion national debt blow up in our country’s face? Nobody knows, but the dramatic increase in interest rates could push our economy into a painful recession.

Many argue that our economy is already in a recession, but the effect of higher interest rates on our national debt could very well be the straw that breaks our economic back.

Bear markets are always painful, but bear markets during recessions hurt the most. Since 1948, the average bear market declines were:

• 25% during non-recessionary periods.

• And during recessions, an average decline of 35.9% with a duration of 280 days.

If the economy does fall into a recession, there will be a lot more downside to come. Here is a look at the past seven recessions:

• 1957: down 20% lasting 385 days

• 1980: down 17% lasting 415 days

• 1982: down 24% lasting 330 days

• 2001: down 30% lasting 435 days

• 1970: down 36% lasting 370 days

• 1974: down 45% lasting 480 days

• 2009: down 52% lasting 355 days

I am relieved that the midterm election insanity is behind us, but our country is still controlled by those lifetime politicians who don’t have the guts to put the brakes on runaway government spending.

And that means there will be a recession in the very near future.

So, 2023 is going to be challenging at best and painful at worst. I hope I am wrong, but I don’t think I am.

Either way, I’ll be sure to have a secure plan in place for you to ensure we’ll be able to navigate the choppy waters and safely come out the other side of all this.

Members of my trading service, Disruptors & Dominators, are currently sitting on open gains of 42%, 30% and 52%! Consider joining them now to shore up your future.

All the best,

Tony