|

| By Tony Sagami |

History shows that December is a very good month for the stock market.

The S&P has gained an average of 1.6% in the month December … more than double the 0.7% gain of every other month.

The week between Christmas and New Year’s Day is full of hope and optimism, and the stock market has historically reflected that.

The S&P 500 has gone up 75% of the time since 1945 during the last five trading days of December and first two days of January, also known as the Santa Claus rally.

The Santa Claus effect is even stronger in years like 2022, when the stock market has lost ground year to date. Since 1896, the Dow Jones Industrial Average has gained 2.2% from Christmas Day until Jan. 2.

Last year, the S&P 500 jumped 4.9% between Dec. 20, 2021, and Jan. 4, 2022.

In years when the stock market is showing a year-to-date gain, the average gain shrinks to 1.2%, which is still good but 54% lower on average.

Sweet Talk from Jerome

Adding fuel to the December fire was some very soothing monetary talk from Federal Reserve Chairman Jerome Powell. In fact, Powell promised that the Fed is ready to take its foot off the monetary brake pedal by saying …

“The full effects of rapid tightening have yet to be felt.”

“Makes sense to moderate the pace of increases.”

“Moderating pace of rate increases could come as soon as December.”

The stock market skyrocketed upon hearing those words last week: The Dow Jones Industrial Average jumped 730 points or 2%, the Nasdaq advanced by 4.4% and the S&P 500 gained 3.1%.

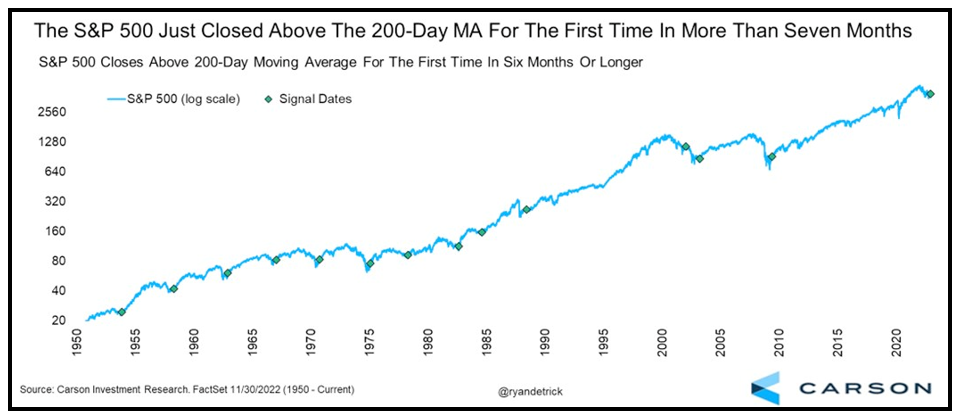

That 3.1% gain last Wednesday pushed the S&P 500 above its 200-day moving for the first time in seven months. Bull markets live above the 200-day moving average, so that was an important milestone.

What happens when the S&P 500 does break above its 200-day moving average?

Since 1950, the S&P 500 has traded below its 200-day moving average for six months or longer on 13 different occasions. Here’s the good part … in 12 out of the 13 times, only once did the S&P 500 go on to make a new low.

Instead, the average gain 12 months later was an impressive 18.8%.

Click here to see full-sized image.

Between Santa Claus, the month of December and a friendlier Federal Reserve, the stock market should be headed even higher this month and into 2023.

Bottom line: Savvy investors should not hesitate to take advantage of this present opportunity to take some nice Christmas gains well into the new year.

All the best,

Tony

P.S. Check out my premium service, Disruptors and Dominators, for more in-depth market analysis and recommendations. Members of my service are currently sitting on open gains of 42%, 34% and 21%!