These past two years have proven that this is a world where anything can happen. But let’s sit back and appreciate the investing moment at hand.

Right now, the economy is roaring, corporate America is flying high and gains for investors are there for the taking.

In 2022, profits are projected to reach $222.3 billion — the largest in history.

To get a piece of those profits, it’s important to know what trends to tap into and when. For insights, Financial News Anchor Jessica Borg turned to Weiss Ratings Senior Analyst Sean Brodrick, editor of Wealth Megatrends and Supercycle Investor.

You can watch the video segment or continue reading for the full transcript.

Jessica Borg (narration): The market has seen quite a year.

What can we expect in the months ahead?

Wealth Megatrends editor, Sean Brodrick, weighs in.

Sean Brodrick: All in all, I’m looking for more economic activity and more inflation in 2022, and so I’m positioning my subscribers toward the stocks that should do well in that environment.

JB (narration): That includes cobalt, a metal used in electric vehicle (EV) batteries.

SB: We’ve seen cobalt prices rally 117% this year.

The price of cobalt is now running around $35 a pound.

JB (narration): The global trend of EV sales is driving the price higher ... and another factor.

SB: Much of the cobalt, which is mined in the Congo — the world’s biggest supplier of cobalt — gets shipped out through ports in South Africa. South Africa, before pretty much everyone else, had the Omnicron variant, so that closed their ports for a while and that’s helped give a boost to the price of cobalt.

JB: Now, EVs don’t require a lot of cobalt, but it takes a long time for substitutes to be created.

SB: That’s probably 10 years down the road.

It takes a very long time to actually bring these new things into the market.

It takes a long time to invent them. It takes a long time to make them efficient, to actually produce them and it takes a long time for the market to adopt them broadly.

JB (narration): Another hot commodity is lithium.

SB: It’s an incredibly useful metal.

It’s now 26.6% above all-time prior highs, 450% from last year’s lows.

JB (narration): It has a starring role in EV batteries.

Check out the demand for lithium, projected into 2040.

SB: This green line right here — that’s demand!

Demand for lithium is growing at three times the rate of supply growth.

JB: What is the sweet spot for investing in lithium?

SB: We can see a big long-term supply-demand imbalance that isn’t going to be addressed at least for the next five years.

So, I think that’s the sweet spot for investing right now … five years is a great investment time frame.

JB (narration): In Supercycle Investor, he has picks for certain miners he sees as promising in the long term.

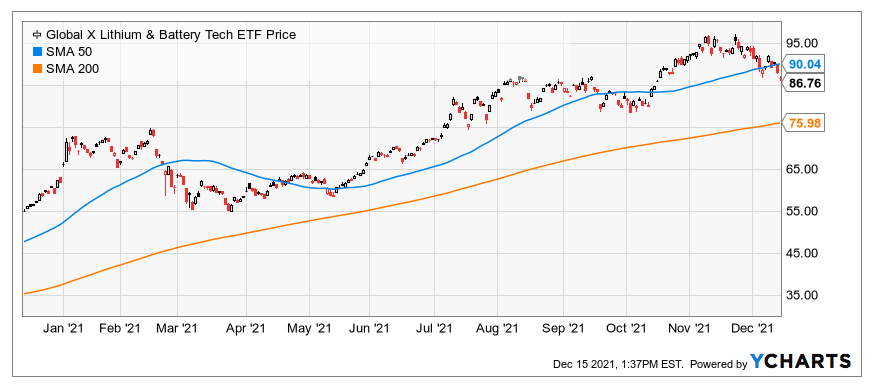

He also recommends Global X Lithium & Battery Tech ETF (NYSE: LIT) to gain exposure to lithium.

Tesla (Nasdaq: TSLA) is a top holding, along with a basket of other stocks.

SB: They are lithium miners, battery-makers, stocks that are leveraged to lithium in one way or another.

As the price of lithium goes up, LIT itself has also been going up.

The stocks in it are doing well and we have individual stocks that are up more than 100%.

JB (narration): Cybersecurity is also a sector to get in on.

This chart tracks “zero-day vulnerabilities,” which are weaknesses in software that hackers can exploit.

SB: The number of zero-day vulnerabilities discovered this year is more than twice the amount discovered last year.

As computers get more complex, they become easier to hack because there are more interdependent systems.

That’s why we’re seeing all these companies spend money on getting a very secure online presence … because they do not want to have happen to them what happened to some big-name companies in the past.

Their reputations are basically ruined, and they’re open to all sorts of lawsuits because customers’ user data was picked up off their website.

JB (narration): Over the next five years, the industry will grow rapidly.

SB: As the world becomes more dependent on automation — which is another big megatrend that I’m looking at for 2022 — hacking and cybersecurity will become more and more of an issue.

JB: Cybersecurity is a space that investors should not ignore, but individual stocks can be tricky.

SB: There are so many moving pieces.

They could be fine people running a fine company … and they still get hammered because there are so many forces in this market. And if they miss a product cycle or something like that, they will get left behind and their stock will crash.

They really have to be cutting edge.

JB (narration): Two exchange-traded funds (ETFs) with momentum are ETFMG Prime Cyber Security ETF (NYSE: HACK) and First Trust NASDAQ Cybersecurity ETF (Nasdaq: CIBR).

It’s a world where anything can happen … but right now, profits are here for the taking.

SB: We seem to be in an economic boom. It could be derailed by a whole bunch of things, but for now we’re in an economic boom.

JB (narration): So, ride the trends being swept up in the boom.

JB: Senior Analyst Sean Brodrick, great speaking with you. Thanks so much for your time and insights.

SB: Thank you very much. I had a great time.

Best wishes,

The Weiss Ratings Team