Secret AI Sauce Brings Life Back to This Mag 7 ‘Hold’

|

| By Michael A. Robinson |

What company comes to mind when I mention AI chips?

Did you say Nvidia?

That’s understandable. After all, Nvidia makes lightning-fast processors.

Its specialized chips handle tasks like machine learning and AI.

And because it provided the fuel for AI’s breakout, Nvidia grew into a multitrillion-dollar company.

Yet, from a profit standpoint, Nvidia isn’t the juiciest play these days.

Sure, I expect this stock to keep going up over the long haul.

But most of the life-changing gains have already occurred.

Don’t despair, though. Another company out there is also cranking out next-gen AI chips.

Just like Nvidia, it’s playing a key role in the $22.3 trillion AI Supercycle.

But unlike Nvidia, I believe this company could double its earnings in as little as 15 months.

Let me show you why …

A Refresher on the AI Supercycle

Before we dive into the company I’m talking about, let’s back up for a second.

You’ll recall I used the phrase “AI Supercycle” above. The capital letters are intentional.

That’s because companies around the world … in every sector … are spending heavily on AI.

They use it to upgrade their operations and grow profits.

All these trillions in investment are making AI even better and more widespread.

And that leads to even more investment and exposure.

The result: An AI Supercycle that will run full throttle for at least a decade.

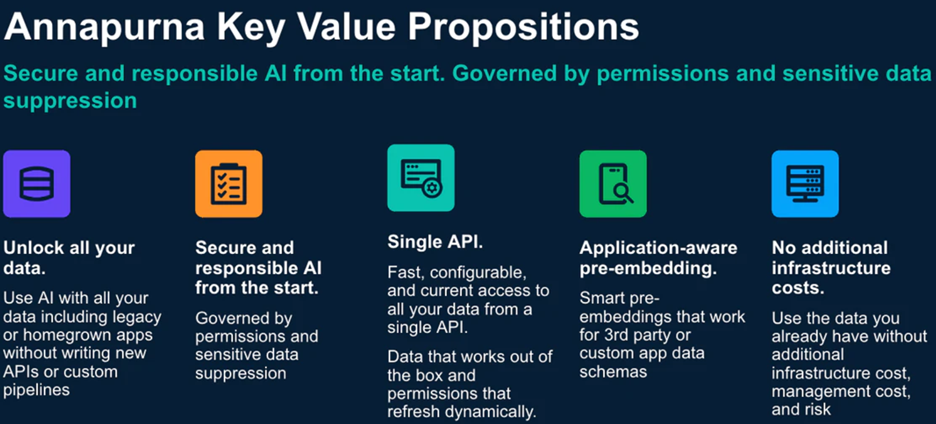

Meet a Quiet Chip Leader: Annapurna

For most investors, Nvidia remains front and central to the whole AI ecosystem.

But we may not have ever had a cycle like this if it weren’t for little-known companies like Annapurna Labs.

Born in 2011, Annapurna was based in Israel.

And it launched at an intriguing point in tech history.

At the time, most people in tech were focused on consumer products like smartphones and tablets.

Meanwhile, Annapurna’s cofounders were drawn more to infrastructure products — chips, servers and behind-the-scenes hardware.

It was difficult to build successful consumer products outside of the U.S.

So, Annapurna’s leaders focused on this overlooked, but lucrative, niche.

And as cloud-computing exploded over the next decade, demand for those types of infrastructure products did, too.

As a result, Annapurna became a hit.

And today, it’s a critical part of the AI Supercycle.

I’d love to recommend this company as an investment. Heck, I’d love to scoop up shares of it myself.

The thing is, Annapurna isn’t eligible for investment.

However, we can invest in the company that acquired it …

A Buyer You’re All Familiar With

Ten years ago, Annapurna was acquired by Amazon (AMZN) for around $400 million.

You’re no doubt familiar with Amazon.

It’s the e-commerce giant that lets you buy everything from clothes to groceries to electronics online.

And it’s one of the five largest companies in the world based on market cap.

Perhaps surprisingly, though, Amazon’s ranking among the world’s richest firms isn’t due mainly to its e-commerce business.

Rather, it’s thanks to the company’s cloud-services business, Amazon Web Services.

This division, known as AWS, provides on-demand access to computing resources like storage, databases, networking, analytics and machine learning.

While it’s difficult to pinpoint exactly how much AWS is worth to Amazon’s overall business, analysts have estimated its value at more than $1 trillion.

The thing is, AWS likely wouldn’t be nearly as valuable without its secret sauce …

Amazon’s Secret Sauce

Like a lot of big tech companies, Amazon is spending huge amounts on the AI boom, specifically for its AWS business.

AWS is the main driver of Amazon’s profits, and it’s harnessing the potential of AI for its customers.

Notably, capturing this potential means depending heavily on Annapurna — more specifically, its technology.

In fact, the company’s entire AI strategy is built on a bedrock of chips designed by Annapurna.

They’re so crucial that analysts have described this custom silicon as the “secret sauce of AWS.”

As Amazon CEO Andy Jassy recently told The Wall Street Journal,

“If and when they go back and tell the story of AWS, our acquisition of Annapurna was one of the most important moments.”

This deal’s importance is growing amidst the AI Supercycle that’s sparked a trillion-dollar arms race. Competitors like Microsoft and Google are also investing billions into robust chips.

Every tech titan is also building its own custom hardware, partly to chip away at their reliance on Nvidia.

But no company is spending more than Amazon.

This year, it plans to spend more than $100 billion, mostly on the AWS infrastructure required for AI systems.

It’s even building a supercomputer trained on a cluster of advanced chips designed by — you guessed it — Annapurna.

Perhaps the most intriguing product coming out of Annapurna’s labs is a chip for training AI models.

It’s called Trainium.

There will be hundreds of thousands of them in the supercomputer Amazon is delivering to AI startup Anthropic.

Double Your Money in 15 Months?

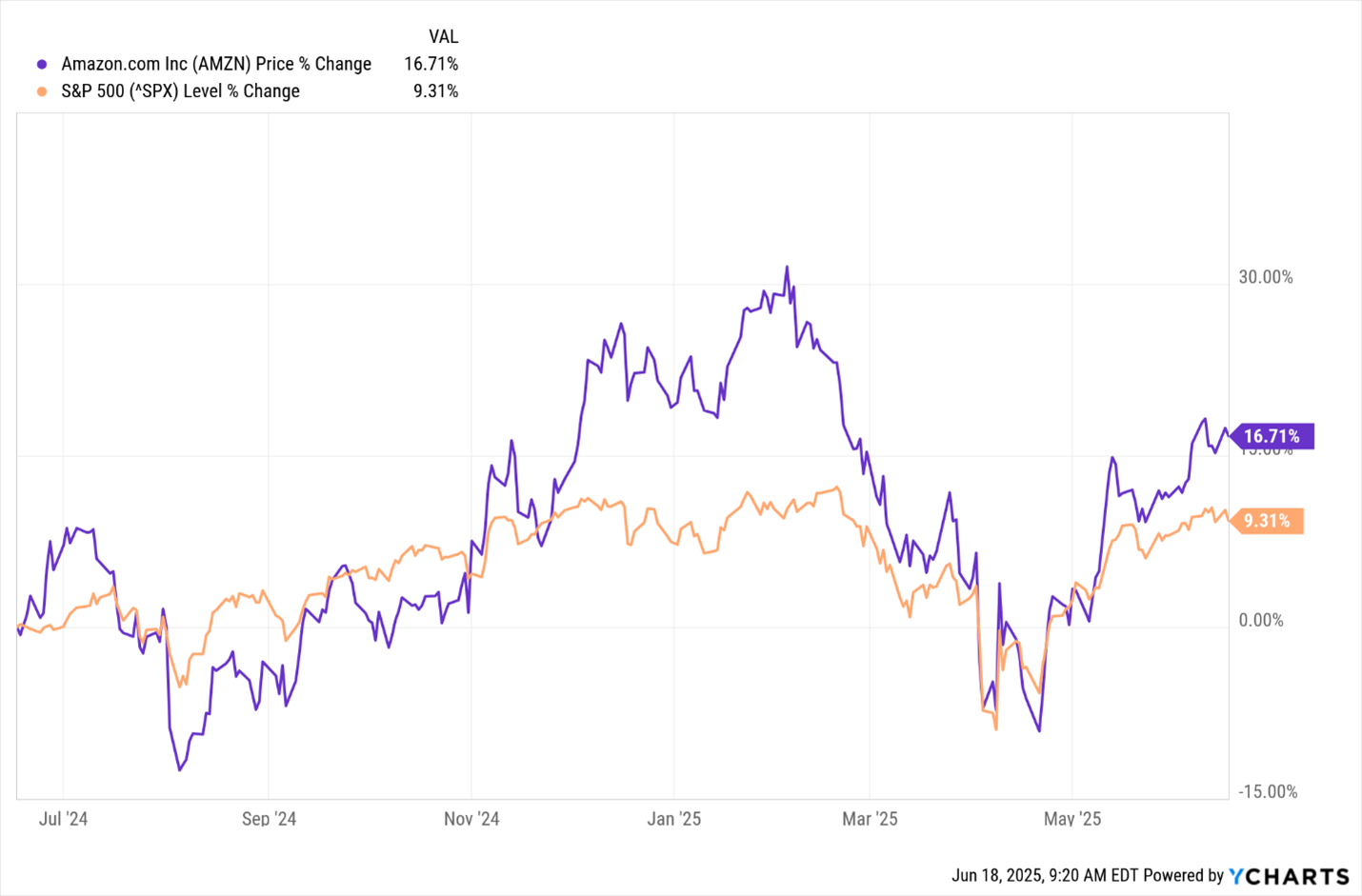

Amazon’s stock has gone on a wild ride lately. So has the entire stock market.

As is the case with most companies, tariffs have played a major role in the choppy trading.

Amazon’s stock fell due to concerns about higher costs and potential trade wars.

But it’s bounced back by more than 20% with the promise of tariff relief.

And you can still grab shares at a nice discount to its long-term uptrend.

And make no mistake. This is a profit machine.

The firm is growing per-share earnings by roughly 60%.

At that rate, they could double in less than 15 months.

And when profits rise, stock prices do, too.

One caveat: It is currently rated a “Hold.”

That could soon change with the work Annapurna is doing.

So, bottom line?

You may not think of Amazon as a way to profit from the AI Supercycle.

But thanks to its secret sauce, this is a great way to tap into this highly lucrative field with a long-term winner.

And if you believe — like me — that this partnership could soon bump it back to a “Buy,” now’s a great time to start picking up shares.

Best,

Michael A. Robinson

P.S. Amazon isn’t alone with its secret sauce AI component. China isn’t sitting still either.

Of course, most investors are still missing a major detail about Chinese AI. My colleague, Sean Brodrick, has the full story.