|

| By Kenny Polcari |

As you know by now, last Friday Silicon Valley Bank became the largest failure of a U.S. bank since Washington Mutual in 2008, sending shockwaves around the globe.

It didn’t catch everyone off guard, though.

All sorts of questionable, behind-the-scenes moves provided hints that something was rotten with the financier supporting almost half of U.S. venture-backed tech companies. So, some folks definitely saw the writing on the wall.

But not even the most inside of insiders expected the final stake to be driven through SVB in a bank run that took less than 48 hours.

Let that sink in.

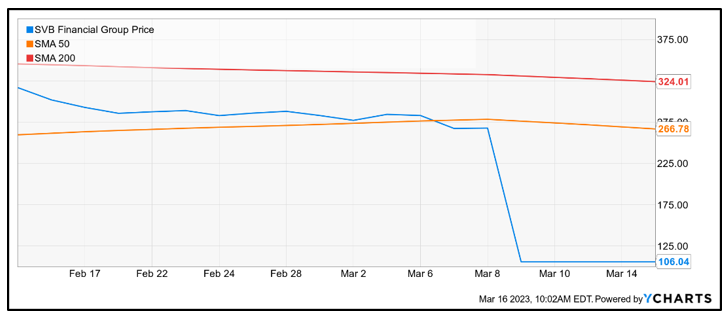

Click here to see full-sized image.

This chart shows how quickly SVB fell from investors’ graces.

It was a classic bank run in the sense that it fits the typical definition — fearful customers ran as fast as they could to withdraw money.

However, I’d call the run anything but classic when you consider the speed at which it occurred. Anomaly might be more fitting, but that would suggest it might not happen again.

In fact, it’s almost guaranteed to happen again. And no institution will be immune from what the media and many of my peers now refer to as a social media-fueled bank run.

The players who pulled it off knew exactly what they were doing. Savvy venture capitalists used social media outlets to disrupt the system.

They analyzed SVB’s earnings report data and they all read and discussed an analysis written on thediff.co, a newsletter that “explores technology, companies and trends that are making the future high variance.”

Posts on the site range from in-depth company profiles to applied financial theory, strategy breakdowns and macroeconomics. It’s a great blog site, but many are calling it the catalyst behind igniting the VCs and sending them into a tailspin.

This particular analysis raised concerns over the hold-to-maturity accounting rules — which was not an unusual practice in the banking sector and something they should have all known.

Then they used “implied concerns” as a bomb … flooding emails, chat rooms, slack rooms and social media websites to bring it down. It created all kinds of hysteria about how SVB had invested in a long-term bond portfolio that was underwater and about to implode.

They urged companies to “take your money out of the bank,” causing a tidal wave of redemptions and withdrawals resulting in the bank having to liquidate its declining long-term bond portfolio. A $1.8 billion loss arose from the need to raise fresh capital.

Now, what is really interesting here is that SVB was “their” bank. It served their community: startups in the tech and healthcare space. It serviced many of the VCs’ personal wealth and many of the founders’ newfound wealth before it all blew up.

The rapid-speed run caused complete mayhem and confusion last weekend, raising doubts about the U.S. banking system and leaving the world wondering what just happened and who is going to jail.

It also left the Federal Reserve, the Treasury and the Federal Deposit and Insurance Corporation to figure it out — which I believe is unfair.

I still think the government did the right thing in stepping in to protect SVB’s depositor money. But the buck cannot stop there.

We need to follow the money, the emails and the conversation. We need to get answers on when and how this unraveled so quickly.

On Wednesday morning, we learned that the Justice Department and the Securities and Exchange Commission are investigating the event. So, this is all just the tip of the iceberg. But I doubt this is the last time social media will play a role in financial shenanigans.

In the meantime, this situation creates a conundrum for the Fed because Chair Jerome Powell and company must consider the fight to kill inflation as it relates to maintaining financial stability. And financial stability has taken on a new definition after the SVB debacle.

Financial stability used to mean the effect rising rates had on the economy and the markets. Think bonds, stocks, housing and real estate, to name a few.

Now, it includes the possibility of another social media-style run on the banks, a focus on the dangers lurking in social media and how quickly it can ignite a sell-off.

This creates a paradigm shift in the way the world spins with how quickly social media brought SVB to its knees.

Since you cannot control SVB, or the Fed, I urge you to control what you can.

Pay attention to your portfolio. Know what you own and why you own it. Stay within your comfort zone and always manage risk.

Also, since I am a firm believer that chaos creates opportunities, make sure you own enough liquid assets — cash or something you can sell quickly — to take advantage of those pockets of opportunity.

Above all, brace for more volatility, more uncertainty and more copycats.

All the best,

Kenny Polcari

P.S. On Dec. 12, 2018, Weiss Ratings made history: Lead Crypto Analyst Juan Villaverde posted his now-famous tweet, announcing the big bottom in Bitcoin.

Anyone who bought Bitcoin on that day had the chance to turn $10,000 into $200,832. And that was among the least profitable opportunities.

But if you missed that big day, now you have a second chance, as Juan gets ready to announce the next big bottom in Bitcoin, the single best time to profit from the next bull market. To learn exactly how to seize this historic opportunity, click here for your free ticket to our upcoming forum, to be held Wednesday, Sept. 28.