|

| By Chris Graebe |

SpaceX is truly a revolutionary company.

Over its lifespan, it’s managed to cut the cost of sending a kilogram into orbit by 90%.

That’s made SpaceX an industry leader — above and beyond other private sector competitors, and even national space programs.

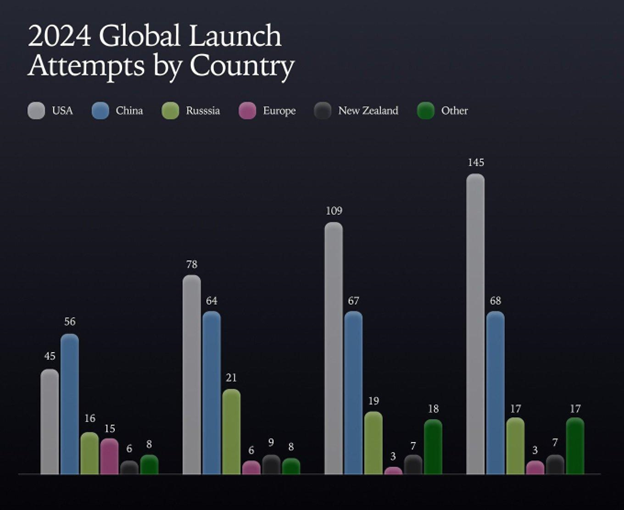

It’s allowed the United States to maintain its lead in space launches.

That kind of massive progress — a 90% cost reduction — would make any publicly traded company a top performer.

And SpaceX isn’t resting on its laurels.

The company attempts new ways to reuse rockets and engines and has created systems to grab rockets as they’re landing.

Despite all the setbacks along the way, SpaceX has recovered over 350 boosters, which it can then use again and again.

SpaceX has managed to nab over $13 billion in government contracts, largely from NASA.

That even includes a $2.9 billion project for the Artemis program, which is aiming to maintain a sustainable presence on the moon.

Plus, SpaceX’s Starlink network of over 7,550 satellites provides global internet coverage at a low monthly cost.

It’s a huge form of consistent cash flow, an estimated $12.3 billion from 7.6 million subscribers in 2025.

And Starlink often provides free services in disaster-struck areas.

Currently, SpaceX is valued at about $350 billion.

That’s based on the company’s recent repurchase of employee shares for $185.

However, secondary markets have shares trading for about $225, a 21.6% premium, likely reflecting the illiquid private market.

In short, SpaceX is a hot investment.

There’s just one problem: It’s nearly impossible for retail investors to get hold of shares.

The Challenge for SpaceX Investors

SpaceX isn’t public yet.

It has primarily relied on raising capital from private equity, funds and wealthy investors over the years.

So, its shares are privately held.

You could buy shares through a site such as EquityZen, which I’ve written about previously.

But it still takes a minimum $5,000 commitment to buy on that platform.

A few funds, such as the ERShares Private-Public Crossover ETF (XOVR), hold shares of SpaceX.

However, that means investors have to buy a basket of other companies to get access to SpaceX.

But there's big news coming out of the private markets that means more opportunities for investors.

While I always encourage more access to private markets, this one comes with a …

‘Buyer Beware’ Warning

The latest development? It’s a big one. Tokenization.

Much like how a publicly traded company’s shares represent fractional ownership, a token is a digital asset representing ownership.

Any asset can be tokenized, and many rapidly are.

Crowdfunding site Republic recently announced the rSPAX, formerly rSpaceX, token.

They’re describing it as a “mirror token.” It’s designed to reflect the changing value of SpaceX.

Bear in mind, SpaceX isn’t publicly traded.

You can’t get daily pricing like Tesla or Nvidia.

Privately held shares trade hands far less frequently. And valuations only really come when SpaceX raises more capital.

But for just $50, you can join the waitlist on Republic for this rSPAX token. Tokens are $1 each, so your minimum buy would get you 50 tokens right off the bat.

But again, a token isn’t the same as a share. It’s a digital representation of shares.

Sure, if you think SpaceX will go up in value, so what? The value of the token should rise.

However, that’s like thinking your Bitcoin is safe because it’s on an exchange.

Just ask those who kept their crypto on FTX or Mt. Gox how that went.

Digital assets can be a powerful tool. But when they’re representing another asset, it’s a step removed from actual ownership.

And that’s key if you want to not only make money … but keep it over time.

Not the Opportunity You Think

The knowledge that you could invest in SpaceX today is certainly intriguing.

But it's important to consider the terms and the path to liquidity that the deal offers — especially with token-based assets.

These markets are still in their early stages compared to public exchanges.

And they’re opening new pathways for liquidity and enabling more opportunities to tap into the private market beyond traditional angel investing and venture capital.

I’m always excited to see changes that lower the barrier to entry for private market investors.

However, with a token, today’s investors won’t get actual equity — shares of SpaceX themselves …

Only a representation of value, which may not amount to anything at all.

That’s why I don’t like this deal structure. It isn’t in your best interest as an investor.

And you don’t have to get too far into Republic’s fine print to realize that this token has a one-year lockup period — during which time, anything could happen, including dilution of the token’s value.

Given that Republic’s rSPAX token will be valued based on a $225-275 share price, and that recent private transactions have occurred at a price of $185, the token may be as overvalued as 48.6%!

That doesn’t give investors much upside potential unless SpaceX’s value substantially increases over the next year.

Plus, typically, a lockup period creates a massive rush for the exit when it ends.

That’s another strike against buying this tokenization offering.

Investors interested in SpaceX are better off paying up for shares on the private market — like we already showed you — or buying some of today’s tech funds that hold a position in SpaceX.

A far better way to get at what my colleague, Michael A. Robinson, calls the “New Space Race” is by looking elsewhere.

In fact, he’s going to take part in a virtual summit on Tuesday, Sept. 23, at 2 p.m. Eastern.

There, you’ll discover the companies crushing the SpaceX monopoly … including the name and ticker of one of the best stocks in this niche, revealed for free.

Grab your spot for this event here.

Happy hunting!

Chris Graebe

P.S. What’s even more exciting about this summit is that one of the companies he will be discussing is also still pre-IPO, like SpaceX …

Michael will give his recommendation for what to do when its likely upcoming IPO happens.

You’ll want to hear what he has to say. I certainly will.