|

| By Chris Graebe |

You may have only just heard of Nvidia (NVDA) in the past year or so since AI became all the rage, but I can almost guarantee that you come in contact with its products every single day when you use your phone, laptop or gaming console.

They all have very powerful computer chips made by this now multi-trillion-dollar company, Nvidia. It's virtually impossible to go online or check the news and not hear something about the company.

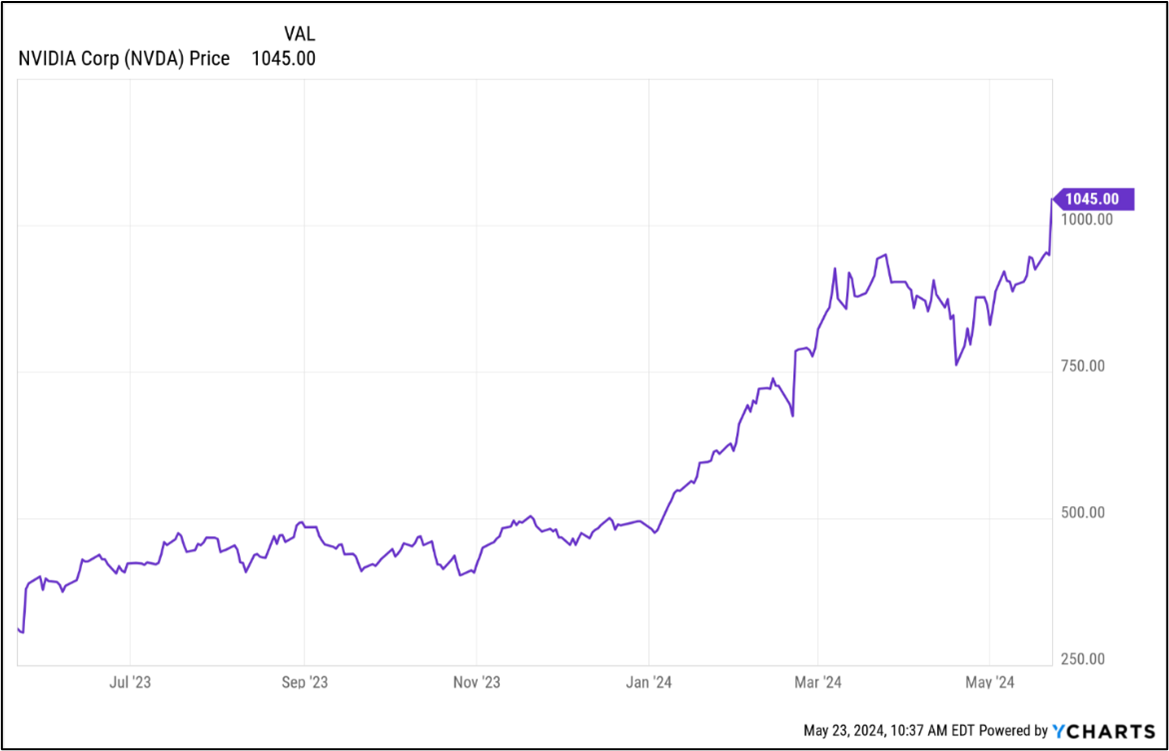

Investors have certainly taken note of the company. Shares of NVDA skyrocketed 237% in 2023 and are up 111% so far this year.

It’s earnings from all those essential chips back up that price rally.

Just last week, the company reported Q1 revenue of $26 billion — a 262% increase year over year. And EPS came in at $5.98 — a 629% increase year over year!

Meta Platforms (META) is just one of many companies reliant on Nvidia’s technology. The company formerly known as Facebook recently purchased 350,000 of its chips and plans to spend more than $1 billion in 2024 on Nvidia’s products.

What you may not know is this small startup came to us in 1993.

The idea of Nvidia started as the founders sat down for dinner at Denny's and began planning on the back of a napkin.

Nvidia initially focused on the world of video game processing, helping to create semiconductors and chips to make gaming faster. Then the team noticed a trend in the world of computing and a dire need for speed … and they kept doubling down.

Every single day we hear how technology is doubling or tripling at rates faster than we could ever possibly imagine. And that means that the hardware required to run all of these machines and AI must continue to scale itself. That's where Nvidia has really made a name for itself.

In fact, in the AI world, Nvidia's chips are in such high demand that it’s literally impossible for the company to fulfill every order. Its GPUs are now the standard in AI processing.

While Nvidia is by no means a one-trick AI pony, management realizes that even a company its size can’t provide enough horsepower on its own to drive innovation.

That poses big challenges for the industry … but even bigger opportunities for investors.

Up until this point, Nvidia pretty much ran the AI show and captured the hearts of investors. Those who believed in its story in 2023 alone saw shares rise 237%.

Moving forward will require companies to adapt to operational realities … becoming more innovative, agile and responsive in the process.

No doubt that will result in regular breakthroughs that blow our collective minds. However, don’t assume the progression will be smooth.

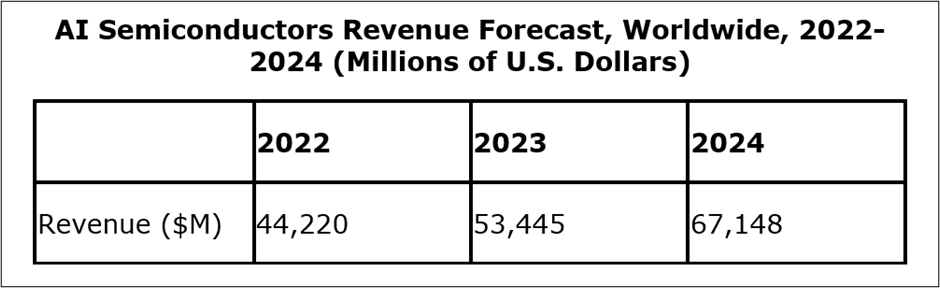

Big and small, public and private, they’re all chasing a massive opportunity. Precedence Research sees the $43 billion AI hardware market in 2022 rising to $240 billion by 2030.

Plenty of companies are taking note and coming for Nvidia’s crown, like its obvious competitors Advanced Micro Devices (AMD) and Intel (INTC).

However, many startups are developing alternatives to the GPU and better ways to process large language models and other elements of AI.

Like I always say, entering the startup world with an innovative way to solve a big problem or meet a big consumer need is the main ticket for success.

After a dismal 2023 when U.S. chip startups raised just $881 million in the first nine months, a flurry of funding rounds for VC-backed chip companies in recent weeks suggests fresh investor enthusiasm.

Here are a few examples:

- Israeli startup, Hailo, recently announced an additional $120 million in funding to challenge Nvidia from the edge — that is, putting chips in devices that don’t have continual access to the cloud, such as robots, cars and smart cameras. Hailo says its chips can run AI workloads on those types of devices while using less memory, much less power and for much less money than Nvidia AI processors running in data centers.

- SiMa.ai announced $70 million in new funding led by Maverick Capital and is also looking to the edge with chips that can speed up AI performance in devices, including cameras and cars.

- Recogni raised $102 million in February and is in the mix for accelerating AI chips.

- And chipmaker Cerebras Systems is planning to go public in the second half of this year at the earliest, according to Bloomberg. The company may seek an IPO valuation above the $4 billion achieved in its 2021 funding round.

I recently read an article in the Microprocessor Report where its editor-in-chief summed up the landscape perfectly:

“The only way new chip startups get funded and can deliver 5-to-10x value is by focusing on a specific application and segment, rather than competing broadly against a 10,000-pound gorilla like Nvidia.”

I couldn’t agree more.

Nvidia is hell-bent on not relinquishing its AI crown and is working closely with a handful of companies to ensure it doesn’t happen.

In fact, it is now making a “Trillion-Dollar AI Pivot,” as I write. I urge you to check that out by clicking here.

Happy hunting,

Chris Graebe