|

| By Tony Sagami |

How have your holidays been so far? Mine have been spectacular.

I’ve been surrounded by my three precious grandchildren, and I go to grandpa heaven every time I see them. Other than changing diapers, I can honestly say that being a grandparent is one of the most enjoyable experiences I have ever had in my life.

Speaking of dirty diapers, I want to warn you about some economic issues that could make our economy stink in 2023. Let’s take a look …

The Heavy Burden of Debt

Americans are raking up debt. Total consumer credit jumped by $27 billion in October, a billion more than in September.

Credit card balances surged by 15% in Q3, the quickest growth in 20 years, according to the Federal Reserve Bank of New York.

Click here to see full-sized image.

Plus, the cost of debt is significantly higher today because of the Fed’s interest rate hikes. The average credit card rate today is 26.72%, according to CreditCard.com.

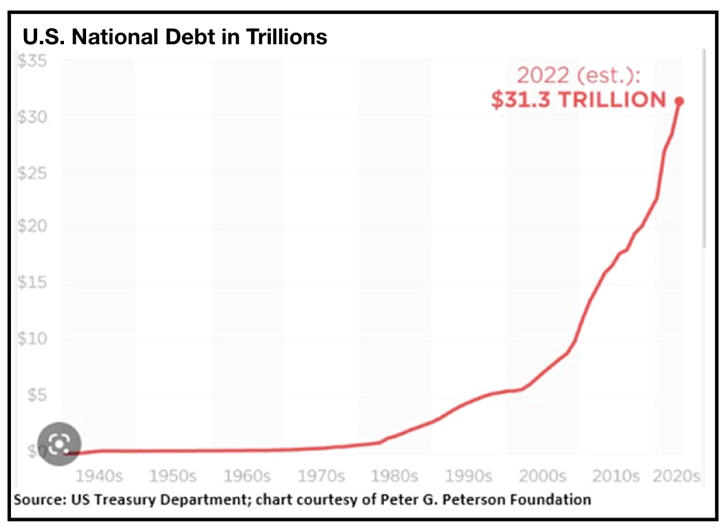

Consumers aren’t the only ones piling up debt. Our national debt in the U.S. reached $31 trillion in November.

$31 trillion works out to about a $250,000 per U.S. taxpayer.

No other country on Earth comes close to spending money it doesn’t have and at such a high amount. In fact, no nation in the history of the world has ever accumulated as much debt as the United States. Nobody is even close.

That spend-a-thon has been gaining steam. Over the past fiscal year ending in September, the government added more than $1.136 trillion to our national debt. Yikes!

When President Biden was sworn in on Jan. 20, 2021, the U.S. national debt stood at $27.76 trillion. That's an increase of $2.5 trillion over the past year, and an increase of $3.17 trillion during President Biden's tenure.

Sadly, nobody seems to care and acts like the size of our national debt doesn’t matter. Well, I’m here to tell you that debt nonchalance is about to change.

Just the interest cost of serving our national debt is expected to pass $1 trillion this year! Plus, the carrying cost of our national debt will move from the fifth-largest expense of the U.S. federal budget to as high as number two … only behind Social Security.

Falling Home Values

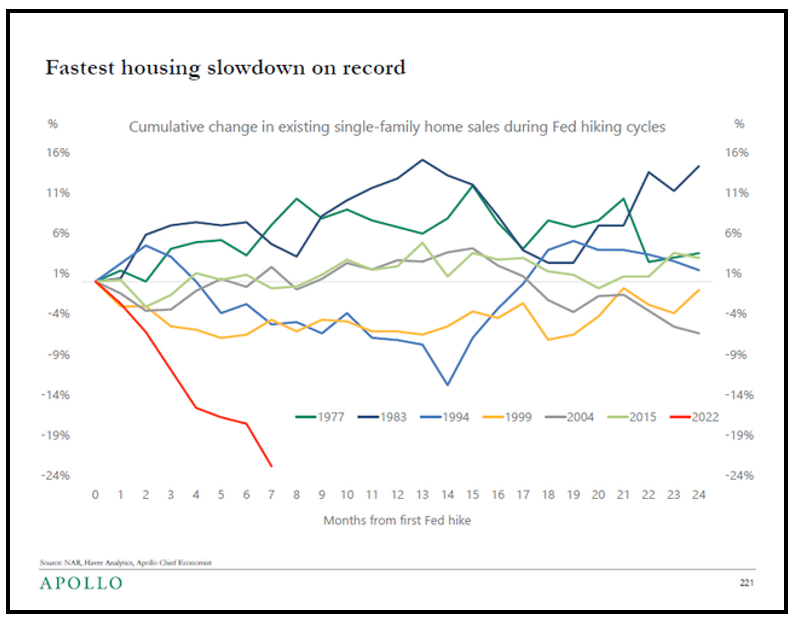

Restoration Hardware CEO Gary Friedman stated, "One thing I'm certain of: The housing market is collapsing.”

He’s right; the median home price has dropped from $413,800 in June to $379,100 in October. As with credit cards, Fed rate increases have pushed 30-year conventional mortgage rates to over 6.5% and priced many Americans out of the market.

Click here to see full-sized image.

Sadly, 270,000 homebuyers who bought homes in the first nine months of 2022 already owe more than their house is worth.

The Rising Cost of Eating

The government tells us the cost of groceries has increased by 8.5% over the last year. I don’t know what grocery stores those government officials are shopping at, but I am paying a lot more than that for my groceries.

Eggs are up 43% in 12 months, butter is up 27%, cereal is up 17%, coffee is up 15%, milk is up 14.5%, bread is up 15%, lunch meats are up 19% and chicken is up 14.5%.

And if you want to eat a high-quality steak … be prepared for some serious sticker shock.

I could go on about things that worry me, but I believe a lot of stocks will be much cheaper in 2023 than they are today. However, you won’t be able to take advantage of lower prices unless you have the cash to buy them.

Don’t think of cash as a boring, unproductive place to hide your money. Cash is an option to buy something cheaper in the future and that is what many of the investors I talk to don’t have much of, unfortunately.

Don’t be one of them.

Check out my premium service, Disruptors and Dominators, for more in-depth market analysis and recommendations. Members of my service are currently sitting on open gains of 39%, 27% and 15%!

Wishing you a healthy and prosperous 2023,

Tony