|

| By Jordan Chussler |

There are a dozen calendar days Americans look forward to celebrating each year.

Independence Day? Fire up the grill and prepare the fireworks.

Veterans Day? Shake a service member’s hand and thank them for their sacrifice.

New Year’s Day? Bloody Mary breakfasts and college bowl games.

No matter the month, it seems there are always days worth celebrating.

Except today. “Happy” Tax Day.

As the adage goes, nothing is certain but death and taxes. Today, we face the inevitability of the latter.

The Price of Civilization

Former U.S. Supreme Court Justice Oliver Wendell Holmes Jr. once mused that “taxes are what we pay for a civilized society.”

Without them, we wouldn’t have paved roads, public education or emergency services. (Though we wouldn’t have politicians’ salaries, either, which I’m sure plenty of us would be just fine with.)

But since the enactment of the 16th Amendment, Americans have (mostly) been dutifully paying federal income taxes since 1913.

I say mostly because in 2021, 57% of households paid no federal income tax. A year prior, that figure was 61%.

But for the rest of us who do, a majority …

Pay for Preparation

According to eFile, in 2019, 138 million Americans filed an income tax return. Of those, 57 million were self-prepared … meaning over 80 million people paid a tax professional to prepare their taxes.

And around this time each year, unless you live under a rock, I’m sure you’ve seen ads popping up on TV, the internet and the radio for discounted tax preparation services.

So, in the interest of our readers, I wanted to look at some of those companies to see if there’s an opportunity to generate some returns … even if they’re not from your taxes this year.

The Big Three

1. H&R Block

We’re all familiar with the bright-green logo and pop-up locations, but what you might not know is that H&R Block (HRB) is a behemoth that operates in the U.S., Canada and Australia.

Founded in 1955, the company has approximately 12,000 brick-and-mortar locations and — since the beginning of the pandemic — offers fully remote tax preparation services.

With a market capitalization of $4.32 billion, the company spins off an annual dividend of 4.09%.

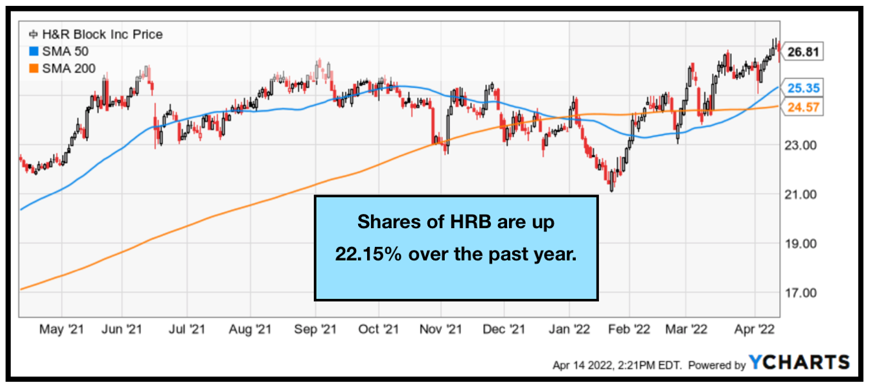

While shares have been range-bound over the past year, the stock hit a 52-week high last Thursday. And with its generous dividend yield, HRB pays investors to hold it … just like the “C+” Weiss Rating suggests.

2. Intuit

Heard of TurboTax? How about QuickBooks? Mint? Intuit (INTU) owns them all, along with a whole slew of other popular financial and tax software.

Intuit’s market cap is an enormous $140.81 billion. The Mountain View, California-based company’s dividend of 0.55% annually isn’t as impressive as the other two companies on today’s list, but its share growth has been prodigious over the past five years.

In fact, the stock has risen 292.87% since April 2017 and currently receives a Weiss Rating of “C+.”

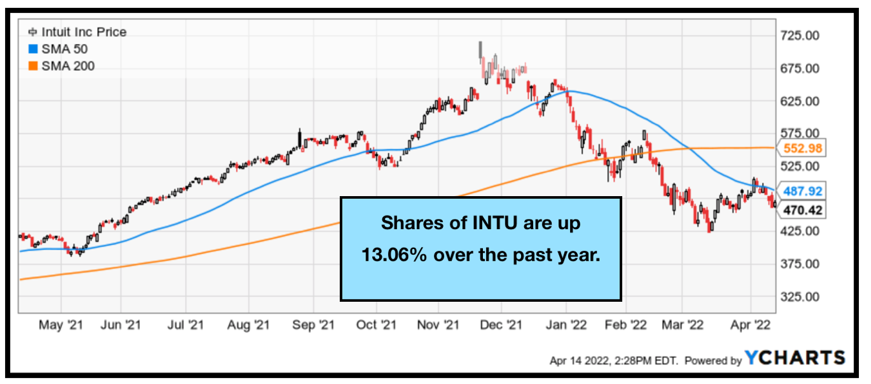

Despite being down from its 52-week high of $716.86, shares are still up 13.06% over the past year.

The dip in price can largely be attributed to the widespread sell-off that rocked the tech sector and much of the Nasdaq at the start of 2022.

The stock appears to have found a bottom, but it is experiencing resistance around the 50-day moving average.

3. Franchise Group

Franchise Group (FRG) might not be a household name, but I’m sure you’ve heard of some of its holdings, including The Vitamin Shoppe, Sylvan Learning and Liberty Tax Service. And just last Wednesday, FRG bid $9 billion to acquire Kohl’s (KSS).

The new kid on the block, Liberty Tax, was founded in 1997 and is the fastest-growing tax preparation franchise ever. With over 4,000 physical locations in the U.S. and Canada, the company has prepared over 16 million individual tax returns since its inception.

FRG receives a Weiss Rating of “C+” and has a modest market cap of $1.6 billion.

But what makes FRG particularly appealing is its whopping 6.22% annual dividend.

Shares are up 5.42% over the past year and up 170.77% over the past five years.

Like Intuit and other Nasdaq-listed companies, FRG fell victim to the tech sell-off in early 2022. But shares are trying to find support around the 200-day moving average, and investors should keep an eye out for a potential bounce.

No matter how you decide to prepare your taxes this year or next, there’s profit potential from publicly traded companies like these with ever-increasing demand from the American people.

And with the right one, next year you might just find yourself wishing your neighbor a happy Tax Day.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily