The AI Cornerstone of a $145 Trillion Sector

|

| By Michael A. Robinson |

Talk about a market-moving moment.

Fed Chair Jerome Powell recently hinted at something investors had been waiting to hear for months: The door is open to lower interest rates.

The reaction was swift.

Stocks ripped higher, bond yields eased and every talking head on Wall Street started buzzing about a “new chapter” for the Fed.

Here’s the thing. Powell didn’t actually cut rates.

But by even signaling a dovish tilt, he’s shifted the psychology of the markets.

Here’s the thing. We have rates poised to fall at a time when tariffs are still rolling out in a scatter-shot fashion.

That means lots of pros in the $145 trillion global financial services sector are looking for better ways to manage their money.

Today, I want to tell you about a tech leader with deep expertise in doing just that.

And the good news is, it just boosted its earnings growth by 45% …

Pressure on the Pros

Let’s step back for a moment and make one thing clear: We are not in a recession.

But the jobless picture isn’t looking great.

Consider that back in 2019, before Covid slammed the economy, jobless claims averaged 220,000 a week.

A few weeks ago, the four-week average came in at roughly 235,000.

In other words, though the markets have rallied to new heights, it looks like the economy may be slowing.

So, Powell made it clear he may soon cut rates — though not as quickly as the White House might like.

To be sure, he has been moving slowly on purpose, saying he wanted to make sure tariffs didn’t greatly increase the price level before acting.

Make no mistake. Powell isn’t the only one who is a tad cautious.

Even the most seasoned managers with advanced models and decades of experience can’t get it right every time.

That’s why the smartest firms are leaning harder than ever on tech like software that tracks every penny, reconciles every trade and ensures compliance with a thicket of regulations.

From Back Office to AI Backbone

That’s where SS&C Technologies (SSNC) enters the picture.

It’s not a household name. But it does play a vital tech role in global finance.

SS&C started life as a humble back-office software firm, helping financial companies keep records straight.

Important, yes — but hardly glamorous.

Then the 2008 Financial Crisis hit.

Suddenly, “keeping track” wasn’t enough:

- Regulators cracked down.

- Clients demanded transparency.

- Executives wanted real-time dashboards showing exposure, leverage and risk.

SS&C didn’t miss a beat.

Then again, it had a bevy a tech tools the pros needed and also built a cloud-based empire of financial software.

Today, it’s the world’s largest hedge fund and private equity administrator, as well as the largest mutual fund transfer agent.

Last year alone, roughly $35 trillion in transactions ran through SS&C systems. That’s not a typo — trillions.

And while many investors still think of this as “plumbing for finance,” SS&C has quietly layered in machine learning and AI.

Its Aloha platform lets fund managers tap into accounting, performance, compliance and portfolio tools all in one place.

It’s a dashboard built for the AI Supercycle — a way to automate the grunt work so pros can focus on strategy.

Building Through Smart Acquisitions

Another key to SS&C’s growth is its knack for bolt-on buyouts.

Rather than chasing flashy moonshots, it targets firms that strengthen its core.

Its recent buyout of Calastone is a perfect example.

Calastone runs one of the largest fund transaction networks in the world, spanning more than 35 countries.

Integrating that into SS&C’s system expands reach, adds volume and locks in more clients.

This roll-up strategy has turned SS&C into a juggernaut.

It’s why the firm remains the go-to for asset managers, insurers, mortgage bankers and wealth advisers.

Simply put, it’s not just selling software. It’s embedding itself in the nervous system of global finance.

Which brings me back around to the Fed.

Powell’s dovish hint is good news for risk assets.

Lower rates mean cheaper money, which means more capital sloshing through stocks, bonds and alternatives.

And when that flood of money moves, SS&C’s systems are the pipes, pumps and filters that keep it flowing.

Think about it.

Whether investors are piling into municipal bonds, rotating into equities or shifting into private funds, SS&C is there.

Its clients don’t just use its software — they depend on it.

That makes this company one of the best “picks and shovels” plays on the financial sector.

Looking Beyond Powell

A lot of investors will spend the next few weeks parsing Powell’s tone, trying to guess whether the Fed cuts later this month, November or early 2026.

And with the pressure from the White House to step aside, they will also be handicapping when he will leave and who will replace him.

That’s fine by us. We don’t need to play the guessing game.

We can own the stock that thrives no matter what Powell does.

SS&C has grown from a back-office tool into an AI-enabled backbone for global finance.

It serves the biggest funds, the toughest regulators and the most demanding clients.

To be sure, earnings growth was solid but not spectacular in the last three years as the firm invested in its backend tech, especially AI.

That has started to change.

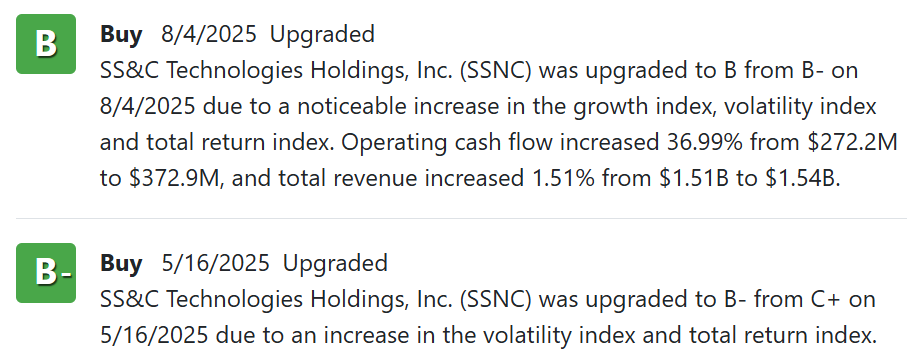

As you can see, it’s been moving up the charts here at Weiss Ratings of late:

The firm is forecast to grow per-share profits by 10% this year. That’s 45% better than its three-year average.

In other words, the firm’s back-office spending set it up to be ready to profit from a Fed-driven market across every aspect of finance.

While Powell may set the mood, it’s leaders like SS&C that keep the markets moving — and keep investors like us on the right side of history.

Best,

Michael A. Robinson

P.S. One area that’s certain to see a continued boom in transactions is crypto. But not just any digital currency will do.

In fact, it’s NOT Bitcoin you need to watch.

Instead, you’ll want to get ahead of a major shift that’s coming.