Editor’s note: Nilus Mattive just got home from a family trip to Indonesia. We gave him the day off to sort through the unique, and quite unexpected, investment ideas he found there.

In his absence, I will channel Nilus to say too many people buy hot tech stocks without checking their Weiss stock ratings.

Especially stocks that have even the slightest whisper of “AI” in their profiles.

Now, that doesn’t mean an AI bubble is imminent. The thing with bubbles is they can get much bigger.

Plus, unlike the Tech Wreck era, today’s AI universe is filled with real companies producing real results …

And real profits.

That universe, however, also has future has-beens getting bid up.

That’s why, starting today, your favorite editors and I will show you our top ways to invest in the next phase of AI.

We’ll even bring out the big guns … including someone who builds and trains AI trading algorithms here at Weiss!

First, let’s look at how corporate spending on AI is driving the largest tech infrastructure buildout in history …

|

| By Dawn Pennington |

Earnings season is mostly over, with majority of the big tech names already reporting.

At this point, only Nvidia (NVDA) remains — but it will likely post great results.

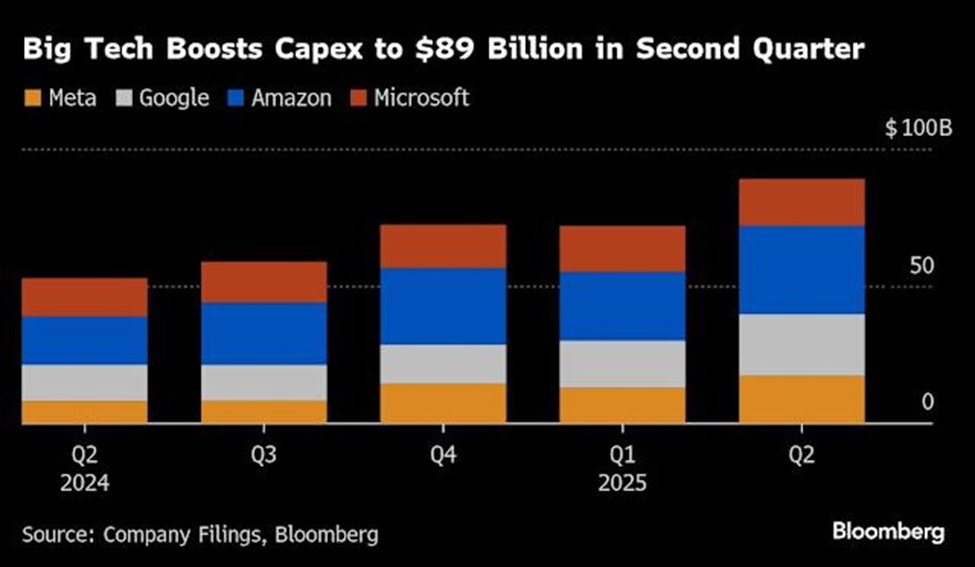

Why? Q2 2025 earnings showcased unprecedented AI-driven capital expenditure (capex) commitments from major technology companies.

That demonstrates their continued aggressive pursuit of AI leadership.

The scale of investment has reached historic proportions, with big tech companies collectively targeting over $200 billion in capital spending for 2025.

And nearly $90 billion in the second quarter alone!

That’s a two-year gain that's triple the 2020-23 average as generative-AI demand spurs outlays on data centers and new products.

This massive spending surge extends beyond initial projections.

Tech mega-caps now plan to spend more than $300 billion in 2025, with Microsoft (MSFT), Meta (META), Alphabet (GOOGL) and Amazon.com (AMZN) expected to spend a record $270 billion on capex this year. That’s according to Goldman Sachs estimates.

Leading technology companies have made extraordinary individual commitments to AI infrastructure development:

-

Amazon announced plans to boost its capital expenditures to $100B in 2025, as it continues its spending spree on AI services.,

Amazon's $100 billion 2025 AI capex dwarfs Google's and Microsoft's current spending.

But it comes at the cost of near-term margin compression.

-

Microsoft spent $24.2B in capital spending on AI in Q2 — a record.

It plans to spend upward of $30 billion in the current quarter.

-

Meta CEO Mark Zuckerberg set his company's AI capex budget at $60B to $65B in January. He called 2025 a "defining year for AI," positioning the company aggressively in the superintelligence race.

Meta reported strong Q2 2025 results with revenue of $47.516 billion, up 22% year over year, providing financial capacity for continued heavy AI investments.

-

Apple is the only real laggard in AI spending among the big tech names. The company’s AI spend is going to total about $11 billion for 2025.

It’s still a 45% increase compared to 2024, but far lags these other players.

Unsurprisingly, Apple — with arguably the worst AI-powered virtual assistant of them all — has been the worst performer among big tech. Shares are down 16% year to date.

It’s hard to pick a fight with the Mag 7. But for as much money as they spend on AI, there’s millions more sloshing around.

And this next phase of AI will be dependent upon the companies that get this right …

Data Center Infrastructure

The next leg of the AI spending boom stands upon data center expansion and computing infrastructure.

The capex bonanza for data center growth is separate from the R&D that companies spend on chips and new AI technology.

Clearly, big tech companies are building massive computational capacity alongside their research efforts.

The global capex market itself is expanding, projected to grow from $767.8 billion in 2025 to $2.5 trillion by 2033 at a 5.5% CAGR.

Yet, global spending is truly dominated by a few American-based mega-cap tech companies.

Mag 7 capex rose 40% in 2024. Compare that to the 3.5% among the remaining 493 companies in the S&P 500.

So, while capex is soaring, it’s still largely a Mag 7 play.

Company executives frame this spending as essential for maintaining technological leadership.

Meta now reaches nearly 3.5 billion users across Facebook, Instagram and other apps.

Zuckerberg stated the company's mission is to bring AI "personal superintelligence" to all those users.

The scale of investment suggests companies view AI infrastructure as foundational rather than experimental.

Microsoft's AI investments were credited with driving strong fiscal 2025 Q1 results, generating $65.6B in revenues with 16% year-over-year growth.

Market & Economic Impact

This unprecedented capital deployment represents one of the largest technology infrastructure buildouts in history.

The collective $300B+ in spending creates massive demand for semiconductors, data center equipment and specialized AI hardware.

At the same time, this spending has the potential to reshape global technology supply chains.

The spending levels also reflect companies' confidence in AI's revenue-generation potential.

In the quarters ahead, these investments should begin to translate into meaningful business results.

However, the sheer magnitude raises questions about returns on investment.

It’s also worth wondering whether the current pace of spending can be sustained. Especially if AI monetization doesn't meet aggressive expectations.

The Q2 2025 results demonstrate that big tech's AI capital expenditure surge shows no signs of abating.

It’s clear there are plenty of companies willing to double down on infrastructure investments.

And these investments could define the next decade of technology competition.

As for this quarter?

You can still bet on Nvidia ahead of earnings on Aug. 27.

Bank of America analyst Vivek Arya noted that Nvidia is positioned to maintain its impressive 80% to 85% share of the AI chip market.

That forecast suggests Jensen Huang & Co. could receive a significant portion of the $200B big tech capex spending.

But the real winners could be beyond the Mag 7 plays that have already run.

For those, you need AI tools of your own.

And tomorrow, you can gain access to the best of the best investment tools.

That’s when Dr. Martin Weiss will unveil the AI trading system that took a century to develop.

It, of course, starts with the Weiss Ratings.

But it also uses the 7 terabytes of data we have at our disposal to model individual stocks.

In other words, to see how they are likely to perform in the short term.

To see why Martin calls this the “crowning achievement” of his 54-year career, join him at 2 p.m. Eastern tomorrow.

Click this link here to save your spot right now.

To your health and wealth,

Dawn Pennington

Editorial Director