The Best Defense Against the 'Great Money Nightmare'

|

| By Tony Sagami |

Fun fact: 1 million seconds is equivalent to 11 days ago, 1 billion seconds is 32 years ago, or 1991, and 1 trillion seconds is 30,000 B.C.

What does that tell you about the size of our national debt, which has passed $31 trillion? At the same time, our country has the largest national debt of any nation in the history of the world.

But wait … it gets much worse.

According to the American Legislative Exchange Council, state and local government debt is another $6 trillion, which pushes the total amount of government debt to $37 trillion.

And if you add in the unfunded liabilities of Medicare, Social Security, pension obligations and retiree healthcare liabilities for government workers who are retired but still living, that comes to a total of $105 trillion!

All totaled … that’s a mind-boggling $142 TRILLION. Yikes!

In 2022, we added $1.4 trillion to the national debt, $2.8 trillion in 2021 and $3.1 trillion in 2020. That’s $7.3 trillion in just three years!

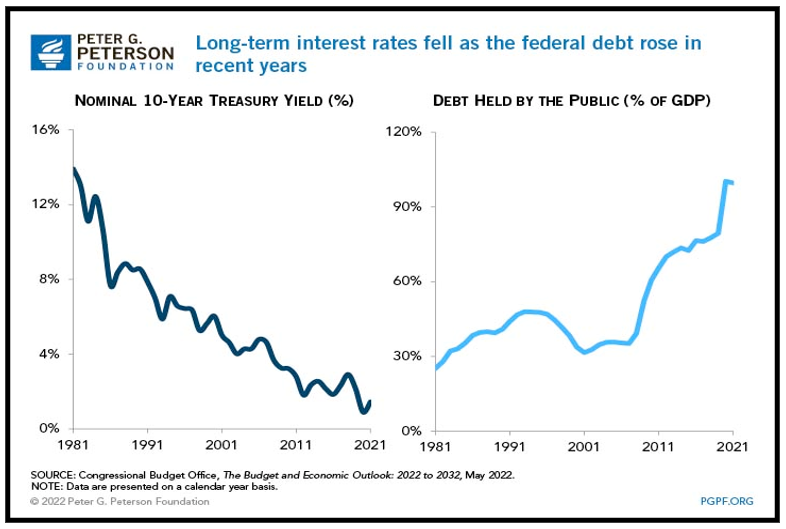

The last time we had a balanced budget was in 1991 under Bill Clinton, so that mountain of debt keeps growing. The U.S. debt-to-GDP ratio has ballooned to an unsustainable 120%.

At some point, our country will simply be unable to meet its debt obligations — and like a third-world country — will default on government bonds.

The arrival date of that default is getting closer because of rising interest rates.

Click here to view full-sized image.

Since 2007, the Treasury has been able to borrow at a relatively low cost, because of low-to-zero interest rates, and comfortably make payments on our federal debt. Interest payments on our national debt were …

-

$376 billion in 2019

-

$345 billion in 2020

-

$352 billion in fiscal 2021

Once the Federal Reserve began increasing interest rates, the cost of serving that debt has skyrocketed.

For example, the Department of Treasury paid $103 billion in interest payments on the national debt in the first two months of the 2023 fiscal year, which began in October. That was a whopping 87% increase from the $55 billion it spent in the same period last year.

Political Spend-a-Holics Race Toward Fiscal Doom

At that pace, the annual interest costs will balloon to over $600 billion this year.

For 2023, the net interest on the national debt will become the fourth-largest item in the federal budget, behind only Social Security, Medicare and defense.

Something has to give. We can’t simultaneously fight inflation and trillion-dollar budget deficits. Washington will have to cut spending … that will be the day … or the Federal Reserve will have to keep creating money out of thin air.

There is almost zero chance that our politicians will become fiscally responsible, which means that the Fed will flood the world with more paper money.

“Great Money Nightmare”

My colleague Sean Brodrick calls it the “great money nightmare.”

The best defense against that flood of paper money is hard assets, like gold. In 2022, for example, gold was one of the best-performing assets on the planet.

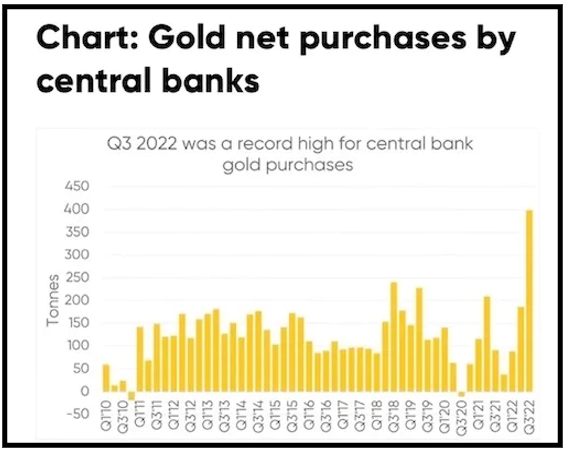

Click here to view full-sized image.

Don’t just take my word for it, look at what the world’s central bankers are doing. In the first nine months of 2022, central banks bought more gold than in the past 55 years combined.

The central banks of China, Turkey and India have been the biggest gold buyers.

The price of gold has returned an average of 8% a year for the past 20 years and could easily rise by 10% or more in 2023. And if global conflict gets worse, gold could reach $3,000 an ounce in no time flat.

Make sure that your portfolio has at least a 5% allocation to gold.

That’s it for today. I’ll be back with more for you soon.

All my best,

Tony

P.S. Earlier this week, Financial News Anchor Kenny Polcari shared for the first time three specific, undervalued investments viewers can use to ride the Made-in-USA Superboom. Click here to get access to those investments absolutely free, as well as two investment MULTIPLIERS with a history of increasing investor gains fourfold. Find out more here.