|

| By Michael A. Robinson |

Every now and then, a story comes along that is so large, so market-defining, that you can see it forming from miles away.

So let me go ahead and say what most people are dancing around: The biggest tech story of 2026 will be the SpaceX IPO.

Nothing else will come close.

When SpaceX finally goes public, it won’t just be another offering.

It will be the single most important financial event of the decade.

Now then, if you’re like me, you have read a fair number of speculative pieces in the last couple of years about a possible SpaceX IPO, which would likely be the largest in history.

What I want to talk with you about today is some recent steps the firm has made and how it intends to use the hundreds of billions it will raise by going public …

Why 2026 Is the Year of The SpaceX IPO

To say I have followed the space sector for most of my life is no exaggeration.

I met astronaut John Glenn when I was six years old.

I used to write about space tech for my dad’s old newsletter.

And did I mention he was a senior editor at Aviation Week and Space Technology, the Bible of the industry?

It’s like I keep saying. I’m no astronaut or NASA scientist, but you could say space is in my blood.

Not to mention that I recently watched a SpaceX launch from coastal Florida.

That’s why a recent story in the Wall Street Journal really jumped out at me.

The Journal revealed that SpaceX was preparing yet another secondary share sale for employees.

That alone values the firm at roughly $800 billion.

And Bloomberg has reported that the SpaceX workers can sell up to $2 billion worth of shares at a price near $420.

While the exact amount is not yet known, we do know that the company has set up its workers to cash in on the IPO.

Here’s a slight hedge …

That’s not how things are lining up right now. But if the market or economy turn weak next year, the IPO could get stretched in 2027.

The Backbone of the Space Economy

It’s not just the money. It’s the reason for the sale that is important to keep in mind.

This is not a startup dipping into venture funding.

This is a mature, scaled, global outfit behaving exactly like the sort of firm that is clearly on a path to going public.

These kinds of structured employee sales are typical of companies in late private stages.

They provide liquidity where none exists and keep talent onboard.

They also act as a bridge until the real liquidity event — the IPO — finally arrives.

It’s not a rumor. It’s a behavior pattern.

And SpaceX has now repeated it several times, with the last one being out of this world in terms of the value of the round.

Meanwhile, Starlink has grown from an ambitious experiment to a worldwide satellite communications network.

It boasts millions of customers and has a footprint that stretches around the world.

It’s just the type of firm that public markets gravitate toward — recurring sales, high demand, global scale and a huge growth runway.

Then there’s Starship.

It has become the backbone of orbital access for the United States and much of the commercial world.

NASA and defense contracts rely on it. Ditto satellite operators.

In other words, SpaceX is now sitting at the center of the world’s space economy.

Why SpaceX Needs the Money

SpaceX isn’t hunting for capital because it’s in trouble. It’s hunting for capital because its goals have outgrown the limits of private funding.

The company is now operating on a scale that demands resources measured in tens of billions, not millions.

And the clearest example of that is its work on NASA’s Artemis program.

SpaceX was chosen to build the Human Landing System — the craft that will return American astronauts to the surface of the Moon.

That responsibility requires far more than a single spacecraft.

It involves a modified Starship built for lunar work.

It also demands a series of orbital refueling missions and the launch cadence to support it all.

Starship also demands massive resources. This is the most powerful rocket ever built.

It will require new factories, upgraded launch pads, environmental systems and gear to support rapid turnarounds.

And there’s also Starlink.

It’s grown from an ambitious idea to become a major satellite communications network, the largest serving Earth.

But the launch gear, ground stations and user hardware are huge cash drains.

Because SpaceX is private, we don’t know those total costs.

I believe they can run into the billions just based on the aggressive launch schedule.

And let’s not forget that SpaceX continues to push ahead with deep-space ambitions — plans for Mars missions, long-duration habitats and high-volume orbital transport.

These are not NASA-funded programs. They are speculative initiatives driven by Musk’s long-term vision. And they must be financed by SpaceX itself.

The Backdoor Opportunity

And this is why I continue to recommend Northrop Grumman (NOC).

The storied defense firm is working with SpaceX on a classified spy satellite network for U.S. intelligence agencies.

SpaceX won a $1.8 billion contract from the National Reconnaissance Office in 2021 to build the constellation.

The network already has about 12 prototype satellites in orbit delivering test images to the NRO.

Northrop supplies the sensors for SpaceX’s satellites.

These imaging systems offer better clarity than existing spy tech.

Northrop also tests the spacecraft at its facilities before launch.

The partnership extends beyond classified work.

SpaceX launched Northrop’s Arctic Satellite mission from Vandenberg Space Force Base in 2024.

Northrop also uses SpaceX for commercial launches, including its Mission Robotic Vehicle.

The collaboration shows old-guard defense firms teaming up with new space companies.

And that makes NOC a great “twofer” as a play on SpaceX and its IPO, along with a defense leader that has the kind of barriers to entry that most firms can only dream about.

Best,

Michael A. Robinson

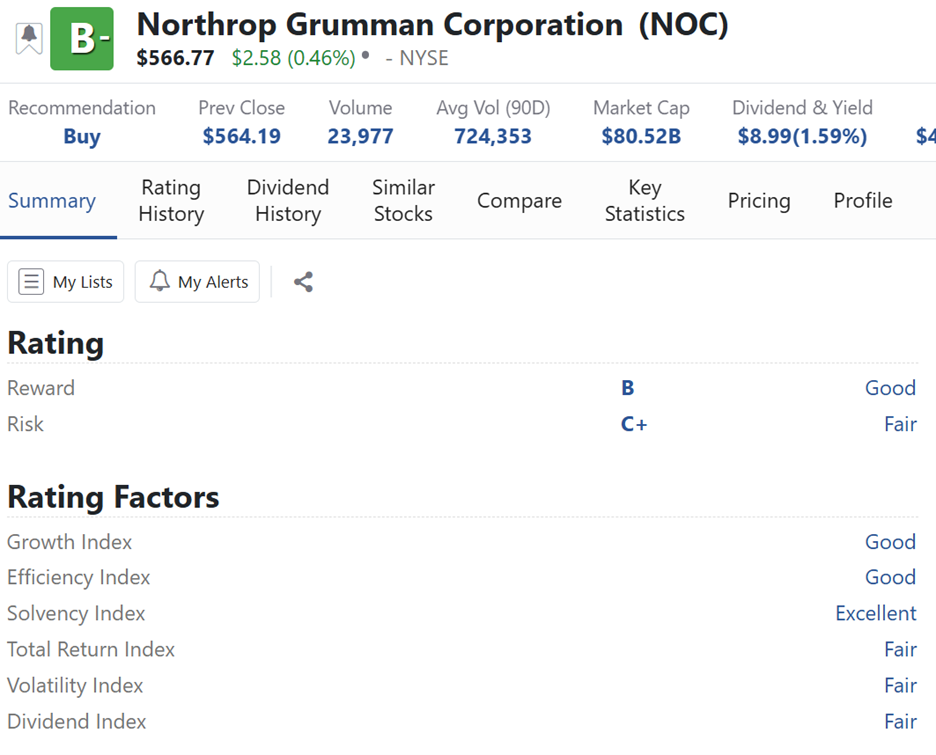

P.S. As you can see above, Weiss Ratings gives NOC a “B-” rating. That’s a solid “Buy.”

But that was true even before this week’s major announcement. Gavin Magor, the head of our research and ratings team, officially unveiled Weiss 3.0.

This is the culmination of 100 years’ worth of proprietary data gathering and AI. Check it out here.