|

| By Tony Sagami |

I named my youngest son after one of my best friends in the world. Sadly, that friend called me to say goodbye.

No, my friend isn’t dying, but he has advanced Alzheimer's disease and soon won’t be able to remember me. Or anyone else.

I got on an airplane the next day to go see him. It was wonderful and sad at the same time, but I am grateful that I was able to spend time with him.

Last minute airfares are insanely expensive, so I used my miles to book a free ticket. But I was shocked at how expensive it was to rent a car — more than $100 a day.

In 2022, the price of rental cars jumped by 76%, soaring by an average of 278% in popular tourist cites.

No wonder Hertz delivered better-than-expected earnings results last week:

• Revenue of $2.035 billion vs. the $2.033 billion expected.

• Earnings per share of 50 cents vs. the 46 cents expected.

Instead of renting a car, I used Lyft (LYFT) — a popular ride-sharing service — to get around.

Lyft is the second-largest ride-sharing company after Uber (UBER), but the ride-sharing business is a cash-burning machine that you should steer clear of.

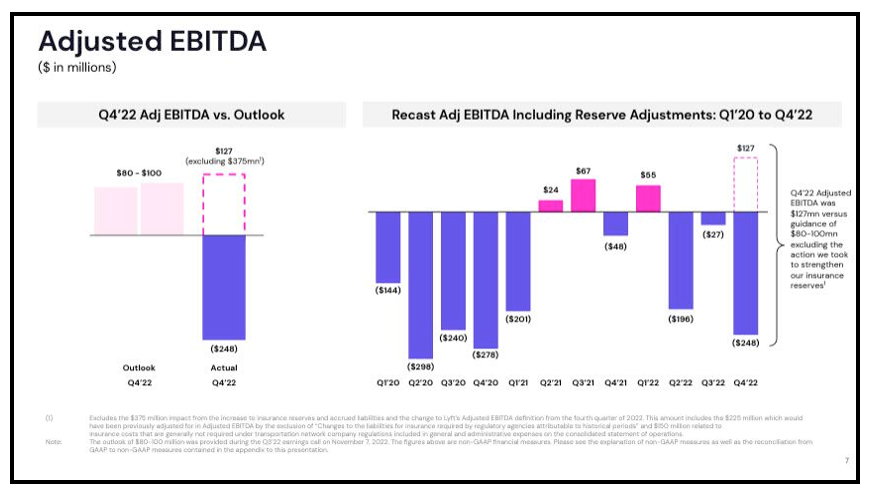

Lyft reported its quarterly results last week and missed expectations by a country mile with a loss of 75 cents per share vs. forecasts of a 10-cent loss.

Lyft’s stock dropped a whopping 36% on the news, from $16.22 to $10.31. Ouch!

Plus, Lyft warned that the next quarter would be even worse, with Q1 revenue of $975 million coming in below the estimate of $1.09 billion. And an earnings before interest, taxes, depreciation and amortization of $5 million to $15 million is projected to badly miss Wall Street’s $83.6 million forecast.

Click here to see full-sized image.

Here is what one analyst had to say about the earnings conference call:

"In 22 years on the Street as a tech analyst, we have listened to thousands of conference calls with many highs and lows. Last night's Lyft call was a top three worst call we have ever heard in our opinion, asmanagement is trying to play darts blindfolded with the expense structure going forward and gave an EBITDA outlook which was a debacle for the ages.”

I like Lyft just fine as a consumer, but it scares the pants off me as an investor. Sure, Lyft has been able to steadily increase its revenues from $340 million in 2016 to $4.1 billion last year …

But the more money that Lyft pulls in, the more money it loses. In fact, it moved from $680 million in 2016 to $1.58 billion last year.

That’s right, a $1.58 billion loss on $4.1 billion of revenues.

Uber Technologies, by the way, lost even more last year with $9.1 billion. Wow!

After seven years in business, you would think that these two ride-sharing services would be making money.

Wrong!

These losses just show how flawed ride-sharing services are as a business. If you own Lyft or Uber after these hideous numbers, I think you need to seriously reconsider.

Ride-sharing companies have become places where capital goes to die and should be avoided.

That’s it for today. I will have more for you real soon.

All the best,

Tony

P.S. The Federal Reserve’s actions should have investors concerned for their financial well-being.

Starting as soon as May 2023, their insidious “Fed Control” powers could go live, which means that any accounts linked with the U.S. banking system could soon be at risk for surveillance of all transactions … or worse.

Investors who want to take action to protect their money should click here for four steps to take now to stay safe and grow their wealth.