|

| By Tony Sagami |

Flying was tons of fun when I was in my 20s, but it’s turned into a headache-inducing burden now that I’m in my 60s. It’s not just because I’m getting older, either. Travel has become a time-consuming nightmare.

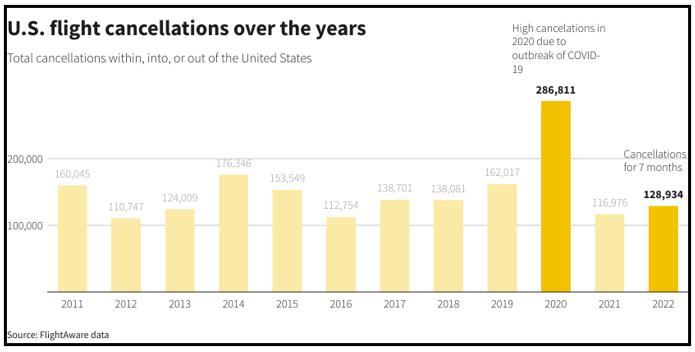

Flights are as unreliable as I’ve ever seen, and if you’ve traveled recently, you know what I mean. U.S.-based airlines have canceled 128,934 flights from January to July, according to flight-tracking website FlightAware.

And that’s just cancellations … there have been almost 1 million flight delays this year!

Just getting to the airport is a pain. It can take me up to two hours in bumper-to-bumper traffic to drive from northern Seattle through downtown Seattle to Sea-Tac International Airport.

But the good news is that airport commuting woes may soon become a thing of the past. I’m talking about the flying taxis that will whisk flyers to airports and bypass traffic-snarled highways possibly in the near future.

United Airlines Puts Down $10 Million Deposit For 100 Electric Air Taxis

United Airlines (UAL) just plunked down a $10 million deposit to buy a fleet of air taxis that will transport flyers to and from airports.

United ordered 100 electronic vertical takeoff and landing air taxis, known as an eVTOL, or electric vertical take-off and landing, aircraft from Archer Aviation (ACHR).

As the name implies, these air taxis have vertical take-off capabilities like helicopters, and they’ll land on traditional helipads or other landing sites, such as the top of a parking garage.

United Airlines and its regional airline partner, Mesa Airlines, have the option to buy up to $1.5 billion worth of these flying airport taxis.

We’re not talking about waiting 10, 15 or 20 years, either. United Airlines bragged that air taxis will offer a “quick, economic and low-emission way to get to airports within its major hubs by 2024.”

By 2024 … and initially in Los Angeles, to be exact.

And the flying taxis will be very affordable for travelers. United says the cost will be comparable to Uber Black, a premium service that uses luxury vehicles. For example, an air taxi trip from Manhattan to a New York City-area airport costs between $110–$120.

Heck, I’ve paid $80 for a regular Uber ride to Sea-Tac and would gladly pay an extra $30–$50 to avoid rush-hour traffic jams.

By the way, these eVTOLs are powered entirely by electricity, so that will bring a smile to the faces of green energy supporters.

How Can Investors Play It

The best way to invest in this trend isn’t through United or Archer Aviation, which receives a Weiss Rating of “D-.”

The best way to profit from this revolutionary, flying-taxi service is the same way you profit from electric vehicles: lithium.

My first introduction to lithium was in my 9th grade chemistry class. At room temperature, lithium is soft, silvery-white in color and is the lightest metal in the world.

I still remember my surprise when I dropped a rock of lithium into a tank of water, and it started to fizz. Even more amazing was that the lithium floated.

So, not only is lithium — aka white gold — the lightest metal in the world, but more importantly for our modern society, it has a high capacity to store energy. Having this property allows it to be used in the manufacturing of rechargeable batteries.

Lithium’s ability to store large amounts of energy makes it ideal for powering portable electronic devices like cell phones, wireless headphones and laptop computers … as well as the future of transportation, EVs.

Skyrocketing Lithium Demand

Lithium consumption’s steadily increased, but worldwide demand is about to skyrocket because of soaring EV production.

Lithium is widely used in lubricants, glass, ceramics and anti-depressants … only 9% of total lithium production was used for batteries in 2010.

But by 2020, the share of lithium produced for batteries surged to 66% and is expected to reach more than 90% by 2030, according to IHS Markit.

Massive amounts of lithium supply will be needed to support the EV revolution.

So how can investors potentially profit from lithium?

There are numerous individual stocks to consider, but if you’re more of an exchange-traded fund investor, take a look at the Global X Lithium & Battery Tech ETF (LIT) or Amplify Lithium & Battery Technology ETF (BATT), both of which will broaden your industry exposure while reducing your risk exposure.

By the way, I’m traveling to the Atacama Desert in September to visit some of the largest lithium mines in the world. I’ll report my findings, including my top lithium recommendation, to members of my service, Disruptors & Dominators, shortly after my return. Be sure to join them, and the open gains of around 57%, 47% and 32% they’re enjoying — before then by clicking here.

The world needs massive amounts of lithium and that means big profits for the companies that produce it.

Remember to always conduct your own due diligence.

Best wishes,

Tony