|

| By Tony Sagami |

“Dad, why should I keep contributing to my 401(k) while the stock market is getting killed? My account has shrunk even though I’ve contributed almost $4,000 this year.”

Millions of Americans are in the same leaky retirement savings boat in which my son finds himself.

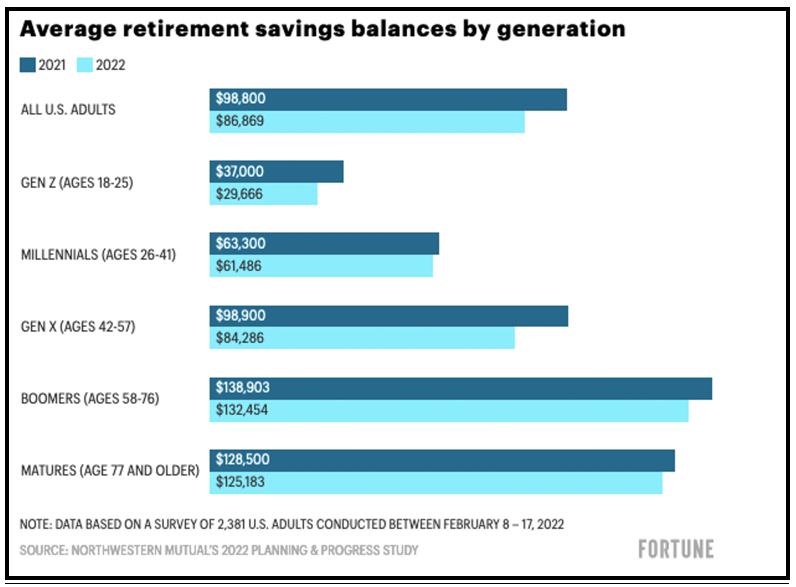

According to a new study from Northwestern Mutual Life, retirement account balances have taken a big hit this year, falling 12% despite current-year contributions.

Gen Z — which includes 18- to 25-year-olds — has savers who have suffered a loss of almost 20% even after contributions. No wonder my brilliant-but-frustrated son is thinking about throwing in the towel on his 401(k).

Apparently, a lot of American workers have already done just that.

According to a recent survey from Allianz Life, 54% of workers have either reduced or altogether stopped making contributions to their retirement account.

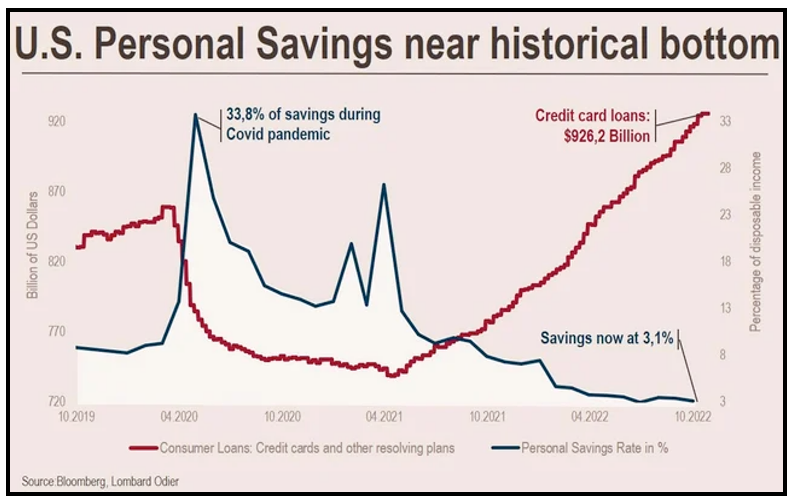

Worse yet, 43% of Americans have dipped into their retirement savings to make ends meet. That’s in addition to running up unsustainable credit card balances and savings rates dropping to near historical bottoms.

Sadly, the effects of skyrocketing inflation and higher interest rates on consumer loans like mortgages, auto loans and credit cards is making it impossible to make ends meet.

More Month Than Money

I am old, fat and semi-rich now but I remember what it was like to financially struggle. I was the sole bread winner of my family of six, so I often found myself running out of money before the end of the month.

If your ability to save for retirement has been compromised, it is VERY important to try to get back on track as soon as you can.

Even before this difficult year, four in 10 Americans felt they weren’t financially prepared for retirement.

That’s precisely why the average expected retirement age has jumped from 62.2 years to 64 years of age.

I verbally slapped my son silly and told him that — under no circumstances — should he stop contributing to his 401(k) plan even though it is swimming in a sea of red ink this year.

Dollar Cost Averaging

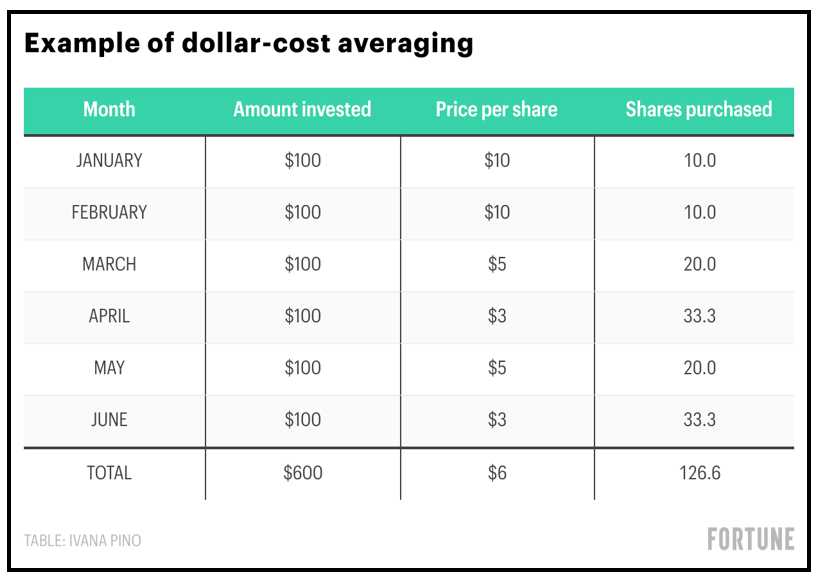

Stock prices down? Invest. Stock prices up? Invest. Stock prices flat? Invest.

That strategy is known as dollar-cost averaging, which is faithfully making investments of equal amounts, at regular intervals, regardless of how the stock market is performing.

Instead of bemoaning the stock market’s fall, I told my son that he should be jumping for joy because the $400-something dollars that he saves every month is buying 20% more shares of the S&P 500 index fund and 30% more shares of the Nasdaq index fund.

Those discounted shares that he is buying today will be worth many times that in the 30+ years until he reaches retirement age.

Today’s bargains are tomorrow’s financial freedom.

And if you’d like to receive some of my tailored picks that can help you get there, consider joining my trading service, Disruptors & Dominators.

Members of that service are enjoying open gains of nearly 41%, 38% and 25% amid the worst bear market in over a decade. Click here to learn more.

Best wishes,

Tony