|

| By Chris Graebe |

Elon Musk is no doubt a controversial character.

But most can agree that his space-tech company is truly revolutionary.

Musk launched SpaceX in 2002. Over its lifespan, it’s managed to cut the cost of sending a kilogram into orbit by 90%.

SpaceX is one of the government’s first calls when it needs a “boost.”

Not only does it launch its own space missions. But national space programs use its rockets, spacecraft and even crew members.

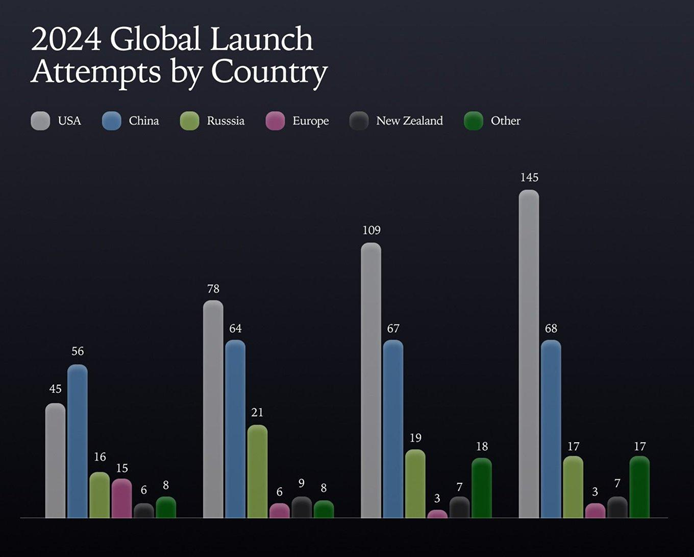

This has allowed the U.S. to maintain its lead in space launches.

And it helps secure our place at the forefront of the space race for years to come.

No wonder SpaceX has managed to nab over $13B in government contracts over the past decade, largely from NASA.

That includes a $2.9B project for the Artemis program, which aims to maintain a sustainable presence on the moon.

Plus, SpaceX’s Starlink global internet service generated an estimated $12.3B from 7.6 million subscribers in 2025 so far.

Currently, SpaceX is valued at about $350 billion. That’s about the same as Weiss “Buy”-rated stocks like Bank of America (BAC), Palantir (PLTR) and German enterprise software company SAP (SAP).

In other words …

SpaceX has all the makings of a hot investment. There’s just one problem.

It isn’t public yet. It’s relied on raising capital from private equity, funds and wealthy investors over the years.

So, not only is it nearly impossible for retail investors to get their hands on shares …

But the two current options don’t get you as close to the investment launchpad as you might like.

2 Ways to Get a Sliver of SpaceX

One option is to buy shares through a marketplace such as EquityZen, which I’ve written about previously.

Even if you can get your hands on some shares, it takes a minimum $5,000 commitment to buy on that platform.

Another option is to consider a fund, such as the ERShares Crossover ETF (XOVR), that holds shares of SpaceX.

However, that means investors have to buy a basket of other companies to get access to SpaceX.

A Third Option: A Tokenized Take on SpaceX

It’s called rSpaceX.

It’s a tokenized asset that you can find on the Republic crowdfunding portal.

The idea behind a tokenized asset is simple: If SpaceX goes up in value, then the value of the token should rise in step.

Republic describes this new product as a “mirror token.” To reflect those changing values.

The minimum investment is $50. But with tokens at $1 each, that means if you join the waitlist on Republic, your minimum buy would get you 50 tokens right off the bat.

But while I am all for new opportunities for private-equity investors, this idea may be too good to be true.

A Leap for Mankind, or a Step Back for Investors?

SpaceX isn’t publicly traded. Which means you can’t get daily pricing the way you can for any stock on the S&P 500 or Nasdaq.

And privately held shares trade hands far less frequently.

That means the best grasp investors like you and I can get on SpaceX’s value is when the company goes to raise more capital.

This discrepancy can have a big impact in your investment.

Republic’s rSpaceX token will be valued based on a $225-$275 share price. But recent transactions on the secondary markets have occurred at a price of $185.

That means the token may be as overvalued as 48.6%!

That doesn’t give investors much upside potential unless SpaceX’s value substantially increases over the next year.

So, what’s the worst-case scenario with tokenized SpaceX shares?

You buy the rSpaceX token for $275. Then, you’re left holding the bag for a year while actual SpaceX shares appreciate from their recent price of $185.

Why a year?

Because buried in Republic’s fine print is a one-year lockup period.

That means you are locked into owning that token, no matter what happens to its value, for one year.

Plus, a lockup period typically creates a massive rush for the exit when it ends.

That’s another strike against buying this tokenization offering.

A Warning About Tokenization

Said more simply …

A publicly traded company’s shares represent fractional ownership.

In much the same way, a token is a digital asset representing ownership.

However, investors who go the tokenized route won’t get actual shares of SpaceX when they invest.

They’ll get an IOU coin.

It’s a representation of value, which may not amount to anything at all in the end.

Which means it’s possible that, even if the value of rSpaceX matches the value of SpaceX shares, you may not have the benefits of actual ownership.

You’ll just be along for the ride.

That, combined with the red flags I laid out earlier, is why I don’t like this deal structure.

If you’re interested in SpaceX, you may be better off paying up for SpaceX shares on the private market.

Or you can try buying some of today’s tech funds that hold a position in SpaceX. XOVR is one. The ARK Venture Fund (ARKVX) is another.

Just keep in mind that isn’t a pure play on SpaceX. And neither fund gets a good Weiss rating. So keep that in mind.

A Better Way

I’m always excited to see changes that enable more opportunities for average folks to tap into the private market.

Secondary marketplaces and tokenized assets may very well become more liquid in time.

And if SpaceX does indeed launch an Initial Public Offering, you can be assured that I’ll be paying close attention.

But for my money, there’s a better way to get into companies before they go public.

In fact, I have one such opportunity in my sights right now.

On Tuesday, July 22, I’m hosting a Private Investment Summit.

There, I plan to tell you more about this little-known company that’s set to disrupt one of the most lucrative industries on earth.

This event is for regular people who want to get into private, pre-IPO companies.

If that’s you, join me at 2 p.m. one week from today.

I’ll reveal exactly how and WHY you should consider claiming an early stake while it’s still private.

Successful deals in this sector offered returns as high as 900% ... 19,942% … 53,423% and more.

I expect seats to go fast. So don’t wait. Click here to reserve your spot today.

Happy hunting!

Chris Graebe