|

| By Michael A. Robinson |

Gold has been on a tear.

Big gains, big headlines — it feels like everyone wants in.

After all, gold rose 42% last year … and has kept on rising.

But here’s the rub: With the Federal Reserve cutting rates, that alone could slow gold’s giant climb.

Don’t get me wrong, precious metals still belong in a smart, long-term plan. I own silver myself.

But when it comes to money-related investments that are really ready to soar, I think it pays to look elsewhere, especially since gold was recently 10% off its highs.

Then again, with Washington moving to shore up the world of cryptos, we’re searching for a way to invest without all the choppy trading we see with Bitcoin and hundreds of other coins.

Now you know why the “new” field of stablecoins is already worth $250 billion and is headed to a value of $3.7 trillion.

Today, I’ll reveal a great back-end play on this massive growth.

It’s a firm that cut its teeth at the dawn of fintech and is on pace to double its per-share profits in the next three years …

The Future of Money

The future of money isn’t exactly hard to guess. But for many, it’s simply hard to understand.

You see, money has gone digital. And I don’t just mean credit cards and online payment systems.

You may recall that crypto is a decentralized form of digital money.

That means it’s not issued by any single bank or government.

Instead, transactions can come from anywhere and almost anyone.

Odds are you heard a lot about Bitcoin and Ethereum, the two leaders in the space.

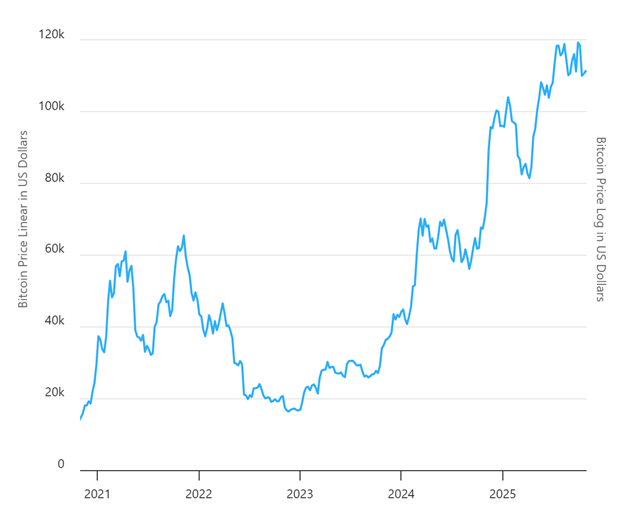

One reason they’re such hot items is that their values can soar. Bitcoin alone has gained 985% over the past three years.

But in 2022, the value dropped more than 70% followed by a big rebound.

It’s now trading around $110,000 — for a single coin.

For average folks and the pros alike, that choppy track record keeps Bitcoin from becoming a mainstream form of payments.

Enter Stablecoins

These are cryptos designed to maintain a steady value.

The concept here is simple and powerful — tie these coins to real-world assets like the dollar or even gold for that matter.

Here’s the thing. Stablecoins can become a standard form of payment for companies, the government and just plain regular folks.

Thanks to the newly signed Genius Act, America is on the verge of setting up a tokenized economy.

And the field is growing fast. The total value of issued stablecoins has doubled from $120 billion to $250 billion in just 18 months.

And data from Citigroup says the world’s supply of stablecoins could swell to a value of $3.7 trillion by 2030.

Stablecoins also benefit from swift and cheap payment processing, 24/7 access and helping crypto users manage risk.

That’s why merchants, fintech firm and even banks are investing heavily in them …

Including one of the biggest fintech leaders in the world …

Introducing Visa

That company is Visa (V).

Visa is a global fintech company, specializing in electronic funds transfers through its branded credit and debit cards.

Now then, Visa doesn’t issue its own cards.

Instead, it provides the infrastructure that allows banks, merchants and consumers to process payments quickly and securely.

Visa was founded in 1958 and today has a market cap of more than $500 billion. It operates in more than 200 countries.

The company’s payment system is its bread and butter. Here’s how it works:

First, you swipe your Visa card at a store. That request for payment then goes through VisaNet — this is the company’s global payment network that authorizes transactions — to your bank.

Your bank then approves or denies the transaction. And Visa sends the result back to the merchant.

Visa’s Role with Stablecoins

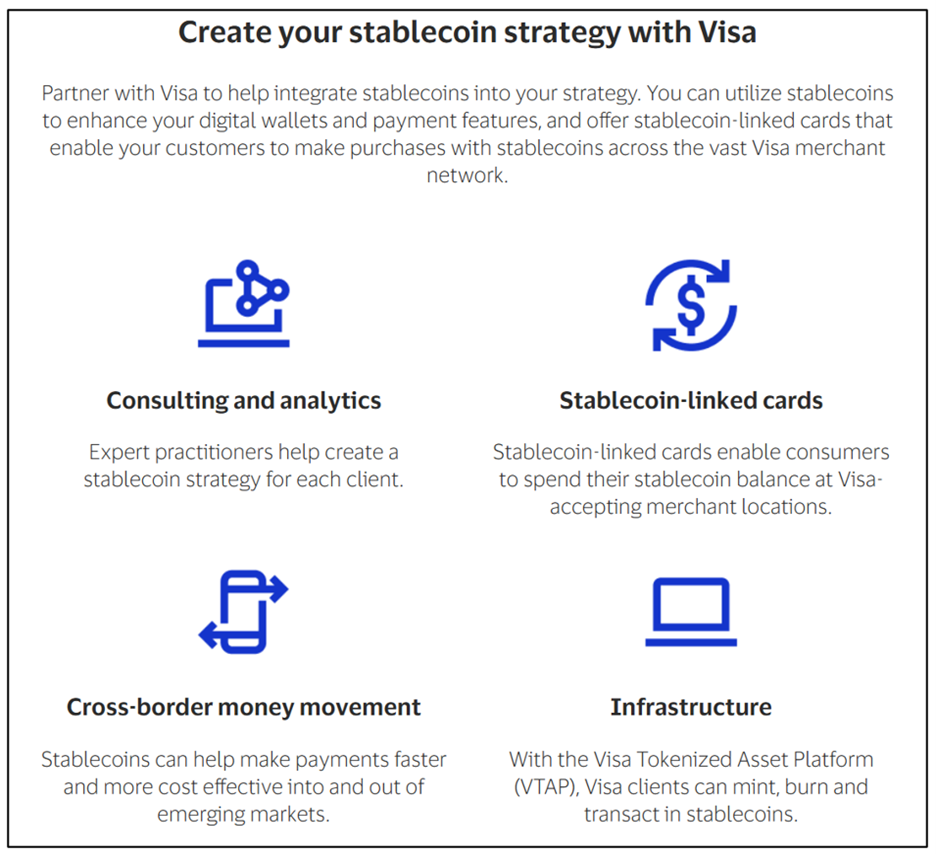

The firm has really stepped up its use of stablecoins. Here are some key moves:

- Settlement Platform — Visa now supports more stablecoins. This includes coins backed by U.S. dollars and euros.

- Merchant Settlement — Visa tested a stablecoin called USDC for merchant payments. USDC matches the dollar's value. This lets merchants get paid in stablecoins instead of regular money.

- Stablecoin Visa Cards — Visa teamed up with Bridge to create new cards. Bridge is a stablecoin company that Stripe bought for over $1 billion. These cards let you spend stablecoins at any store that takes Visa.

- Money Platform — Visa built a platform for digital money. Banks can use it to create and manage stablecoins. Think of it as a tool that makes money "programmable."

Why is Visa so interested in stablecoins?

Beyond wanting to be part of the future of money, the use of these coins can reduce delays that come with fiat wire transfers, bank holidays and time zones.

It’s a step toward high-speed clearance 24/7.

At the same time, as the use of these coins evolves and the field itself matures, Visa is set up to make this a core part of its operations.

Time to Invest

The crypto world is joining with the real world. Stablecoins give us the best of both.

You can use digital money without the ups and downs that keep cryptos from being used by the masses on a daily basis.

Visa leads this push with stablecoins. This bold move means the firm is at the leading edge of next-gen fintech.

On top of all that, profits are getting much better.

Last quarter, profits per share grew 23%. That's 53% more than its three-year average.

And if the higher rate holds, we could see profits double in as little as three years.

Add it all up and you can see why I say Visa is not just about the future of money … it’s about how this new trend will fatten our wallets.

Best,

Michael A. Robinson

P.S. On Tuesday, I met with Nilus Mattive to do something I didn’t think was really possible.

He showed me how to grab a handful of income from tech stocks — an asset class that historically does not pay sizeable dividends.

Nilus also showed how to do the same for many other kinds of investments — gold, crypto and even private equity.

I’m “all-in” on this strategy. Check it out here while you still can.