|

| By Chris Graebe |

Let me start by saying I know that politics is a hot-button issue. I’m not here to press that button.

My focus is on what the outcome of the recently decided election means for private equity investing.

And there is a lot to say about how this election result could impact startup investors like you and me over the next four years.

So, that’s what I’ll focus on today. But before we get to that …

One statement kept coming up during the immediate aftermath of the U.S. election from political commentators across the spectrum.

As I flipped between traditional media and YouTube watch parties, I kept hearing:

“This is the greatest political comeback of all time.”

And looking at it from where I sit, it’s hard to argue. I’ve never seen anything quite like this. I imagine many of you feel the same.

Why do I highlight this? It’s not to say whether this outcome is “good” or “bad.” I’ll leave that to the experts.

What resonates with me is the comeback theme itself.

It’s no secret that a lot of companies fail. From scrappy startups to established global brands and everything in between.

And what I try to do here is find the startups that not only have what it takes to become success stories …

But also, to find founders with the mettle and the resources to make it out of the inevitable tough times.

In fact, the comeback and underdog story are exactly what get me excited. The chance to discover and back ideas that could create a lasting impact driven by dedicated visionaries is thrilling.

And of course, the possibility that those ideas deliver big returns isn’t a bad incentive, either.

No matter where you stand on the political spectrum, I encourage you to keep that resilient spirit in mind.

It’s what our country was founded on. It is what will bring us into the future.

And it is a virtue that will serve you well as an investor. Especially when you consider …

What I See Unfolding

in the World of Startups

As the markets absolutely skyrocketed following last month’s election, it’s clear that Wall Street views President-Elect Donald Trump’s administration as bullish for growth.

Do I think we’ll be without speedbumps over the next year or so? Absolutely not.

The latest labor and inflation figures and high stock and startup valuations suggest we’re due for some kind of correction in the next year.

But here’s where I see opportunity: I believe we’re about to enter a strong period for IPOs.

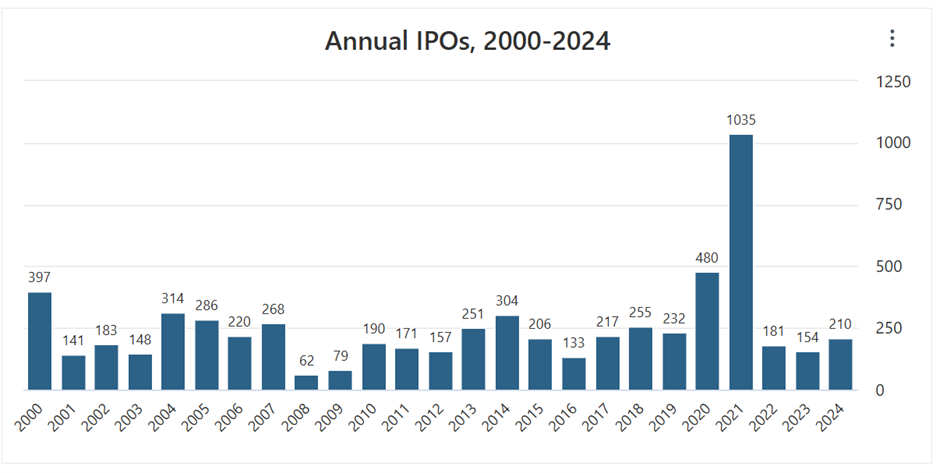

2021 was a record-breaking year for IPOs. But since then, the enthusiasm for startups going public has cooled.

A lot of companies have been sitting tight, waiting for the market to warm back up.

I believe that’s what we could see happen over the next year or so.

Right now, record capital coming from the likes of deep-pocketed investors like Warren Buffett, major private-equity firms and venture capitalists is on the sidelines.

From what I'm hearing, I think we’re going to see that capital deployed in strategic acquisitions and investments. And we may not have to wait long to see it.

This creates fertile ground for the startups I’ve been targeting.

While it’s all a bit of a guessing game, I believe 2025 will be a year of thriving rather than just surviving.

I’m optimistic that hard work will pay off … and liquidity events are on the horizon.

Happy hunting!

Chris Graebe

P.S. Strategic acquisitions often come about when companies buy out their partners.

And since AI leader Nvidia is sitting on $38.5 billion in cash right now, it would be smart to get into its partners before the calendar flips to 2025.

We found three you’ll want to hear about. Check them out here.