The ‘Pentagon’s Nvidia’ Aims to Ease Chip Shortage 2.0

|

| By Michael A. Robinson |

U.S. automakers are bracing for what amounts to what I call the coming Chip Shortage 2.0.

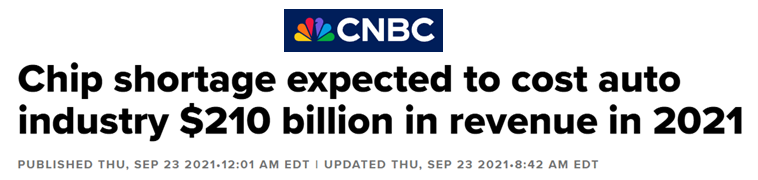

The first big semiconductor chip shortage (of 2020 and 2021) forced automakers to make some painful cuts.

Firms like Ford (F), General Motors (GM) and Toyota (TM) idled plants, slashed output targets, and parked thousands of unfinished vehicles in lots across the country.

That chip crisis ended up costing the global auto sector more than $200 billion in lost sales.

That first chips shortfall showed how vital it is to have a domestic supply chain for chips and other crucial electronics.

Now you know why a recent decision by a storied defense leader to make its own microelectronics, which I just refer to as “micros,” is such a savvy move.

It not only gives that firm more control over its supply chain …

But I also believe it will bring higher margins. Not to mention outside sales.

And the timing is great.

This company just improved earnings growth by more than 800%.

Let me show you why they are on pace to double in 2.5 years …

This Chip News Largely Flew Under the Radar

As part of global trade tensions, China just blocked chip sales that supply 40% of the global auto sector.

That ban has since been eased … for now.

But if ever there were a wakeup call for domestic chip-making, this is it.

After all, chips power almost everything in modern cars and trucks.

Not just any chips. Vehicles require special, highly specific semis.

And if this détente proves tenuous, that could provide an even bigger challenge than the 2020-’21 shortage that stemmed from the Covid lockdowns.

Those lockdowns curtailed Chinese chip output.

Which meant the U.S. market lost access to most of China’s chips and microelectronics (the “brains” of computers).

Eventually, the chips started flowing around the world again.

But now, we know how much damage even a short gap in the supply chain can cause.

That’s why the company I’m about to tell you about is trying to prevent that from happening again.

The Quiet Giant in Chip Demand

President Trump wants the U.S. to make as many chips and micros here as possible.

He isn’t just worried about cars and trucks, for that matter.

One sector tops the priority list for Made in America chips and micros — defense.

Simply stated, we just cannot rely on our chief adversary to supply critical defense parts like chips and micros.

This is especially true now that defense tech drives military spending.

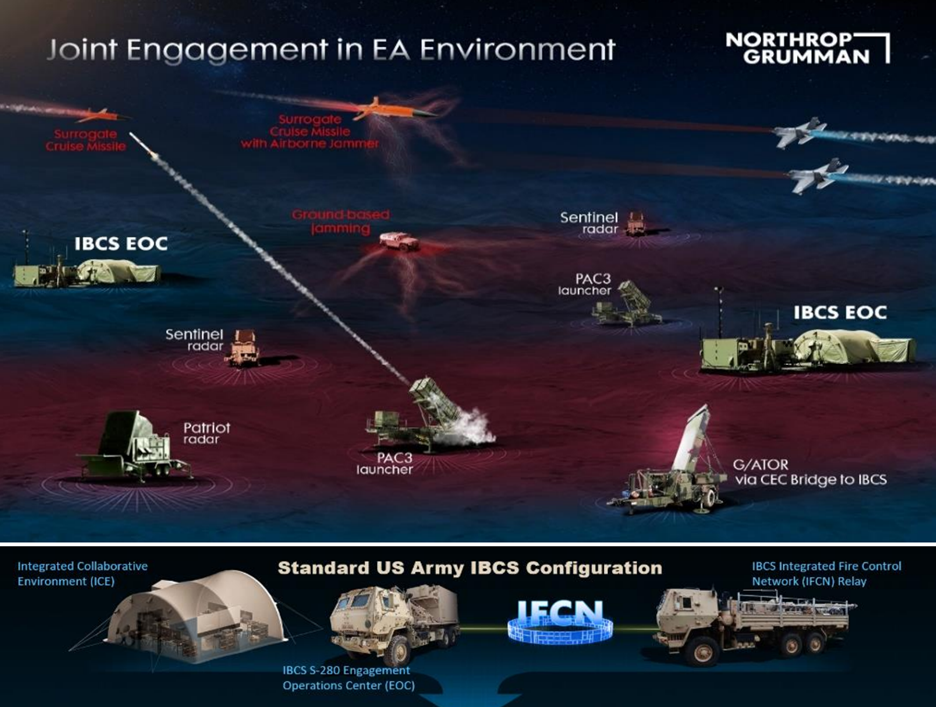

Chips and micros are crucial in the New Space Race, Golden Dome, satellites and the new AI-driven war space.

They’re also vital for next-gen avionics, guidance and secure communications for planes, ships, subs, missiles, drones and combat troops.

Having these unique chips and micros made by our chief rivals is a nightmare waiting to happen.

Not just because of supply chain issues, but for national defense!

If the Chinese put a bug or virus in chips that were in missiles or intelligence equipment, it could spell disaster.

Homegrown Chips

The good news is there’s one storied leader that makes U.S. defense-quality chips and micros in the U.S.

And it isn’t a familiar Silicon Valley name.

It’s major defense company Northrop Grumman (NOC).

Of the major defense “primes,” it’s the only one that has built its own U.S. facilities to make micros and chips.

It has three chip plants around the U.S. — in California, Maryland and Florida.

The California and Maryland foundries are government-certified. The Florida plant is an advanced packaging unit.

Right now, 98% of chip and micros packaging is done offshore.

NOC is one of the few defense firms that can do it in the U.S., especially at scale.

Northrop designs, manufactures, assembles, tests and packages millions of microelectronics annually.

And now it’s opening up those services to its partners.

This could well be a massive growth engine for the company.

That’s on top of all the other work it does on defense, aerospace and communications systems.

Prime Time for This Tech

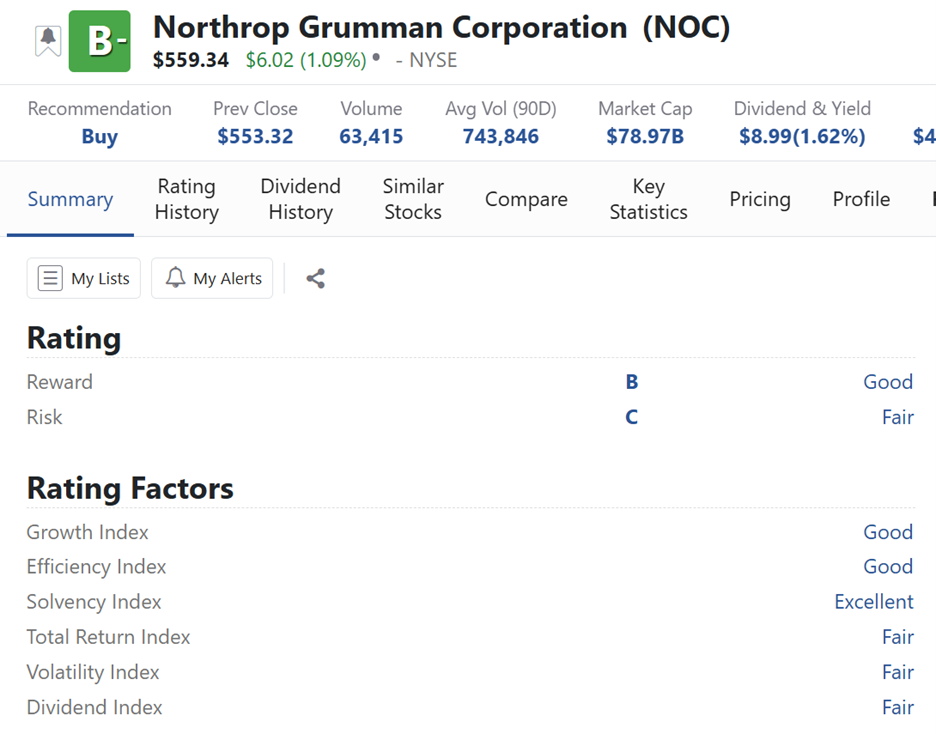

Northrop ranks as the world’s No. 4 defense leader. Last year, 89% of its $41 billion in sales came from defense.

It builds the advanced B-21 stealth bomber, as well as key parts of the F-35 and F/A-18 fighters.

It’s also a leader in missile production, drones, and command and control systems, as well as the U.S. nuclear arsenal.

It’s also hard at work on Golden Dome systems that Trump wants to use as a missile shield for the U.S.

Northrop has streamlined operations in Huntsville, Alabama. And is already testing space-based interceptors.

And a new integrated battle command system (IBCS) in Wisconsin is built as a modern, flexible and scalable production facility.

It’s missile and space-based system will soon be deployed in Poland.

IBCS is the groundwork, while Golden Dome is still in the early stages.

But it shows that NOC isn’t waiting around for orders.

It’s busy innovating.

In the here and now, NOC is getting ready for new contracts from the U.S. Air Force for more B-21s by the end of the year.

And demand for F-35s is growing among allies around the world.

Northropt also just landed a $3.5 billion Navy contract for the successor to the “doomsday” plane.

That’s the aircraft designed to survive nuclear war and command our strategic forces.

Plenty Now, More Tomorrow

The fact is, NOC is one of the most in-demand major defense firms in the world today. And its earnings growth proves it.

In the most recent quarter, earnings growth shot from zero over the past three years to 9%.

That’s an 800% jump if we're being conservative and call the baseline 1%.

Even better, earnings growth was more than twice that of sales.

In other words, despite the complex products it produces for one of the toughest clients on earth, it is still finding new ways to grow profit margins and cash flow.

Add it all up, and you can see this is a company the U.S. defense sector, as well as investors, can count on for the long haul.

Best,

Michael A. Robinson

P.S. Many of Northrop’s clients that will be bidding for its chips and micros are not well-known names yet. Quite a few are still privately owned.

This is an area of investment where you can see mind-blowing profits if you know how to strike — pre-IPO companies.

My colleague, Chris Graebe, just introduced a private deal to Weiss Members. See what it’s all about here.

But hurry. This company raised $2 million within five hours of opening its doors to investors.

At this pace, this opportunity won’t stay open long.