The SEC Just Gave This ‘Other’ Blue-Chip Digital Currency a Boost

|

| By Marija Matic |

Institutional capital, investor sentiment and on-chain activity are all converging around one message:

Ethereum is back in the spotlight — and it’s gaining serious strength.

And it looks like it might be entering the early stages of a major resurgence.

That’s why, despite recent price gains that sent it above $2,800, ETH still appears undervalued.

While analyst views vary widely — from Standard Chartered's $4,000 target to more bullish independent forecasts reaching $8,000-$15,000 — there is significant upside potential.

To be clear, there is significant upside potential even if you don’t have a crypto trading account.

In fact, one main reason for ETH’s recent run-up comes from the traditional finance, or TradFi, world.

Another comes from the SEC … which appears to be warming up to the No. 2 crypto by market cap in a big way.

I’ll tell you more about those today, along with a way traditional investors can get a leg up on Ethereum’s next leg higher.

Smart Money’s Bold Rotation

After years of Bitcoin dominance, institutional investors are now reallocating capital — quite rapidly, in some cases — toward Ethereum.

The clearest signal?

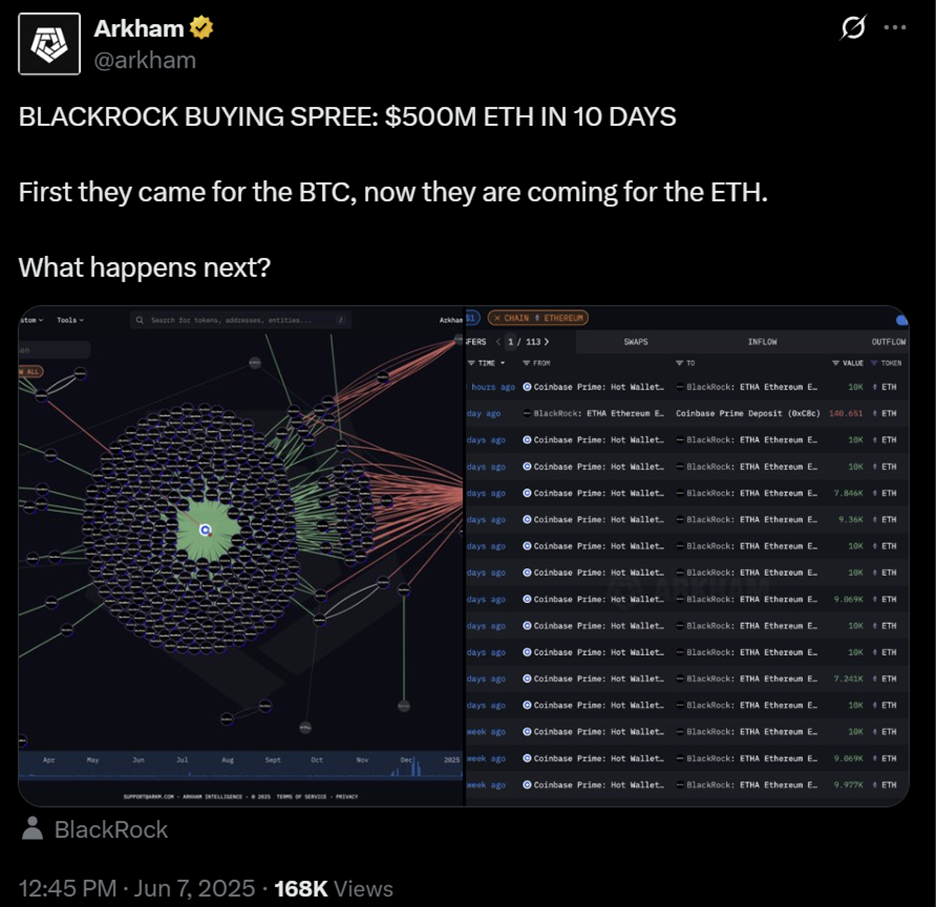

BlackRock (BLK), the world’s largest asset manager, has acquired over $500 million worth of ETH.

To be clear, this all happened just in the past 10 days!

It mirrors the firm’s early Bitcoin strategy.

But this time, it’s Ethereum’s turn to step into the spotlight.

This move reflects growing confidence in Ethereum’s value proposition.

Unlike Bitcoin, often viewed strictly as digital gold, Ethereum offers wider utility.

It powers decentralized finance (DeFi), NFTs, smart contracts, staking and a rapidly expanding Layer-2 ecosystem.

Its role as the most secure programmable blockchain makes it a foundational piece in modern crypto portfolios.

The SEC may even be warming up to that idea.

The regulatory body — which has famously taken a tough stance about cryptos — gave digital currency fans some tangible signs of hope.

First, the SEC has started reviewing a proposal from Bitwise for an ETF that tracks Bitcoin and Ethereum.

If approved, this first-of-its-kind hybrid asset would contain 83% Bitcoin and 17% Ether.

Second, and perhaps more surprisingly, SEC Chair Paul S. Atkins said Ethereum and DeFi embody “the American spirit: economic liberty, property rights and open innovation.”

This was part of Atkins’ June 9 remarks at a Crypto Task Force Roundtable on DeFi.

From the article:

For the first time ever, a sitting Chair of the SEC publicly declared Ethereum’s underlying infrastructure, mining, validating and staking-as-a-service, not to be securities transactions.

With the SEC’s opinion that staking is not a securities event — a concern that had many institutions waiting on the sidelines — ETH’s appeal should only continue to grow.

As risk perception fades, Ethereum is emerging as a blue-chip crypto for institutional investors.

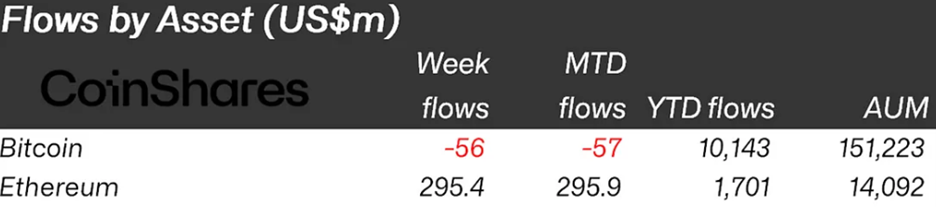

CoinShares’ latest report echoes this trend.

Digital asset investment products saw $286 million in net inflows just last week alone — which also happened to be the seventh straight week of positive flows.

But notably, it was Ethereum at the head of the pack with a massive $295.4 million in inflows.

That makes last week the strongest for ETH since the U.S. presidential election back in November.

In contrast, Bitcoin suffered $56 million in outflows, its second consecutive week of losses.

Meanwhile, U.S.-based spot Ethereum ETFs have delivered four straight weeks of positive inflows to total more than $856 million during that period.

These include:

- iShares Ethereum Trust ETF (ETHA, Not Yet Rated)

- Grayscale Ethereum Trust ETF (ETHE)

- Fidelity Ethereum Fund ETF (FETH, Not Yet Rated)

All of these give you easy access for this next leg up even from withing your regular TradFi brokerage account.

With ETH prices already up over 70% in the past two months, it’s clear that sentiment is surging.

So, you’ll want to consider adding an allocation to the other blue-chip crypto.

But there are still better ways to take advantage of the final — most explosive — leg of the crypto rally.

Watch our Crypto All-Access Summit today before it is taken offline at 11:59 p.m. Eastern tonight.

I hope you see it before it’s too late.

Best,

Marija Matić