|

| By Dawn Pennington |

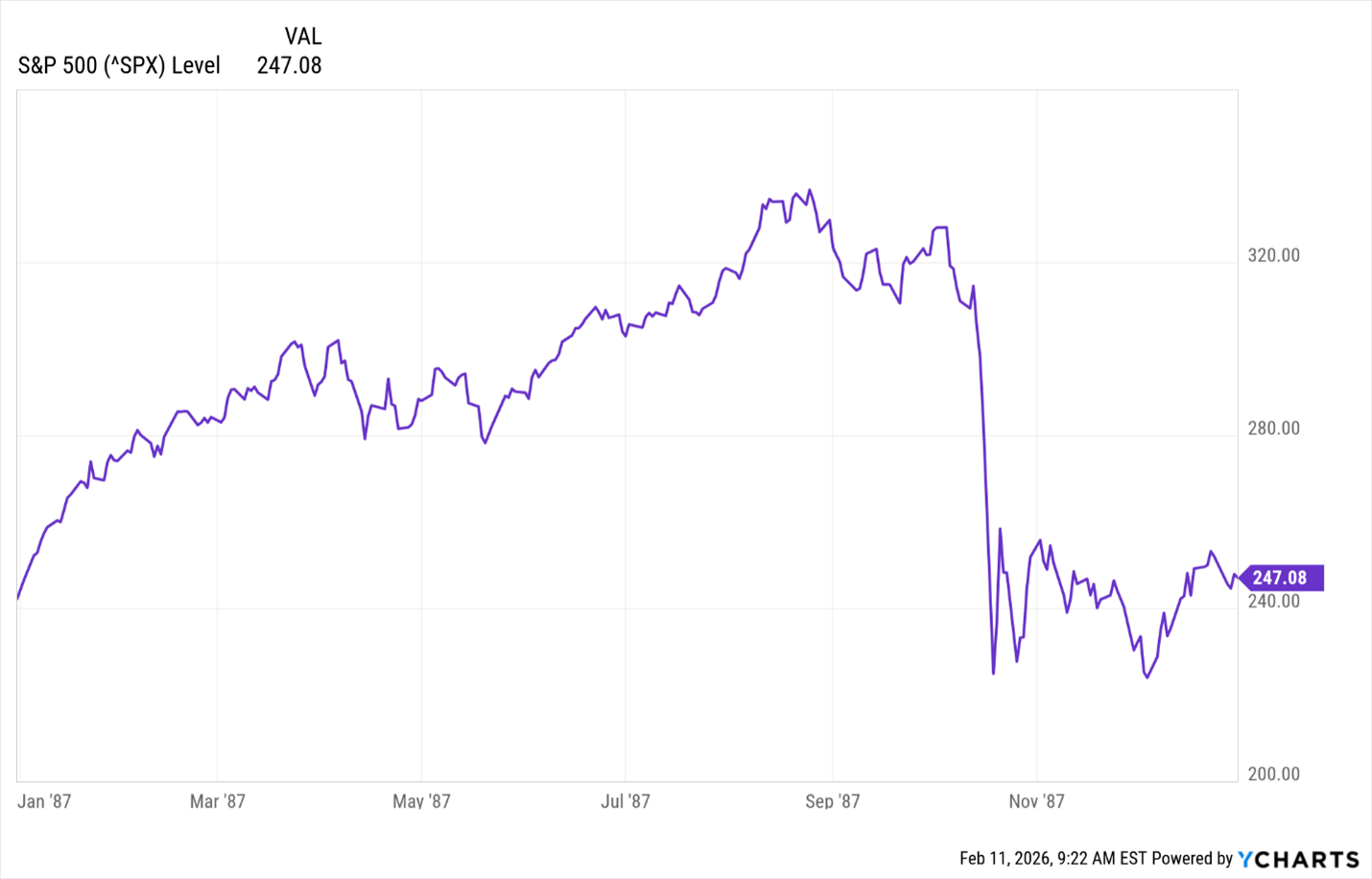

In October 1987, the stock market suffered a one-day 22% decline.

Stocks had been trending higher for the year, but this kind of one-day move triggered fears about a repeat of the Great Depression.

However, some investors were waiting for a discount and started buying stocks.

One such person was Warren Buffett.

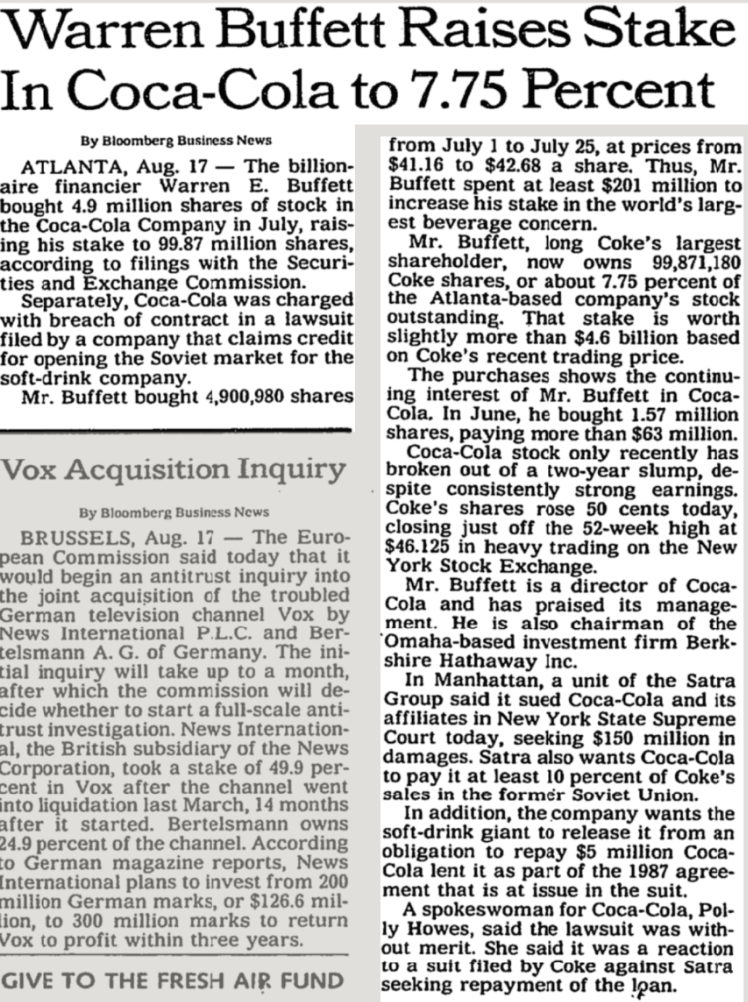

Warren Buffett began buying Coca-Cola (KO) stock in the summer of 1988.

He spent some $593 million to acquire 226.8 million shares at an average cost of around $2.60 per share (split-adjusted).

He continued purchasing in 1989, adding another $431 million, and made a final purchase in 1994 of $275 million.

That brought the total position to 400 million shares (after accounting for stock splits).

The total investment in KO for Berkshire sits at $1.3 billion.

This came at a time when Coca-Cola was recovering from the "New Coke" debacle, and Roberto Goizueta had recently taken over as CEO.

Buffett famously got permission from the SEC to keep the purchases confidential to avoid moving the market.

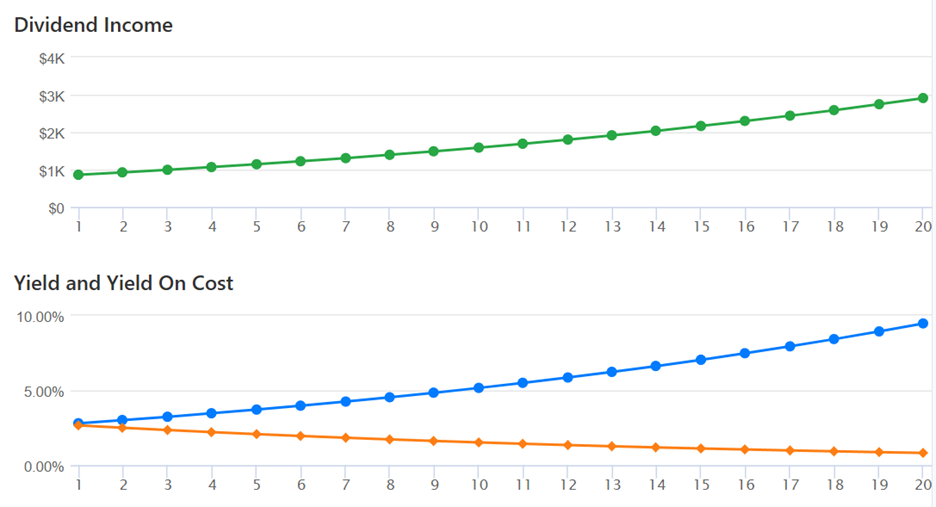

When Buffett purchased Coca-Cola in 1988, the dividend yield was around 3%-4%.

But let’s fast forward to today.

Berkshire now receives approximately $816 million in annual dividends from Coca-Cola.

In other words, Berkshire Hathaway now receives 60% on the original $1.3 billion investment — every year!

That’s in spite of the fact that the current dividend for new investors is $2.04 per share annually.

That’s a yield of about 2.9%.

How did this happen?

Coca-Cola has increased its dividend for 61 consecutive years, making it a Dividend King. (Kings pay for 50+ years, vs. Dividend Aristocrats, which pay for 25+ years.)

So while a new investor today would earn roughly 2.9% yield, Buffett's original investment now yields approximately 60% annually based on his cost basis.

That’s a remarkable demonstration of the power of dividend growth investing over long time periods.

Plus, Berkshire’s Coca-Cola stake is valued at over $28 billion today, or up over 18-fold.

Patiently waiting for dividend payments — and for those payments to increase — has paid off handsomely.

And that’s just with one consumer goods stock that was already a massive world leader.

There are plenty of other companies that offer increasing dividend payouts across several different market sectors today.

Buffett isn’t the only investor to discover this secret — known as “yield on cost.”

Yield on cost can show you how much you’re really getting in income based on what you originally paid.

Once you start seeing a portfolio with yields of 10%-15% or more, you’ll want to let those investments ride rather than try to flip growth plays.

And you can reinvest your dividends in the same company or into new positions to further your growth.

That will best utilize your growing yield on cost.

Besides looking at the current dividend yield, it’ll be helpful to look at how long a company has paid a dividend …

If they’ve been growing that payout annually …

And for how many consecutive years.

Adding in those search parameters will greatly enhance your dividend growth potential and create a rising yield on cost.

That’s exactly what we’ve been working on behind the scenes here at Weiss Ratings.

And we developed a game-changing strategy that combines decent initial yields with dividend growth potential and capital gains — the true trifecta of investing.

Dr. Martin Weiss just unveiled how it works. Watch his announcement here.

To your health and wealth,

Dawn Pennington

Editorial Director