The Transformation of War & Defense Profits

|

| By Michael A. Robinson |

Win, lose or draw in the battle against Russia, the beleaguered nation of Ukraine has shown the importance of drone warfare.

After all, Ukraine is outmanned and outgunned by its much larger adversary.

Defense experts agree that had it not been for Ukraine’s savvy use of drones — which cost a fraction of a missile or a fighter jet — the war would have already been lost, likely more than a year ago.

But Ukraine has used drones to attack Russian ships, tanks and troops to great effect.

Enter Shield AI, an aggressive startup pioneering AI to make drones more accurate and lethal.

Shield AI’s team recently scored a Ukraine contract worth up to $200 million. Then again, their drones are not just accurate; they are cost effective.

This is crucial because earlier this year, Ukraine began using drones to take the fight into Russia rather than simply defending territory in Ukraine. And it’s been working.

It also shows the power of the advanced weapons being delivered, especially AI-powered vehicles and munitions.

Let me show why the defense drone market is on pace to be worth $70 billion and a great way to play it …

Brains & Brawn

If the name Shield AI sounds familiar, that’s because I last told you about it back on May 3.

A recent Wall Street Journal story — written five months after I told you about Shield AI — described how “dumb” drones often get destroyed before they hit their targets.

Which explains why AI-powered “smart” drones are upping the ante.

And Shield AI not only has the drones, but it actually built the brains behind it all … an AI called Hivemind.

Similar to a human pilot, Hivemind reads and reacts to the battlefield and doesn’t require GPS for guidance or onboard communications to make decisions.

Shield AI has doubled its revenue in the past year, and Ukraine has ordered another 200 — at $1 million a pop. Why? Because they get the job done.

Simply stated, AI is taking a lead role. And it’s already beginning to shake up the $875 billion U.S. defense sector.

This is one I expect to do even better now that Trump has won reelection and will seek to beef up the nation’s defense.

Trump’s Pentagon & AI

The Ukraine conflict is showing us how the current war is changing battlefield command and control technology for the conflicts that lie ahead.

I think it’s important that we understand that Trump also is a big backer of AI and advanced weaponry.

In particular, he has expressed interest in fielding advanced drones.

When equipped with AI, they are proving to be highly lethal and cost just pennies on the dollar compared to sending in fighter jets, using missiles or fielding troops.

Even better for contractors and investors, a good AI “brain” can be used for platforms beyond air or sea drones.

And as I noted a moment ago, this is all going down at a time when the Pentagon is likely to get more funding.

Get It All with One Investment

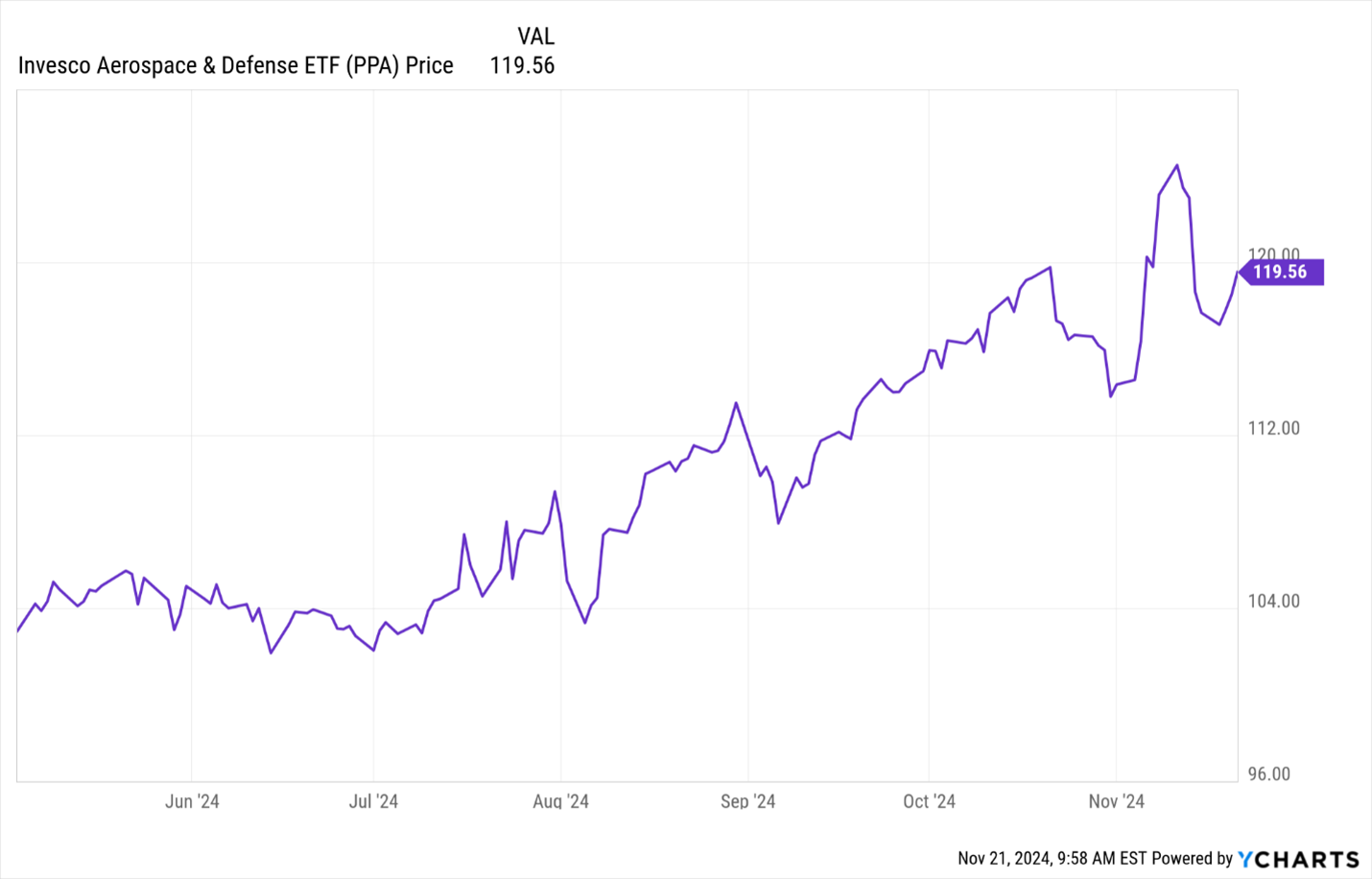

That’s why I continue to recommend Invesco Aerospace & Defense ETF (PPA),a diversified exchange-traded fund that gives you the biggest and best in aerospace and defense tech-driven firms.

It has a seasoned management team that knows the industry well and continues to find stocks to diversify among the blue chips and the hot new companies.

For investors new to the sector, it’s a smart way to get involved, whether you’re a toe-dipper or headlong diver into new sectors.

The ETF has nearly 50 stocks in its portfolio — aircraft makers, component suppliers and electronics firms that are increasingly using AI.

All of them have strong current relationships with the U.S. and our allies as everyone looks to transition their armed forces and aerospace equipment.

This is why I continue to recommend this investment.

As you might imagine, the top three holdings in the portfolio are defense blue chips — Lockheed Martin (LMT), RTX (RTX) and GE Aerospace (GE). Take a look at these other portfolio holdings:

- Honeywell International (HON) has broad exposure to defense and aerospace as well as the civilian aircraft industry and deep roots with NASA. Honeywell is working with the European Union to test an AI platform that would replace one of two human pilots, which could both improve safety and profit margins.

- Kratos Defense & Security Systems (KTOS) is a small-cap provider of communications and radar systems, payload vehicles, rockets and unmanned systems. It’s also involved in the Pentagon’s AI programs. Working in conjunction with Shield AI, it operates the Valkyrie fighter intended to fly alongside modern manned fighter jets.

- Mercury Systems (MRCY) specializes in making plug-and-play subsystems for large defense contractors like Boeing. It has deep expertise in advanced air-defense gear and supplies products for more than 300 defense programs. The firm says it is optimizing its computer processors to handle AI’s rigorous computing needs.

- Palantir Technologies (PLTR) is a fast-growing software firm with a wide range of defense contracts. It also gives investors a foray into AI-powered ground vehicles. Its TITAN Army truck works as a ground station node tapping AI to connect Army units to high-altitude and space sensors, which, in turn, provide precise targeting data to the soldiers.

As you can see, with this one investment, we benefit from the entire sector’s growth.

Given the growth and dynamic needs as we shift to an AI-driven world, a good, diversified ETF is a great place to begin.

Thus, I believe PPA is a cost-effective way to invest in virtually every aspect of America’s increasingly AI-powered defense industry that you can count on for the long haul.

Best,

Michael A. Robinson

P.S. AI is clearly powering the next generation of defense systems and weapons. But what’s powering AI?

This is the question that’s been driving so much of my research of late. And I have some findings you need to hear about right away. Check out this new presentation now.