|

| By Michael A. Robinson |

After years of ignoring the cash that’s up for grabs, Wall Street finally woke up to AI.

But they’re only telling a part of the story …

Sure, the headlines gush about ChatGPT, Nvidia (NVDA) chips and robot assistants. What they’re missing is that this isn’t just an AI moment.

Fact is, it’s nothing short of an AI supercycle that will reshape infrastructure, defense, health care, finance, logistics and energy, just to name a few.

But let’s zoom out even further …

Over the next two decades, AI will transform everything in its path.

We’re talking data centers, power grids, satellites, diagnostics and supply chain, plus defense and agriculture.

Add it all up and, based on data from PwC, we’re looking at a $22.3 trillion reinvention of the global economy by 2035.

The best part? You don’t need to buy a dozen different stocks to profit from it.

I’ve found an aggressive small cap that gives you global AI exposure across multiple industries — all in a single ticker.

Let’s unpack the opportunity …

AI Isn’t New — But It’s Unstoppable

To appreciate this moment, you have to understand how long it’s been in the making.

AI’s roots trace back to a 1956 workshop at Dartmouth College.

A group of scientists boldly predicted machines would match human intelligence within a generation.

They were wrong — but not forever.

What followed was decades of stalled development and disappointment, often referred to as the AI winter.

That began to change in the 2010s:

Cloud computing matured …

Processing power soared …

And data exploded …

These forces finally gave AI the fuel it needed.

Now, with generative tools like ChatGPT and new enterprise-grade infrastructure, we’ve entered the monetization era — real products, real demand and real profits.

Why This Isn’t Just About Chatbots

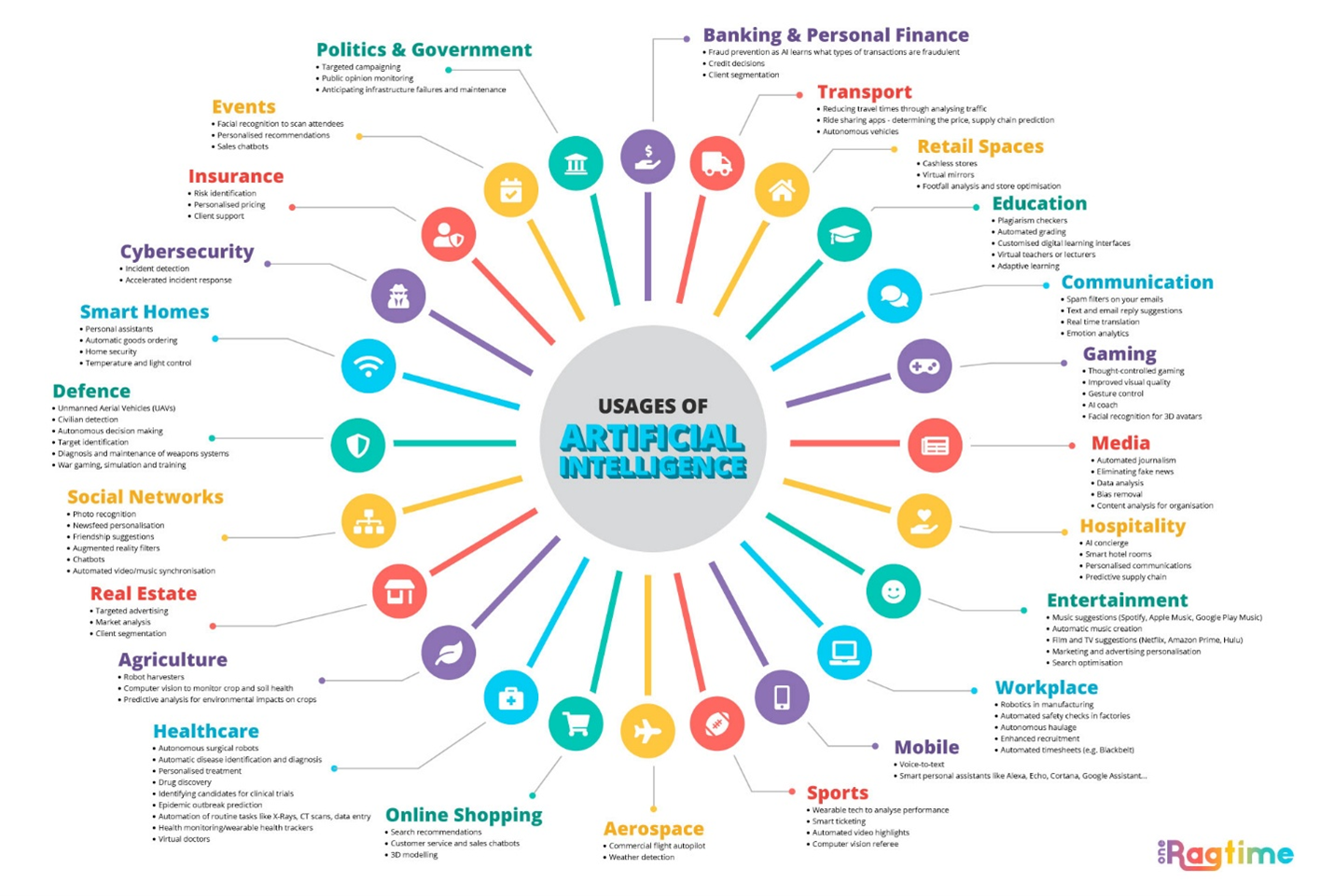

Today, AI powers fraud detection, language translation, logistics, cancer screening, risk modeling and much more.

But the bigger trend isn’t about flashy apps. It’s about AI becoming the operating system of modern civilization.

AI is now embedded in smart grids, satellites, defense networks, factory systems and hospital infrastructure.

The winners in this cycle won’t just be the chipmakers or chatbot platforms.

They’ll be the companies that turn AI into results for global industries.

That’s where our target company comes in.

The Quiet Powerhouse Behind AI Transformation

I’ve been watching one firm that sits at the heart of this transformation.

It’s not a household name, but it’s already embedded in the operations of major multinationals — helping them integrate AI into everything from aviation and media to banking and health care.

The company operates in nearly 20 countries.

It helps clients transform legacy workflows into scalable, intelligent systems.

It’s been named a global AI services leader by IDC and studied at MIT, Stanford and Harvard.

It offers proprietary platforms tailored to sectors like finance, life sciences and logistics.

And its specialized AI division is rapidly expanding to meet rising global demand.

That company is Globant (GLOB).

With a market cap of $4.4 billion, Globant has been investing in artificial intelligence since 2013 — well before ChatGPT made the concept mainstream.

But Globant isn’t just an AI developer. It’s an integrator.

Most companies don’t know how to train a large language model or how to apply AI to their proprietary data.

Globant solves that problem by offering a full-stack solution — strategy, implementation and optimization — customized to each client’s needs.

Its flagship AI division, Globant X, includes nine proprietary platforms tailored for high-growth verticals: Enterprise IT, digital payments, connected devices, health care and more.

With the AI arms race accelerating, Globant is becoming a mission-critical partner.

Blue-Chip Clients, Recurring Revenue & Global Reach

Globant’s client list is a who’s who of corporate leaders. It works with:

American Express (AXP), Alphabet’s (GOOGL) Google, Johnson & Johnson (JNJ), Netflix (NFLX) and Toyota (TM), just to name a few.

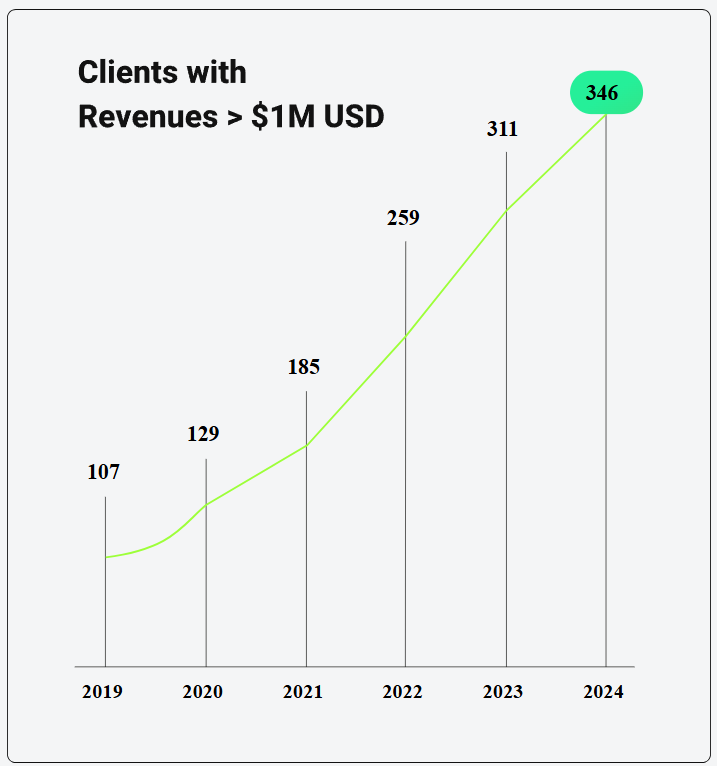

More than 300 enterprise clients each generate at least $1 million in revenue.

No single vertical contributes more than 20% of total revenue.

And 87% of its business comes from repeat customers.

Originally founded in Buenos Aires and now headquartered in Luxembourg, the firm is scaling fast.

It recently committed $1 billion in Latin America alone, much of it aimed at building out AI capacity and regional innovation hubs.

Globant gives you exposure to dozens of industries and hundreds of clients — all in one focused, high-growth stock.

Think of it like owning an AI-focused ETF, but one that’s on track to beat the overall market.

You get cross-sector upside with none of the drag.

Mega Growth at a Discount

Even better, shares are on sale.

With software stocks still lagging broader indexes, Globant’s current valuation offers an excellent entry point.

With a market cap of just $4.4 billion, over the past three years the firm had average yearly profit growth of 15%. At that rate, earnings will double in five years.

And that really is a great time horizon for a stock of this caliber. After all, we are still in the very early stages of the AI supercycle.

Translation: GLOB’s per-share profits could double twice more by 2035.

That puts it in elite company — especially when you consider the long-term runway it has in front of it.

As AI expands from servers and software into physical infrastructure, health systems and national grids, Globant will be right there, helping companies build the digital nervous system of the 21st century.

And that makes Globant one of the smartest long-haul plays in growing AI ecosystem.

Best,

Michael A. Robinson

P.S. We recently made AI upgrades of our own. We also identified the companies — through our 7 terabytes of data — that will lead AI’s second wind rally in 2025. Check them out here.