This Anniversary Present Can Deliver Significant Profits

|

| By Michael A. Robinson |

Happy anniversary, Lisa Su!

Ten years ago next week, Su was named CEO of a storied, but struggling, semiconductor firm.

Wall Street didn’t pay much attention when she was appointed to the position. Her company’s stock didn’t move up on the news. In fact, it went down for the next several months.

That slide could’ve been because Su took over a company that, for years, had played second fiddle to industry giant Intel (INTC).

Or perhaps it was sent down by the rampant speculation that the Silicon Valley firm might be headed for bankruptcy.

But as the saying goes, “That was then, this is now.”

Today, Su is far from an obscure leader. Her company ranks as one of the more respected chip firms in the world. Su herself holds millions of shares, making her a billionaire.

Her ambitious turnaround plan has paid off for herself and her investors.

And the company is now considered a leader in the global buildout for artificial intelligence, perhaps only behind Nvidia (NVDA).

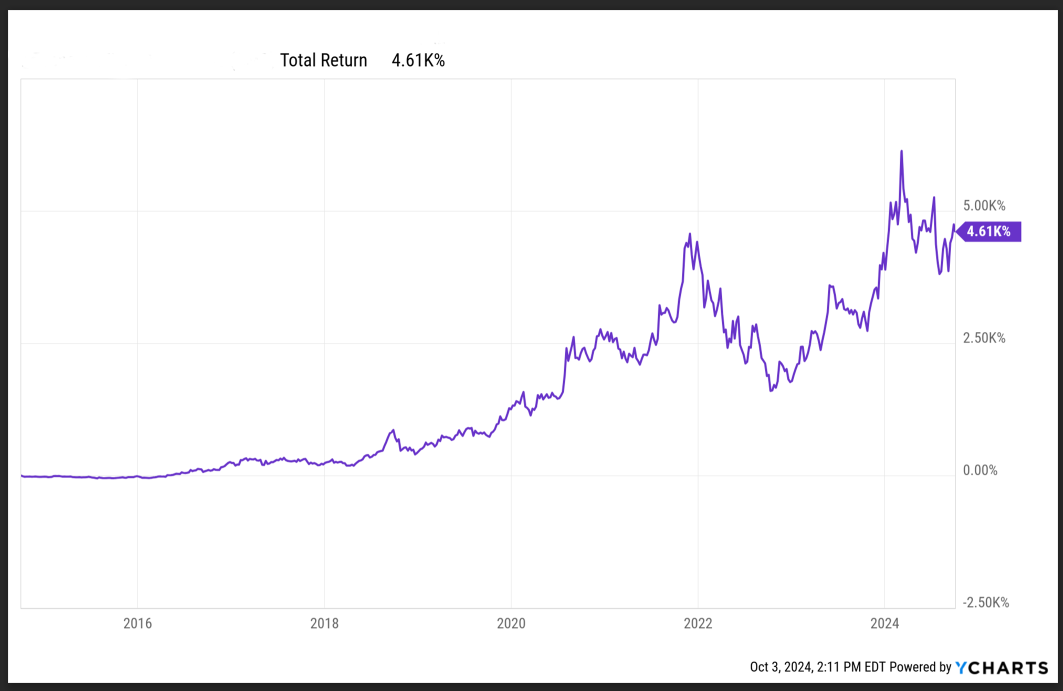

This company’s stock has gained more than 4,000% under Su.

And today, I’ll explain why there’s still plenty of upside ahead.

Su’s Rise to Success

Born in Taiwan, Su moved to the United States when she was three years old.

A tinkerer since childhood, Su attended MIT and majored in electrical engineering, a subject she chose because she believed it would be the most challenging.

Following a Bachelor’s degree, Su earned a Master’s and Doctorate in electrical engineering. Then, she entered the working world.

Su worked at Texas Instruments (TXN), the inventor of the silicon transistor and processors, as well as IBM (IBM), a pioneer in both mainframes and personal computers.

She spent 13 years at IBM and served as Vice President of its Semiconductor Research and Development Center. She was responsible for the strategic direction of IBM’s silicon technologies and R&D operations.

To say she knows the semiconductor industry — both through academic theory and in practice — would be an understatement.

For the last decade, of course, Su has been at the helm of her current business. She joined it in 2012 and held roles including Senior Vice President for Global Business and Chief Operating Officer. Then in October 2014, she was made CEO …

A position from which she has sent this company’s stock price soaring.

Introducing: AMD

The company I’m referring to is Advanced Micro Devices (AMD).

Based in Santa Clara, California, AMD designs, develops and sells computer and graphics processors.

And in recent years, it’s expanded into up-and-coming markets like datacenter storage, gaming and high-performance computing.

It’s also focused on the red-hot market for AI chips, where it trails only Nvidia as the market leader.

But as I hinted at earlier, AMD is familiar in this No. 2 spot. It took on that role in personal computer and traditional server chips for years when battling Intel.

AMD focuses on providing raw computational horsepower with its graphics processing units (GPUs).

Interestingly, it didn’t have a product to rival Nvidia in the AI market until last year, when it launched a family of GPUs for datacenter applications.

The company also has a line of AI processors — the first Windows laptop PC processors in their class that are ready for next-gen AI PC experiences.

This dash of AI is what AMD calls Ryzen AI. And it’s built into each processor and can be used for a range of tasks like:

- Personal use — creating documents, generating travel itineraries and summarizing emails.

- Business use — generating concepts and designs, accelerating productivity and sharpening video.

- Gaming — providing AI-generated graphics for a more immersive playing experience.

These moves have helped AMD close the gap between itself and Nvidia. And don’t forget the guidance and leadership handed down by Su.

A Historic Turnaround

AMD went public in 1972 and became a global entity when Su took the reins in 2014. But shares were in the cellar.

Su accepted that challenge. She went on to orchestrate one of the greatest technology turnarounds in history.

In 2022, AMD bought chipmaker Xilinx in a $50 billion deal to build up its datacenter chops. That same year, it acquired Pensando Systems, a datacenter chip and networking startup, for close to $2 billion.

Su’s push into the datacenter market paid dividends.

Since its founding, Meta had used Intel’s chips to power its cloud datacenters. But an upgraded version of AMD’s line of processors convinced Meta to switch over in 2021.

Today, all four global cloud giants — Amazon, Meta, Microsoft and Alphabet — use AMD processors.

Meanwhile, the deals haven’t slowed down either. Just last month, AMD paid nearly $5 billion to buy ZT Systems, a designer of datacenter equipment for cloud computing and AI.

This deal is designed to help AMD offer a broader menu of chips, software and systems-design assets … and to target customers like Microsoft and Meta.

Plenty of Potential Ahead

Since Su took over as CEO, AMD’s stock is up more than a whopping 4,000%.

The good news for us is that this stock, like several others in the chip sector, has struggled a bit recently.

That means we can scoop up shares at a discount.

AMD shares recently traded for $162.67.

To be sure, AMD’s earnings growth had slowed to a crawl as the company invested in the AI buildout.

But that’s set to change.

In the most recent quarter, per-share-profit growth came in at 19%. Even better, growth is projected to rise by 29% for the full year.

At that rate, we could see earnings double in as soon as 2.5 years.

As you can see, Su is the right executive to lead AMD. And with her at the helm, you can bet the company’s stock will continue to grow.

That’s potential upside we don’t want to miss. So be sure to add AMD to your portfolio.

Best,

Michael A. Robinson

P.S. AMD offers solid long-term upside potential. But, like many stocks, it doesn’t offer a dividend. That’s OK. Even the companies that do don’t seem to pay very much these days.

Fortunately, we have a solution for that. I urge you to sign up for Tuesday’s Great Income Summit to learn more.