This Company Takes Center Stage in the New Global Order

|

| By Michael A. Robinson |

On paper at least, you can see why Nicolas Maduro thought he was safe.

After all, the Venezuelan strong man had Sino-Soviet defense systems in place.

Let’s start with radar that can spot airplanes before they hit Venezuelan airspace.

Those came from China, a nation that wanted access to the Latin American nation’s vast oil supplies.

And then there was the air defense system.

Maduro was counting on the Soviet era S-300 long-range surface-to-air missiles designed to take out aircraft and drones.

Turn outs, the U.S. military had an ace up its sleeve.

It’s the EA-18G Growler aircraft equipped with electronic warfare (EW).

That system jammed Venezuela’s radar and related tech, allowing the U.S. to get the drop on Maduro.

With that recent success under its belt, you can bet that the U.S. intends to put electronic warfare front and center in the nation’s nearly $900 billion defense sector.

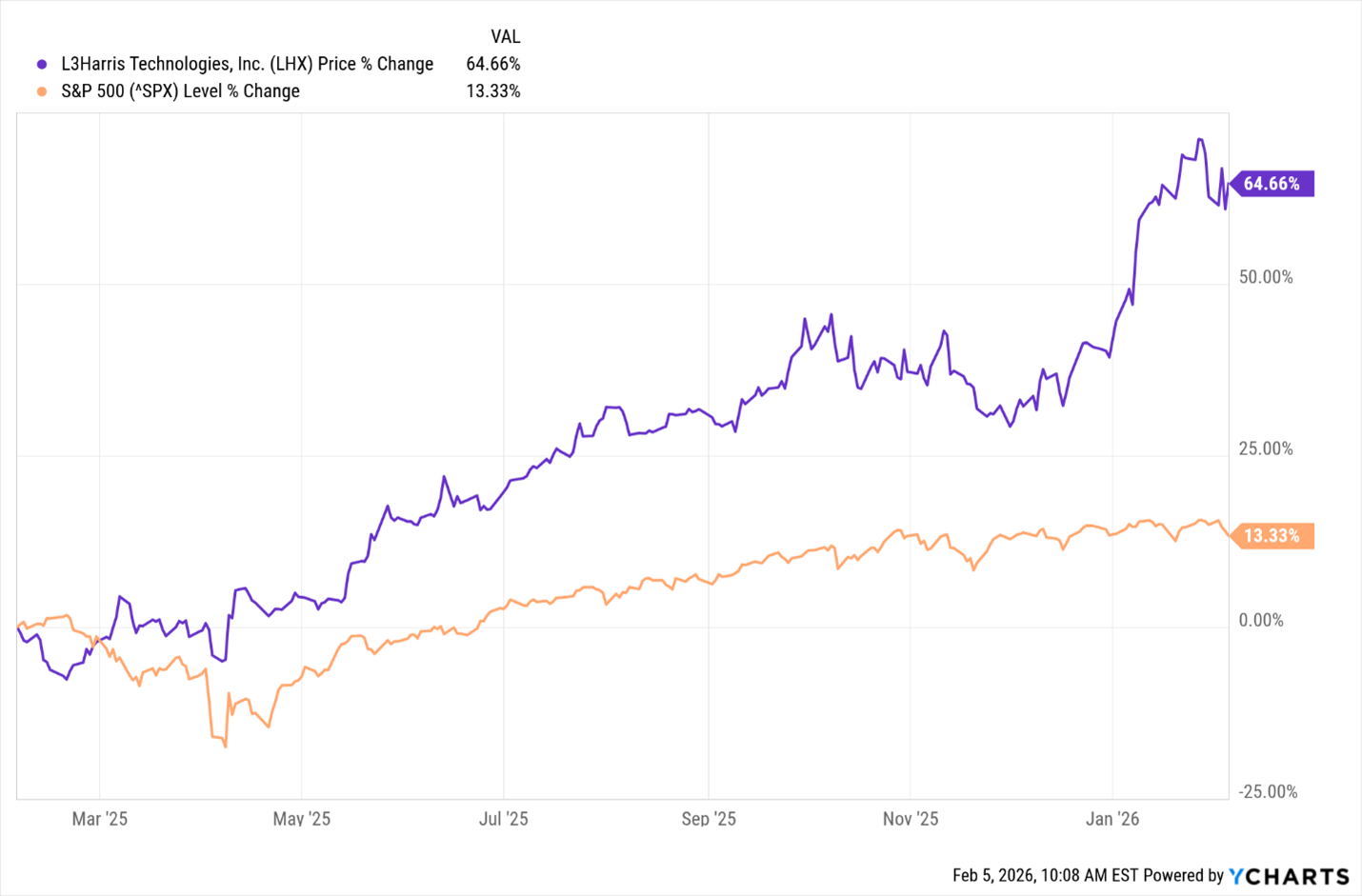

Today I will reveal a great way to play this field that last year beat the market by 141.5%.

Even better, the company at the center of it just announced a reorganization designed to make even more money …

New Tech in a New World Order

The timing here is crucial because President Trump has said he may move on Iran as that nation massacres dissidents.

And he recently placed a naval carrier group to the Persian Gulf, sitting in Iran’s backyard.

Carrier groups have an extensive array of kinetic options available.

And given the tensions Iran has had with Israel in both the first Trump administration and now this one, it won’t take much to light up the skies over Tehran.

Underlying both the actions in Venezuela and now the growing pressure in Iran, there is a message for Russia in all this.

Russia — and China — are key players with both regimes and these shows of force are about the U.S.’ willingness to bark … and bite.

Remember those shadow tankers that were running out of Venezuela?

Those were primarily used by the Russians to ship black market oil to avoid the embargo.

Trump has made it clear that the U.S. controls the hemisphere and its strategic interests beyond.

And any of this tactical force comes with one absolute necessity: Electronic warfare.

NextGen EW

Today’s digital world extends to the battlefield.

And EW use is even more crucial than it has been in the past.

War on soldiers is now also war on systems those soldiers depend upon.

Yet EW has a very long history.

The generally accepted first use of EW in combat dates back to 1904 in the Russo-Japanese War when Japan blocked Russia’s radio transmissions.

And since then, its use has been a key asset for many nations.

For example, in Vietnam and the Gulf Wars, it was very popular.

Today’s EW is smarter, networked and more accurate, as we saw in Venezuela.

Earlier, I noted Boeing’s (BA) EA-18G Growler.

It’s now the EW workhorse for the sky. It’s basically a modified F/A-18 Super Hornet with an advanced EW package.

But with the firm’s quality control issues, and its troubles across its commercial and military platforms, it’s not the best choice at this point.

Plus, I have a much better stock in mind.

Forefather of Comms

The company that’s already extending EW far beyond software and armaments is my choice for today’s systems as well as the future of this tech.

It’s L3Harris (LHX).

This company has grown and expanded through savvy bolt-on buyouts.

In 2019, Harris merged with L3 Communications, a major defense contractor specializing in secure mobile networks.

That merger made it one of the top communications players in the world.

In late 2023, LHX bought the rocket firm Aerojet Rocketdyne to add value to its satellite communications portfolio.

And it’s no coincidence that its headquarters is in Melbourne, Florida, a stone’s throw from NASA’s Cape Canaveral.

LHX has been a key player in space communications since the Apollo era, working with NASA, the Pentagon and global governments.

At the beginning of this year, LHX made another significant shift.

It’s now focused its efforts on building out strategic and tactical comms for Trump’s Golden Dome missile defense and the New Space Race.

It now operates three divisions:

- Space & Missions Systems (SMS) — It focuses on satellite and payload capabilities, especially missile warning and defense systems for Golden Dome. It’s also a leader in space-based laser comms.

- Communications & Spectrum Dominance (CSD) — This is the firm’s bread and butter. It’s all about resilient comms, EW and tactical, secure radios.

- Missile Solutions (MLS) — This group is more forward-focused on “next step” missile technologies. We’re talking about things like hypersonics, advanced production systems and next-gen propulsion solutions.

Buy the Bull

Add it all up and you can see why EW will grow in importance under this administration as it seeks to realign the world order on the planet as well as in space.

Now then, I would like to have seen much better earnings growth.

They remained weak over the last three years as the firm absorbed the costs of its buyouts and growth.

That is set to change this year with forecast calling for per-share profit growth of 12%.

That’s just one percentage point below the same forecast for Apple.

Over the past 12 months, the stock gained roughly 65%. During that time, the S&P 500 was up 13.3%.

That means LHX outpaced the broad market by nearly 5x.

In other words, this remains a great way to cash in on the global realignment and the nation’s advanced defense systems.

Best,

Michael A. Robinson

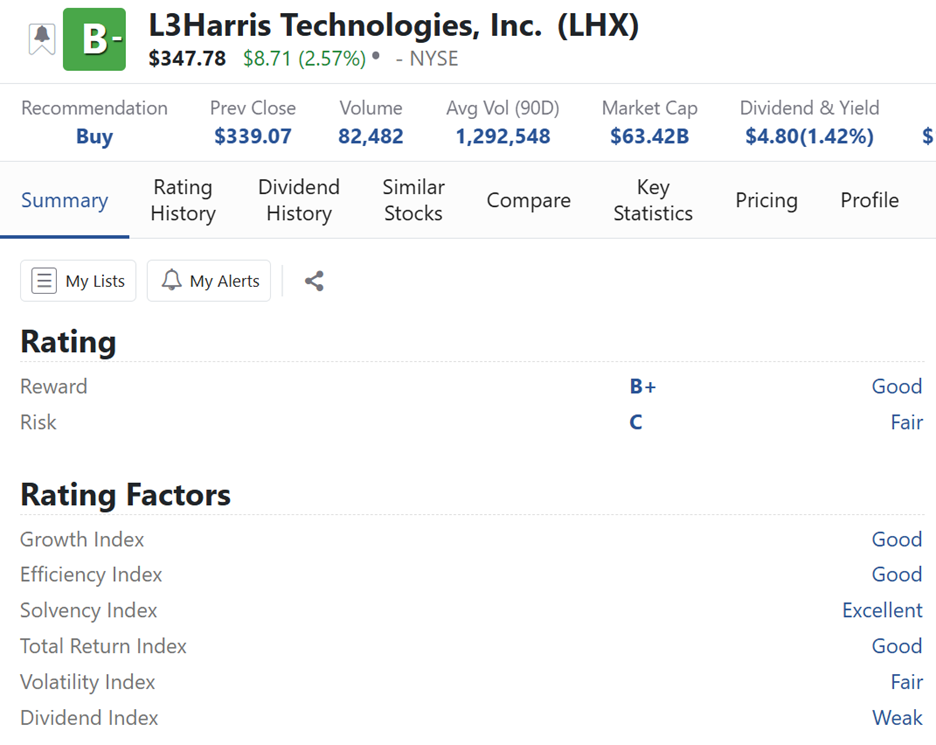

P.S. As you can see above, LHX has stellar ratings nearly across the board in our system. The one “Weak” category is its dividend.

That’s not a surprise. As noted, it has been focused on growth — both through acquisition and government contracts.

Still, if you are looking for income, you’re in luck.

Early next week — on Tuesday, Feb. 10 at 2 p.m. Eastern — Dr. Martin Weiss is holding “The Infinite Income Summit.”