This ‘Easter Egg’ Could Lead You to Market-Beating Returns

|

| By Michael A. Robinson |

By and large, the new spy movie “Argylle” was a total bust.

No doubt, it stars A-list actors. We’re talking Henry Cavill, Bryce Dallas Howard, Sam Rockwell, Bryan Cranston and Samuel L. Jackson.

The film centers around a reclusive author who is drawn into the world of spies and espionage. This occurs after she realizes that a new spy novel she is writing actually mirrors real-world events.

Argylle cost $200 million to produce and market. And since its release in theaters a few months ago, it’s only grossed $96 million worldwide.

On Rotten Tomatoes, a popular website where viewers and critics rate movies, Argylle has just a 33% rating from critics.

Yet ironically, despite Argylle’s struggles, the movie did include an “Easter egg” that could be very valuable …

At least to investors like us. Let me explain.

Hidden Profits

If you’re unfamiliar with the term, an “Easter egg” is an element — usually a visual — that’s hidden inside a movie or television show.

For example, famous director Alfred Hitchcock used to place himself in his own films in brief, split-second cameos.

In Argylle, though, the Easter egg I’m referring to isn’t visual. It’s auditory.

More specifically, it’s a song in the movie’s soundtrack whose significance was likely lost on viewers and critics alike …

Well, most viewers, that is.

You see, I immediately recognized the song’s importance. And it’s due to a massively disruptive type of technology that we’ve been talking a lot about lately …

One that enabled the late John Lennon to come back to life (in a manner of speaking).

I’m referring, of course, to artificial intelligence. And at the moment, I’m focused on how this technology is set to transform every aspect of the economy, including the creative industries like the arts and music.

This transformation is a big reason why Fortune Business Insights says AI will be worth more than $2 trillion by the end of this decade. But for now, let’s stick with AI’s role in music …

AI Brings the Beatles Back

Last year, singer Paul McCartney told the BBC that, with the help of AI, he was going to create one “last Beatles” record, this one coming some 54 years after the release of the group’s iconic hit album, “Abbey Road.”

Essentially, director Peter Jackson was able to isolate the voice of former Beatles singer John Lennon from an old demo tape using AI. And that recording was incorporated into McCartney’s track, “Now and Then.”

And if you haven’t deduced yet, “Now and Then” was the Easter egg track featured in the movie Argylle!

Don’t get discouraged if you had no idea this project was happening. Argylle’s music director, Lorne Balfe, was instructed to keep the breakthrough under wraps.

But we certainly don’t need to keep quiet when it comes to AI’s ability to influence the creation of movies, books and other music.

In fact, there’s a profitable company that dominates this part of content creation, specifically as it relates to art, photography, design and even desktop publishing.

A Creative Content King

I’m referring to Adobe (ADBE).

Adobe is a computer software company that serves as a platform for creating, editing and managing digital content.

You might have used Adobe for doing things like editing photos or designing a resume.

But perhaps surprisingly, this company is a great play on AI. And much of that has to do with the fact that Adobe recently rejuvenated itself by making a strategic move to the cloud.

Let me explain …

Not long ago, Adobe sold each tool separately, releasing regular paid-for updates.

But in what amounted to be a creative spark, the company began moving to a digital rental model. Users had to pay an ongoing monthly subscription fee to use its platforms in return for continuous updates and support.

This move paid off handsomely. And it enabled Adobe to position itself at the forefront of technological development with a model based on delivering content via the cloud.

Then in March 2023, the company announced the addition of generative AI to its platform. This is AI used to create text, images and other media.

The platform enables users to quickly generate images and text and automate workflows by telling the software what they need.

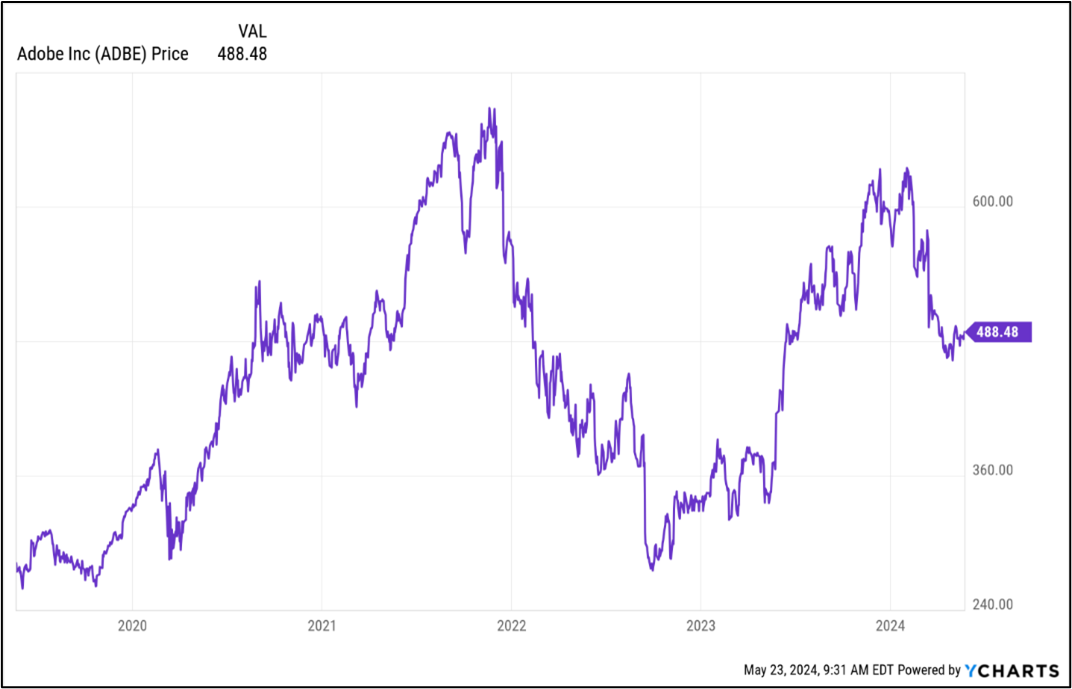

The addition of AI sent Adobe’s stock soaring, as well as its bottom line. Now, investors are wondering if this rise is set to continue …

Here Comes the Money

Having reviewed the firm’s growth strategies, I believe Adobe’s AI efforts will begin paying off in earnest in the months ahead.

With its latest product announcements, Adobe has created end-to-end workflows around content creation, marketing and analytics. It also has more generative AI innovations in its pipeline.

Soon, it’ll offer video, audio and 3D model creation tools.

To be clear, Adobe’s stock was recently out of favor, just like several other software companies. But since bottoming out on April 30, the stock has entered a new uptrend.

And its long-term track record is great. In the five years ending at the stock’s most recent high this past February, Adobe gained 135%.

That’s nearly 63% better than the bellwether S&P 500 during that period.

With Adobe’s AI efforts set to pay off for investors later this year, it’s an important reminder that the road to wealth is paved with tech …

And that the journey is much more rewarding if you focus on the long run.

Best,

Michael A. Robinson

P.S. Adobe’s AI efforts are going to bring profits aplenty. But AI leader Nvidia has even bigger plans — a “Trillion-Dollar AI Pivot.” Click here to find out which companies the chip giant will take with it.