This ‘Free Market’ Leader Is Dominating Latin America

|

| By Michael A. Robinson |

At the recent Weiss Investment Summit in Florida, I answered rapid-fire questions from a room full of veteran investors.

One attendee stood and said into the microphone:

“Michael, I’ve got a real concern. With all the tariff noise lately, should I be looking overseas to hedge my portfolio?”

A few heads nodded. It was a fair question.

This year’s “Tariff Tantrums” created real volatility. We even saw a few foreign ETFs pop for a couple of months.

But here’s what I told the room: Don’t chase headlines.

Sure, there may be a temporary sugar high in some of those international funds.

But that’s not where real tech wealth is built.

You want long-term winners — the kind of firms that don’t just survive market noise … they use it to get stronger.

I gave them three ideas that won’t be shared anywhere else within the Weiss universe.

Note: If you want to be in the room next year, I urge you to grab your spot now.

And as it turns out, I’ve had my eye on another such winner.

I’ll share that with you right now.

It’s a killer e-commerce play that just blew the doors off Q1 earnings.

It operates in a region many investors wrongly overlook.

And unlike a lot of the broad funds out there, it passed my five rules for building tech wealth with flying colors.

I’ll take you through this test right now.

You’ll no doubt see why this stock still has long-term upside ahead …

Meet This ‘Free Market’ Leader

Make no mistake. This is no flash in the pan.

After all, the company formed in 1999 and has never looked back.

Today, Mercardolibre (MELI) serves more than 650 million people across 18 countries.

And it’s doing it with the kind of precision and dominance that makes it a vital player in one of the world’s fastest growing regions.

Now, this firm’s name translates to “Free Market,” which is fitting.

Because what it’s really doing is unlocking a middle-class consumption wave across Latin America — one that could mint fortunes for those who get in early.

Let me show you why this could be the most overlooked tech wealth builder on the planet.

Here are the five rules I use to screen for elite investment opportunities:

Tech Wealth Rule No. 1: Hire Great Operators

Every truly great company starts with leadership.

The founder of this firm earned his MBA from Stanford, and it shows.

Some 25 years ago, Marcos Galperin launched the company in a garage in Buenos Aires — taking a page straight out of the Silicon Valley playbook.

A finance professor introduced him to some heavyweight VCs.

They weren’t just impressed with his business model — they believed in him as a visionary.

Yes, he is stepping down from his CEO position. But he will remain an executive chairman next year. And his replacement, Ariel Szarfsztejn, is no slouch.

He also boasts an MBA from Stanford and has held a top role at the firm for roughly the last eight years, a period of massive growth for the firm.

Tech Wealth Rule No. 2: Separate the Signal from the Noise

To build wealth, you need to separate signal from noise.

And there’s a lot of noise around Latin America — border headlines, currency concerns, political instability. But what gets lost in all that?

Massive digital growth.

This firm’s sales are growing three times faster than Amazon’s. Not just better margins … not just catching up … faster.

It now accounts for one in every five online transactions in the region. That’s market dominance.

Tech Wealth Rule No. 3: Ride the Unstoppable Trends.

The best stocks don’t fight the current — they ride megatrends.

This firm is riding two tidal waves:

- E-commerce adoption. As incomes rise, consumers are moving online en masse — and they’re skipping the brick-and-mortar phase as much as they can.

- Mobile penetration. More than 68% of the population is now online, and Brazil alone is projected to hit over 200 million smartphone connections by the end of this year.

In other words, we can expect the firm to ride these trends to outsize profits for years to come.

Tech Wealth Rule No. 4: Focus on Growth

In the last three years, this company has delivered average annual sales growth of 42%.

At that rate, they would double revenue roughly every two years.

And it’s not just retail. The firm’s fintech arm, which includes digital payments, mobile wallets and even credit products, is growing like wildfire.

The company’s fintech operation is going gangbusters as well.

Last year, total payment volume — driven heavily by its Mercado Pago fintech platform — reached $197 billion, up 34% from 2023.

Think about that: It’s becoming the digital bank of choice for millions across Latin America.

That kind of vertical integration is rare — and powerful.

Tech Wealth Rule No. 5: Look for Doubles

Here’s where we crunch the numbers and see how long it will take us to roughly double our money.

After all, doing so is a great way to build tech wealth.

Over the last three years, the stock has averaged per-share earnings growth of 121%. To be conservative, let’s cut back by two thirds to 40%.

Using the Rule of 72, we divide 72 by 40 — and find the company could double its earnings in less than two years.

And since share prices mirror earnings growth over time, that’s a green light for upside.

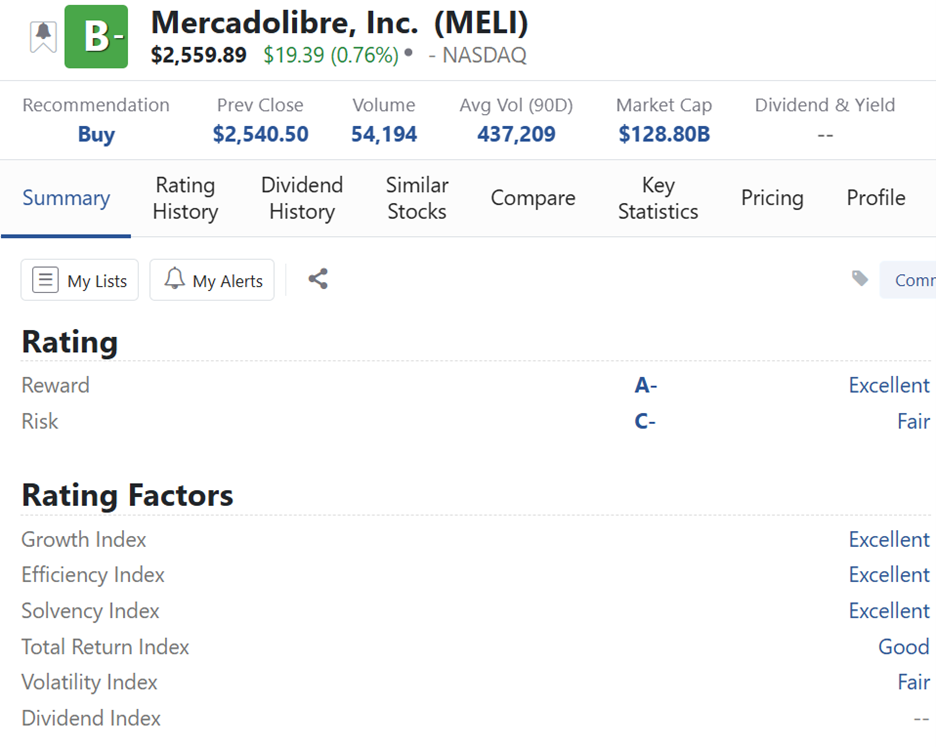

In fact, Weiss Ratings just gave it a fresh green light earlier this year. It’s now rated a “Buy” for the first time since 2018.

As you can see, it gets an “Excellent” rating for Reward, Growth, Efficiency and Solvency Indices.

Weiss Ratings Plus Members can study these indices and ratings in more depth. You can join them here.

Now, some investors get nervous when they see a price tag around $2,500.

But that’s short-term thinking.

We’re not buying price … we’re buying value.

And if this company follows in Amazon’s footsteps and initiates a stock split — say, 20-for-1 — you’ll still own the same growth trajectory. Just with more affordable entry points for future buyers, which could juice demand.

Either way, this is a class-A tech disruptor — with digital retail dominance, fintech velocity and region-wide scale.

I believe this stock has plenty of upside ahead.

While others chase headlines and short-lived ETF pops, this firm is laying down the rails for long-term wealth — across a continent that’s going mobile, digital and cashless faster than anyone expected.

And if you follow the five Tech Wealth Rules above … you’ll know exactly why this company belongs in your portfolio.

Best,

Michael A. Robinson

P.S. Anyone can check the current rating of a stock like MELI on our website. But only members of Weiss Ratings Plus can dig into those indices I just mentioned.

What’s more, they can use exclusive charting tools, discover the full ratings history of any stock we rate and access the same data that my colleagues and I use.