|

| By Tony Sagami |

My mother is an angel.

I had trouble swallowing pills when I was a child, and my mother would smash an aspirin in a tablespoon with a few drops of water and table sugar when I ran a fever.

Frankly, I think her loving strokes on my feverish forehead made me feel better than the aspirin did. But her aspirin of choice — like tens of millions of other Americans — was Bayer (BAYRY).

Bayer was founded in 1863, making aspirin one of the oldest drugs in the world. In 1897, a chemist at Bayer discovered that acetylsalicylic acid was an effective pain reliever and used it to alleviate the pain that his father suffered from rheumatism.

Click here to view full-sized image.

Bayer seized the vast potential of acetylsalicylic acid as a pain reliever and began selling it around the world as aspirin. Bayer's trademark protection ran out a decade ago, so aspirin is now used as a generic description, just like Q-Tips, Band-Aid and ChapStick.

Today, aspirin is universally recognized as an effective heart attack prevention regime for men and for the prevention of stroke in women. And according to the U.S. Centers for Disease Control and Prevention, one-third of all adults use aspirin regularly and Bayer Aspirin is one of the most widely used over-the-counter medicines in the world.

Bayer: Much More Than Aspirin

Bayer is a German pharmaceutical and consumer health giant, but it is a significant global powerhouse for medical devices, crop sciences and animal health.

Pharmaceutical drugs account for 41% of the company's revenues and include Xarelto, Eylea, Mirena, Kogenate and Nexavar.

Those are Bayer's prescription drugs, but its OTC product lineup is filled with household names like Aleve, Alka Seltzer, Claritin, Coppertone, Flintstone vitamins, Midol, One A Day and Solarcaine to name a handful.

Click here to view full-sized image.

The great thing about established consumer health brands is their reliable cash flow. After all, most consumers are unwilling to save a couple of bucks when it comes to medicine for their children.

Bayer's portfolio of entrenched OTC medicines produces such a reliable stream of sales and free cash flow that it is such a moneymaking juggernaut.

Click here to view full-sized image.

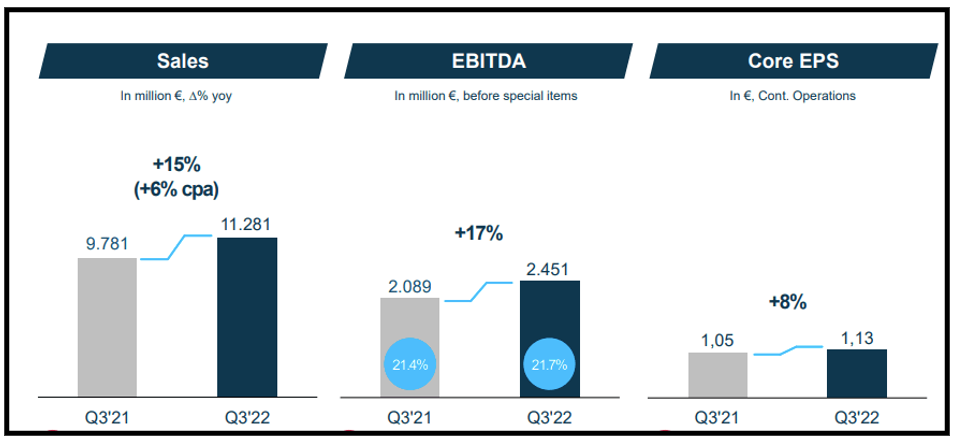

In the last quarter, Bayer reported a 15% year-over-year increase in revenues and a 17% increase in earnings before interest, taxes, depreciation and amortization.

Crop Sciences Division: The 'Seed' of Future Growth

Bayer's lineup for established consumer brands is the foundation of profitability, but the most promising part of Bayer's business isn't its entrenched pharmaceutical and consumer health products, but its innovative crop sciences division.

Bayer acquired Monsanto in 2018 because of its world-class research and development labs, lucrative seed lineup and pipeline of crop science patents. The merger created a perfect marriage of Monsanto's seed business (biotechnology) and Bayer's crop protection (chemistry) business.

Bayer is now a one-stop shop for seeds and crop chemicals, controlling 25% of the pesticide market, and is the largest seed producer in the world.

The crop science division is the largest revenue generator for Bayer and accounts for more than 45% of revenues.

The world population is growing, and genetically-engineered crops have been proven to reduce production costs by an average of 28% and increase yield by 72%.

Plus, climate change is making genetically-engineered crops even more attractive because biotech crops are more capable of surviving harsh conditions like droughts, floods and temperature extremes.

Fat But Infrequent Dividend

Like its aspirin, Bayer trades on the OTC market.

Most U.S. companies pay a dividend four times a year, the German multinational company only pays its dividend annually, generally in the spring (April or May).

In May, Bayer paid a $0.52/share dividend, so shareholders have to wait six months to collect its next dividend. But it's worth it because it yields 3.75%.

Best of all, Bayer is trading for only 13 times earnings. Cheap!

That's all for today. I'll have more for you soon.

All the best,

Tony

P.S. If you haven't yet joined my Disruptors & Dominators service, now is the perfect time to join. Members are enjoying open gains of 41%, 36% and 23% and are well-positioned heading into year-end! Click here to learn more.