|

| By Tony Sagami |

Remember “Wall Street Week” with Louis Rukeyser? The show pioneered economic reporting on television and ran from 1970–2002.

I was a young stockbroker at Merrill Lynch in the 1980s, and everyone in the investment advisory business religiously watched “Wall Street Week” every Friday night.

My favorite guest commentator was Martin Zweig, one of the all-time great market timers.

On the show’s Oct. 16, 1987 episode, Zweig said:

“I haven't been looking for a bear market per se. I've been really in my own mind looking for a crash. But I didn't want to talk about it publicly because it's like shouting 'fire' in a crowded theater.”

The reason this show is so important is that three days later, on Monday, Oct. 19, the infamous Black Monday Crash of 1987 occurred. The Dow Jones Industrial Average fell 508 points … or 22.6%.

Click here to see full-sized image.

That’s right: a 22.6% loss in a single day.

Zweig nailed Black Monday, which made him my favorite analyst on Wall Street. He died in 2013, but his groundbreaking work is just as relevant today as it was in 1987.

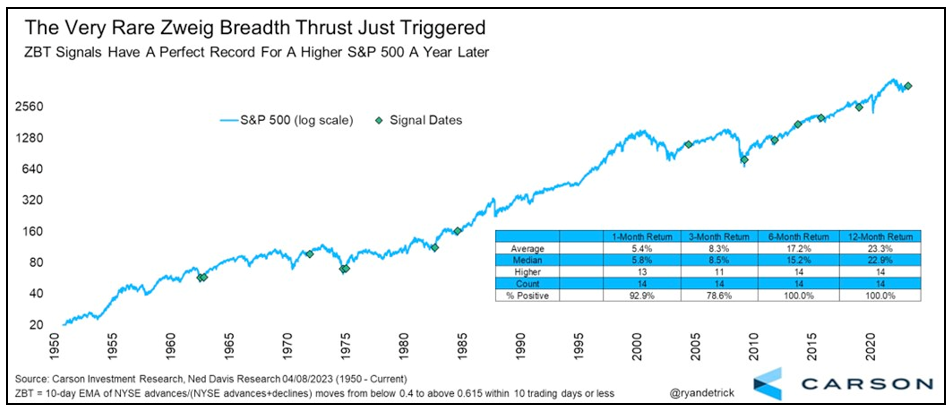

I bring up Zweig because one of his extremely reliable and extremely rare timing signals just flashed a very bullish signal for the stock market.

Zweig’s Breadth Thrust

The Breadth Thrust Indicator is based on the principle that the sudden change of money in the investment markets elevates stocks and signals increased liquidity. In other words, this indicator identifies sudden changes in the NYSE advance/decline ratio.

When the numbers go from poor to great in a compressed period of time … something very good is going on.

A “thrust” indicates that the stock market has rapidly changed from an oversold condition to one of strength … but has not yet become overbought.

Moreover, most bull markets start off with a bullish Breadth Thrust.

Click here to see full-sized image.

This rare signal has been triggered 14 times since 1950, and the S&P 500 was higher a year later. That’s right: Every. Single. Time.

We’re not talking about a little bit, either. Of those 14 signals, the S&P 500 was up by an average of 23% a year later.

We’re talking about 100% accuracy and an average 23% gain. Of course, nothing is guaranteed in investing, but you have to hang your hat on something, and history is as good of a guideline as there is.

If you want to follow the Zweig Breadth Thrust Indicator, leveraged ETFs would give you the most bang for your investment buck:

1. The ProShares UltraPro QQQ (TQQQ): Delivers 3x the daily performance of the Nasdaq-100 Index.

2. The ProShares Ultra Dow30 (DDM): Delivers 2x the daily performance of the Dow Jones Industrial Average index.

3. The ProShares Ultra S&P500 (SSO): Delivers 2x the daily performance of the S&P 500 index.

4. The ProShares Ultra Russell2000 (UWM): Delivers 2x the daily performance of the Russell 2000 Index.

Warning: That double and triple performance applies to the downside as well as the upside. For every 1% the index declines, you can expect the value of a leveraged ETF to drop by 2% or 3%.

For example, if the Nasdaq-100 declines by 10%, you can expect the ProShares UltraPro QQQ to lose 30% of its value. Everybody loves upside volatility, but nobody likes downside volatility.

On the other hand, if Martin Zweig is right, the aforementioned leveraged ETFs will make you a small mountain of profits.

Best wishes,

Tony

P.S. The Federal Reserve’s recent actions should have investors concerned for their financial well-being. Starting as soon as May 2023, their insidious “Fed Control” powers could go live, which means that any accounts linked with the U.S. banking system could soon be at risk for surveillance of all transactions. Investors who want to take action to protect their money should click here for four steps to take now to stay safe and grow their wealth.