|

| By Michael A. Robinson |

This week brought good news from Beijing.

An unexpected thaw in U.S.-China trade tensions sent the market soaring.

The media and Wall Street focused on the short-term news.

But something far more important is happening behind the scenes.

In a quiet yet seismic shift, Apple (AAPL) is moving to shift even more iPhone production from China to India.

Analysts note the Silicon Valley legend could source as much as half of iPhones from India by the end of the year.

President Trump told Apple CEO Tim Cook not to move more iPhone manufacturing to India. But the tech giant is already doing business with the country.

Already, Apple has exported nearly $6 billion worth of iPhones from India in just six months — a 33% jump.

Apple executives are laying the groundwork to make India the primary hub for the future production of the world’s most iconic tech device.

And they’re not alone.

From semiconductors to satellite internet, U.S. tech giants are quietly pouring investment into India’s fast-growing innovation hubs.

And today, I’ll show you a great way to play this powerful shift that’s been beating the broad market by more than 60% …

Apple’s Shift Signals India’s Moment

Now then, Apple’s move is not just a supply chain decision — it’s a bet on India’s future.

India is no longer just a low-cost outsourcing destination. It’s a strategic centerpiece for the next era of global innovation.

With projected GDP growth of 6.5% in 2025, the country is rapidly ascending the economic ranks.

It’s on pace to surpass Japan and become the world’s fourth-largest economy.

What’s driving this momentum? A potent mix of demographics, digital infrastructure and policy.

India has the largest population of young, tech-literate workers in the world. At the same time, India’s startup ecosystem is exploding, with over 100 unicorns and rising.

Add to that an English-speaking workforce and a pro-Western foreign policy. You get a pretty attractive environment.

For U.S. tech firms, it’s a no-brainer.

They’re not just relocating — they’re reinvesting.

From cloud services and data centers to semis and AI labs, India is quietly being built into a next-gen tech superpower.

Computer maker HP (HPQ) — not to be confused with Hewlett Packard Enterprise (HPE) — plans to double its production capacity in India this year.

HP will tap into the government’s production-linked incentive scheme and make more computers and laptops.

Alphabet (GOOGL) already expanded operations in India in recent years.

And Elon Musk’s Starlink entered into agreements with two of India’s top telecom operators to provide satellite-based internet.

“A Diplomatic Bridge with Deep Roots”

Vice President JD Vance’s recent four-day trip to India was far more than ceremonial.

It was personal — and strategic.

Vance’s wife, Usha, is the daughter of Indian immigrants. Their three children accompanied them on the visit, underscoring the cultural bridge that connects their family to the world’s largest democracy.

That connection is likely to shape how the administration approaches Indo-U.S. relations — especially in the context of trade, tech and regional power dynamics.

But it wasn’t just a family photo-op.

Vance held closed-door talks with Indian officials aimed at doubling bilateral trade to $500 billion by 2030.

That’s not just rhetoric — that’s a roadmap.

And it reflects a deeper alignment between the two countries … one built on a mutual interest in counterbalancing China’s influence in the Indo-Pacific.

This makes India more than an economic partner — it makes it a geopolitical ally.

It’s also become an attractive investment opportunity. But how in the world can we invest in a country? Funny enough, all it takes is a single investment …

An India-Focused ETF

It’s called the WisdomTree India Earnings ETF (EPI).

This ETF exposes us to the Indian equity market. The fund launched in 2008 and today boasts close to $3 billion in assets under management.

It’s one of the larger ETFs covering the Asia-Pacific region.

And it is also a “Buy” at Weiss with its current “B” rating.

With a single investment, we get to invest in more than 400 companies. That list includes some of India’s largest and fastest-growing tech enterprises.

Infosys (INFY), for example, is the second-largest IT company in India. That’s in this fund.

So is Reliance Industries, a multinational conglomerate that has interests in everything from energy to textiles to retail.

The fund also includes Tata Steel, part of the massive Tata Group.

There’s also Dr. Reddy’s (RDY). This is a pharmaceutical company that produces more than 190 medications. It generated $3.4 billion in revenue in fiscal year 2024.

Of course, with any investment we make these days, we want to look at the company or fund’s exposure to AI.

And this fund’s got it.

While EPI doesn’t specifically target AI-focused companies, its wide array of tech holdings enables us to invest in companies that are indirectly involved with sectors like AI research, development and implementation.

The EPI ETF is the best way to invest in India’s ascension. And not only has it achieved steady, reliable growth over the past decade, but its future is bright, too.

A Market-Beating Performance

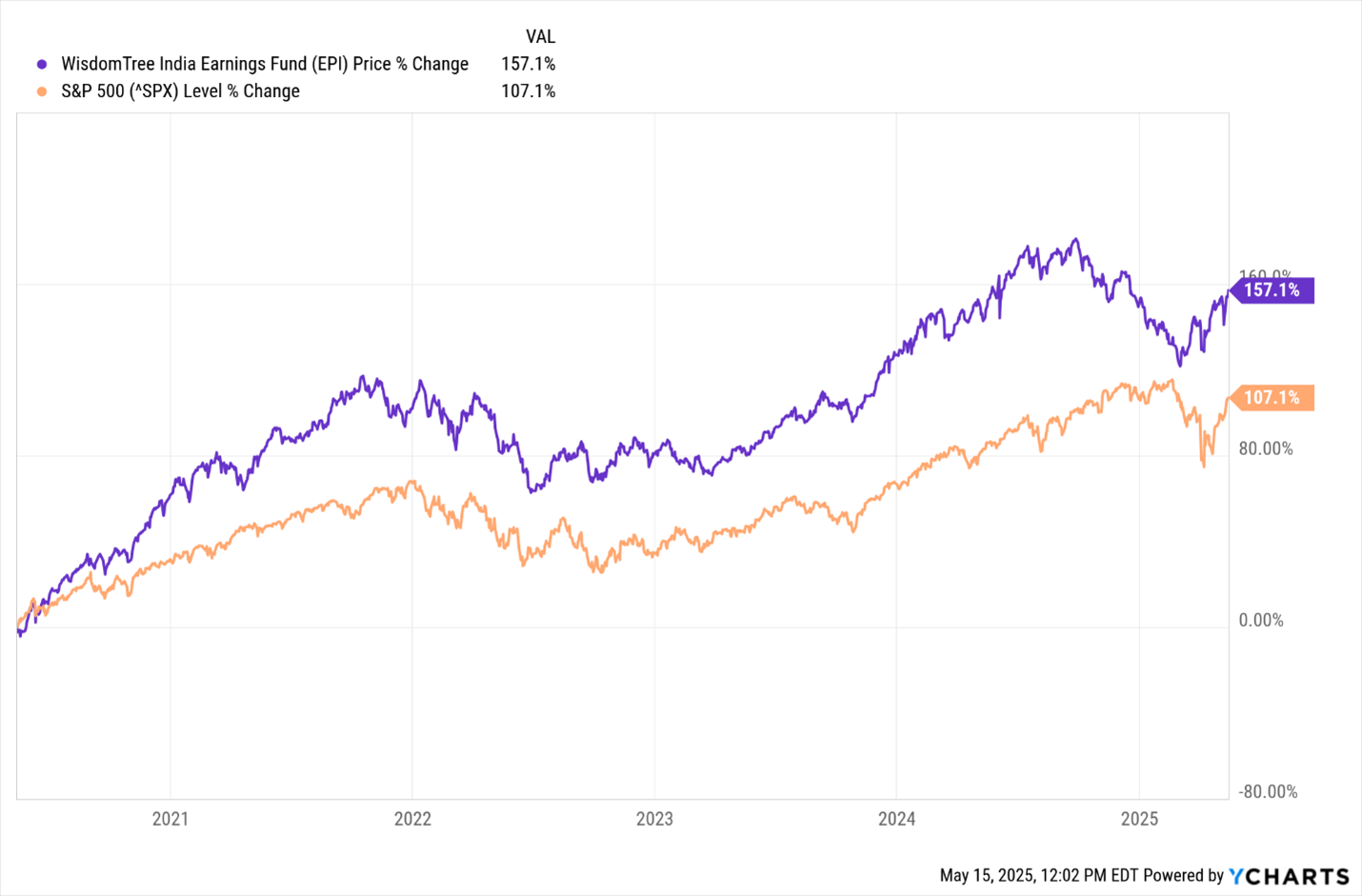

Over the past five years, the S&P 500 is up a very respectable 107%. By contrast, EPI is up more than 157% during that same period … 50 percentage points better.

In addition to its superior performance, one aspect I like about this ETF is that it focuses on a company’s earnings rather than its market capitalization.

Often, a company’s market cap can rise or fall based on hype or misconstrued expectations. Earnings, meanwhile, are much more likely to move based on a company’s fundamentals.

If a company’s earnings are growing, you can bet that its business is growing, too.

And because the ETF focuses on earnings, we can rest assured that the assets in its portfolio are being targeted for their true growth potential.

With tariffs shocking the world and putting America’s relationship with China on even thinner ice, companies are looking elsewhere to continue their business. And they’re setting their sights on India.

As investors, we should be doing the same. And investing in the EPI ETF enables us to capture the growth potential of India’s fast-growing economy.

Best,

Michael A. Robinson

P.S. In just four days, we’re hosting an Emergency Wealth Conclave.

And one of the key recommendations will be how to invest and protect your wealth overseas … like in India. Grab your spot here.