This Pattern Break Could Lead to Gains of 3x, 5x & Even 10x

Editor’s note: A giant shift just happened a few weeks ago when the GENIUS Act passed Congress.

It formally added stablecoins to the global dollar system, which opened a floodgate of capital flowing into digital networks.

But this new law did SO much more than that.

And the ramifications could kick off one of the most profitable crypto seasons you’ve ever seen.

Today, we invite Juan Villaverde our econometrician and pro crypto trader to explain what he recently did to his premium members …

Namely, what’s happening and how to potentially see 3x, 5x and even 10x gains in the near term …

|

| By Juan Villaverde |

Altcoin season refers to periods when crypto assets other than Bitcoin shoot up significantly to outperform the OG crypto.

In the past, we’ve seen some alts surge past BTC by hundreds of percentage points — even thousands in select cases — over just a few months.

That’s why it gets people so excited.

Own crypto apart from Bitcoin?

With the right coins, you could pile up 3x, 5x, 10x in short order. Gains that are nearly impossible to find outside crypto.

Since altcoin season is by far the most lucrative time to be invested in crypto, the obvious question is this: When can we see the next one?

This brings us to Ethereum, crypto’s second-largest asset by market cap. And, in my opinion, the key to when altcoin season will take off in earnest.

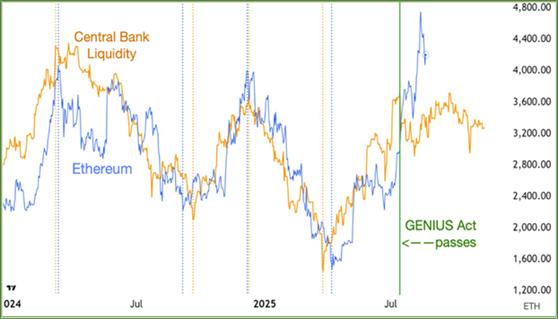

Central Bank Liquidity (CBL) and Ethereum

This is my favorite chart in crypto right now.

The orange vertical dotted lines mark CBL highs and lows.

While the blue vertical dotted lines mark 320-day-cycle highs and lows on ETH.

Notice how closely they match up.

Indeed, the correlation between CBL and Ethereum prices is also striking — much stronger than with Bitcoin.

Unlike Bitcoin, as CBL made lower highs and lower lows, so too has Ethereum. That is, until the mid-July passing of the GENIUS Act (marked by the green vertical line).

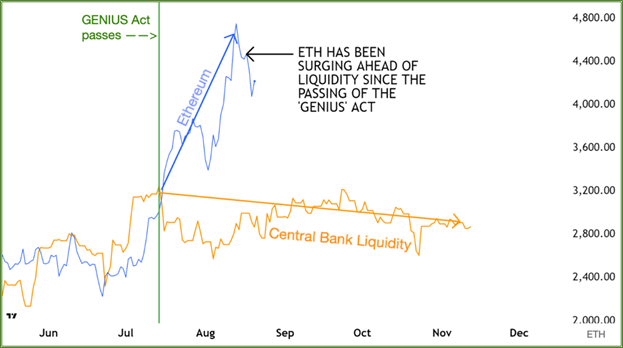

Let’s zoom in.

Ethereum Surges as CBL Flatlines

Notice that after July 14 (marked by the green vertical line), Ethereum has surged higher, even as liquidity flatlined.

What’s causing this divergence?

Answer: The GENIUS Act, which formally added stablecoins to the global dollar system, giving them Washington’s seal of approval.

This unleashed massive institutional investment flows into Ethereum — where most stablecoins trade.

That was enough to push it and decouple from CBL for the first time since 2022.

We saw something similar with Bitcoin before.

It decoupled from liquidity on speculation (and later confirmation) of spot ETF approval. That’s what sparked the current bull market.

So, the question now is this: Is the same thing happening to Ethereum?

In other words, will Ethereum surge past its all-time high of $5,000 despite flatlining liquidity?

Recent price action certainly suggests it will.

If we are going to see a big altcoin season, this is when it would happen.

Now, how do you play it?

Start with today’s Emergency Crypto Briefing, between Dr. Martin Weiss and my friend and colleague Mark Gough.

There, you’ll hear how specific coins could blow past Bitcoin and even Ethereum when this altcoin season officially kicks off.

I’m talking gains as large as 1,204% … 2,324% … and even 17,862%!

It all starts today at 2 p.m. Eastern. Watch it live here.

Best,

Juan Villaverde