This Single Company Is Why You Can’t Put Down Your Phone

|

| By Michael A. Robinson |

My wife and I recently had a wake-up call about the impact of apps on everyday life.

We installed a state-of-the-art Mitsubishi ductless heat-pump system in our home. Then we debated whether to pay an extra $400 for a cloud-based mobile app to manage the four comfort zones.

Ultimately, we opted out — not because of the cost, but because of its dismal 1.8-star rating on Apple’s (AAPL) App Store.

The app’s failure highlights a significant gap: Many companies fail to capitalize on what I call the “App Economy.”

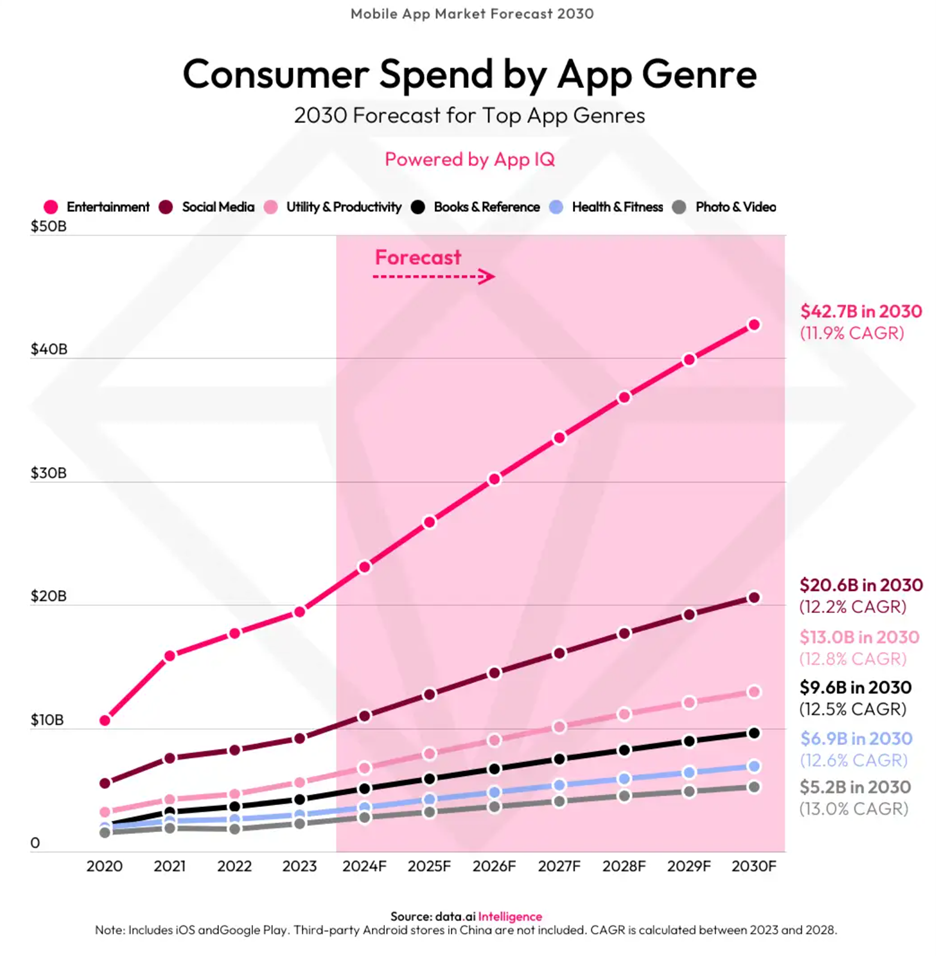

Don’t scoff. Insight Partners says this market will grow from $207 billion in the 2022 base year to be worth $571.6 billion by 2030.

Today, I’m revealing a market-crushing opportunity for savvy investors in this hyper-growth sector.

The App Economy: Essential for Modern Life

Apps are central to modern life. It’s being driven by rising smartphone adoption, emerging markets and expanding functionalities like AI.

According to App experts at Oberlo, the average consumer has 18.5 apps installed on their smartphones.

While many may get scant use, several have become essentials for millions of us.

For instance, my family regularly uses Venmo to make and receive payments. Here in Oakland, Calif., the city is set up to accept payments for parking through ParkMobile.

I use the mobile app to board Southwest flights and to get complimentary cocktails as an A-List Preferred Member. And I’m a regular user of Uber through my iPhone.

I could go on at length, but you get the gist …

Consider that analysts suggest as much as 25% of Apple’s roughly $390 billion sales last fiscal year came through the App Store.

Alphabet’s store, Google Play, had 27.5 billion downloads in 2023, the last full year for data.

A Mobile App King

Now you know why I’m so excited to introduce you to Twilio (TWLO).

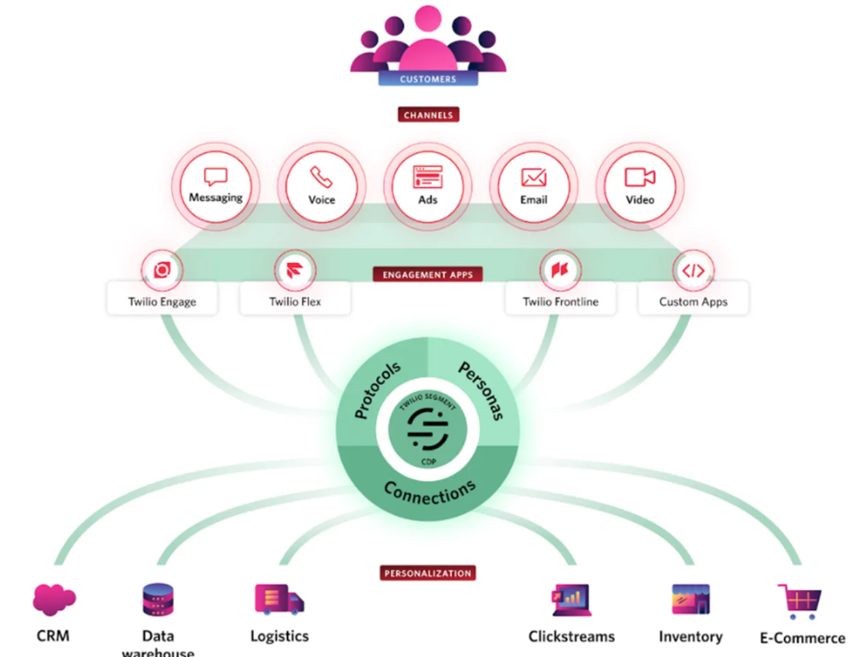

Twilio doesn’t just create apps … it powers them.

As a leader in cloud-based communications, Twilio provides developers with tools to integrate voice, text, video and more into their apps.

From tech giants to emerging startups, Twilio’s robust suite of APIs (application programming interfaces) forms the backbone of many apps you use daily.

Twilio’s client roster reads like a who’s who of tech innovators:

- PayPal (PYPL) relies on Twilio’s tools to handle communications for its 400 million users across 200 countries.

- Airbnb (ABNB) turned to Twilio to create a seamless app experience for reservations, payments and communications.

- Box (BOX) uses Twilio’s two-factor authentication to secure sensitive data for 240,000 clients.

Other big names include Uber Technologies (UBER), Amazon.com’s (AMZN) Amazon Web Services and Salesforce (CRM).

Twilio doesn’t just serve corporate giants. Over a million independent developers use Twilio’s APIs to create specialized apps quickly and cost-effectively.

These tools eliminate the need to write complex code from scratch, enabling rapid deployment of new apps.

For Twilio, this translates into a steady revenue stream from developers who continuously build on its platform.

Savvy Bolt-on Buyouts

In 2018, Twilio acquired SendGrid, a leader in email communications, for $2 billion. The merger expanded Twilio’s addressable market to $70 billion, with email management alone contributing $11 billion.

This acquisition solidified Twilio’s position as a comprehensive communications provider, integrating messaging, voice, video and email services.

In addition to acquiring SendGrid, Twilio has pursued several strategic acquisitions to strengthen its platform.

For example, the acquisition of Authy added two-factor authentication capabilities, addressing the growing need for secure communications.

Similarly, the acquisition of Segment in 2020 allowed Twilio to integrate customer data platforms into its offerings, enabling businesses to deliver personalized customer experiences at scale.

These acquisitions not only expand Twilio’s addressable market but also enhance its value proposition to customers.

By offering a comprehensive suite of tools, Twilio ensures that businesses can manage all aspects of their communications strategy from a single platform.

And Twilio’s diverse client base minimizes risk. No single customer accounts for more than 5% of its revenue. This diversification ensures stability and consistent growth.

The Path to a Market-Crushing Investment

Twilio’s story isn’t just about technology. It’s about transformation.

Apps are no longer just tools but essential channels for business growth, customer engagement and operational efficiency.

As businesses across industries pivot to app-centric strategies, Twilio is poised to capture a growing share of this expanding market.

Twilio’s APIs cover a wide range of use cases, from customer service chatbots and in-app messaging to advanced analytics.

By supporting industries as varied as healthcare, retail and finance, Twilio ensures its relevance across a broad spectrum of applications.

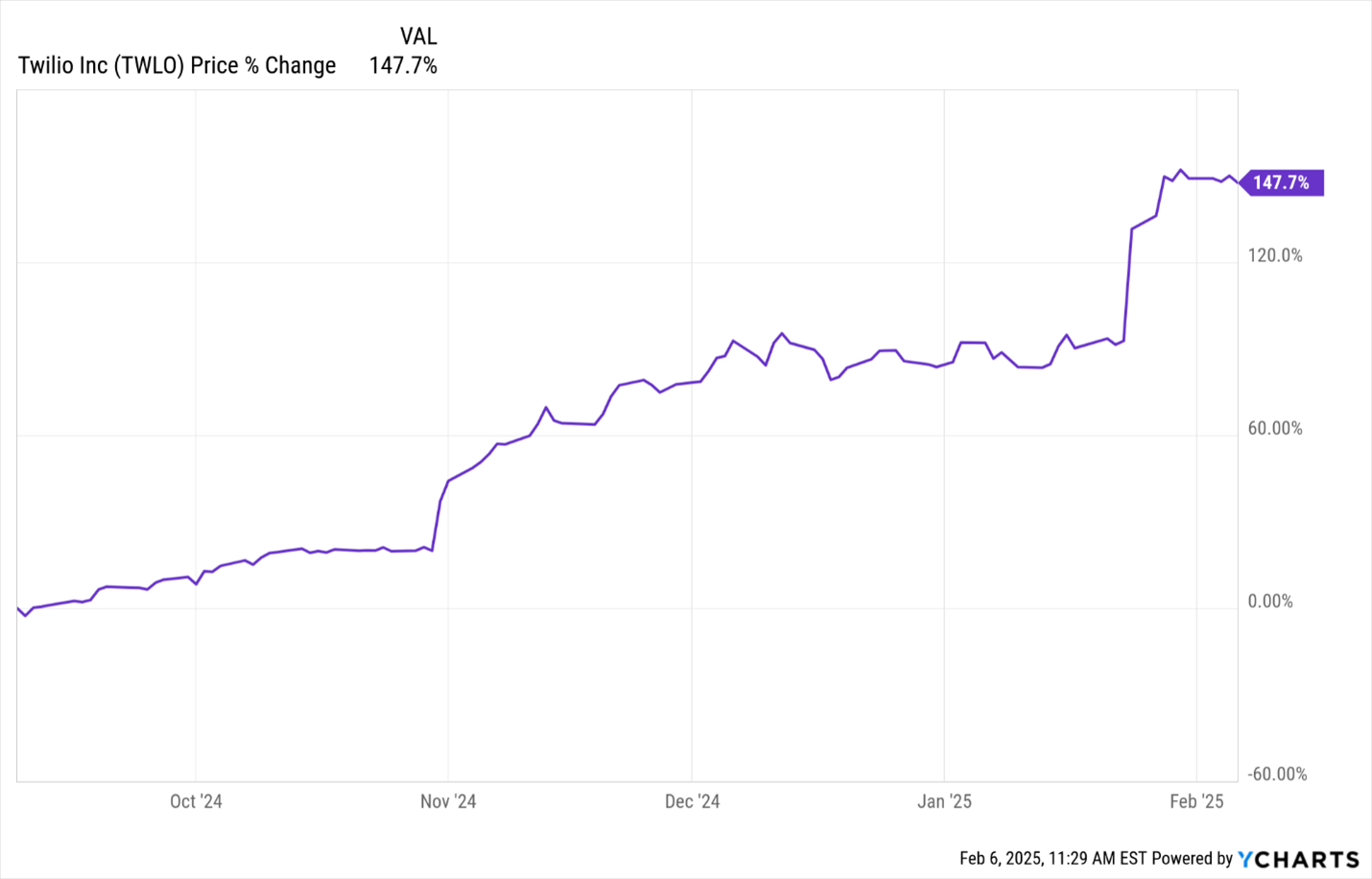

Make no mistake. The stock has been a strong performer of late.

It broke out on heavy volume back on Sept. 10, rising more than 148% over the next several months.

The stock then soared again on Jan. 24 after the firm reported preliminary quarterly results.

Twilio said it expects a 10% sales increase for last year’s Q4 and said fully diluted earnings would beat previous forecasts.

This was exactly what Wall Street was looking for in advance of the official earning release scheduled for late next week.

Over the past three years, earnings growth had remained tepid as the firm build out its franchise.

Forecasts now call for earnings growth 35% this year. If that rate holds, we’d see earnings double in just a little over two years.

The app economy isn’t just a trend — it’s a transformative force reshaping industries and driving unprecedented growth.

Twilio stands at the center of this revolution, enabling the apps that billions rely on daily.

By investing in Twilio now, you’re not just buying a stock. You’re securing a stake in the future of this essential technology.

Best,

Michael A. Robinson

P.S. While I mostly keep in the tech lane in these pages, I do keep my eyes on the rest of the investment world. And there’s another major bull market developing. Check it out here.