This Unconventional Tech Giant Smokes the Mag 7

|

| By Michael A. Robinson |

When it comes to making money off credit cards, I’m a walking, talking contradiction.

See, as a “Boomer of a certain age,” I’m happily out of step with the vast majority of Americans.

Now with higher interest rates — and busy back-to-school shopping this month — millions of them are getting in hock up to their eyeballs as their card balances rise to keep pace with inflation.

Not me. I own everything free and clear.

Irony abounds … I am actually nothing short of a total credit card fiend.

I almost never pay cash for anything at a physical store. And because I do most of my shopping and business transactions online, my cards get a very heavy workout.

My wife runs her parents’ finances and charges just about everything they need.

Simply stated, we love the bonus points. See, you get the same number of points whether you stay in debt or pay off your balances every month like we do.

I bring up this dichotomy for a very important reason. Digital payments at stores and online have become the backbone of our consumer-driven economy.

It’s one of the big reasons why the economy has withstood the shock of historic inflation and higher interest rates.

In a moment, I’m going to reveal a supply firm company that is well poised to profit from this paradigm. The company plays a pivotal tech role in all that I am talking about.

But first, allow me to set the stage …

A Great Tech Play

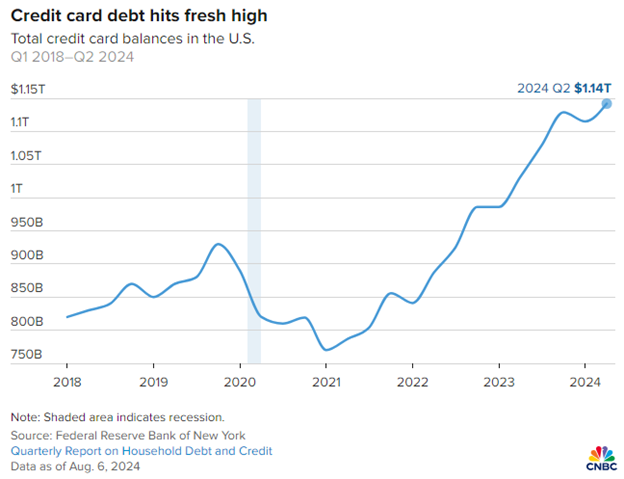

Just last week, we learned that credit card balances now stand at $1.14 trillion based on data from the Federal Reserve Bank of New York. Since the first quarter of 2021, credit card balances have risen by $372 billion.

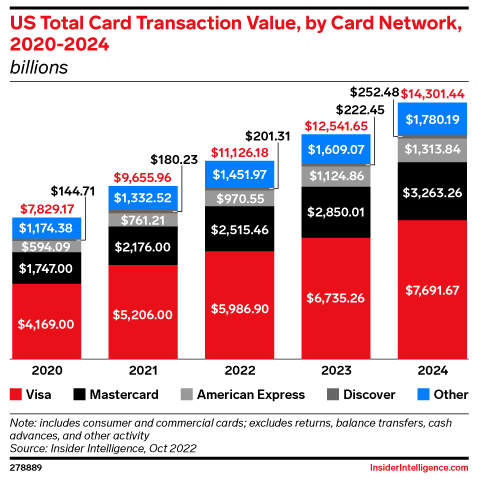

Total volume is much higher than actual debt. The Nilson Report says that by 2026, credit cards volume will hit $6.3 trillion, just in the U.S.

And when it comes to consumers, it’s not all about rising debt loads. Fact is, debit card use is up sharply over the past several years.

The American Bankers Association says that debit card transactions have four times the dollar value of credit cards. We’re talking some $4.3 trillion.

That’s why I am such a big believer in the investment potential behind Visa (V),the largest card payment organization outside of China.

Let me get one thing cleared up right now. I’m not suggesting this as a way to make money off of consumer debt at a time when many Americans are struggling with the high cost of living.

Instead, Visa is at heart a tech company — and a great one at that. It makes its money off of transactions, not debt.

Consider that outside of China, Visa’s card payment network handles more than half of all card payments, some $10 trillion annually.

That network is VisaNet, and it’s a sophisticated operation the company has invested in for many years now.

The net result: VisaNet connects more than 4.2 billion debit, prepaid and credit cards. It operates in some 200 countries and connects 15,000 financial institutions.

$14 Trillion and Counting

The platform had more than $14 trillion worth of transactions as of June last year, the last period for which it supplied data.

Of course, with 50% of card payments relying on VisaNet, Visa has gone to great lengths to make sure the network is reliable.

To make it all work seamlessly, Visa routes all those transactions through one of four high-speed data centers located in Colorado, Virginia, London and Singapore.

Each one of these facilities is one of the most secure locations on the planet, with the ability to generate its own power if the grid goes down. They are also fully protected against terrorist attacks, criminals and even natural disasters.

I believe this is a really great way to make money off the nation’s financial system without concerns about the impact of interest rates changes on financial institutions.

That’s because Visa is not a bank. The firm does not make loans or even issue the cards that use its VisaNet system.

Rather than make or underwrite loans to consumers or companies, it licenses its technology and access to its network to banks, credit unions and payment processors.

Outshining Apple

This gives the company a great business model with steady cash flow. Visa gets that by taking a cut of about 2% from each one of the more than 80 billion transactions made over VisaNet each year.

In other words, Visa is a tech company with a sophisticated backend enterprise, allowing the financial and retail industries to function while taking a cut of their revenues.

Make no mistake. Visa is a very stable company.

Over the past three years, per-share profits have grown an average of 20%.

To give you a sense of how strong that really is, consider that Meta Platforms (META) has roughly one-third of that earnings growth rate.

Visa earnings growth also outranks that of Apple (AAPL), which has a three-year growth rate of just 5%.

Ditto that of Microsoft (MSFT), with three-year growth of 13%.

In short, Visa is a company uniquely poised to cash in on America’s rising digital payments flow and credit card debt without the risk of any loan losses.

Even if we do see a recession in 2025, folks are still going to use credit and debit cards because, quite honestly, their finances depend on them.

This is why I think Visa is a great tech investment for the long haul.

Best,

Michael A. Robinson

P.S. I work closely with your private equity expert Chris Graebe on fast-emerging technologies. When he shared what he has lined up next, I immediately became interested.

It’s a private company that has a secret technology that could spark a $1.8 trillion tech revolution. And he has a way for you to get PRE-IPO SHARES. All you have to do is check it out here.