|

| By Michael A. Robinson |

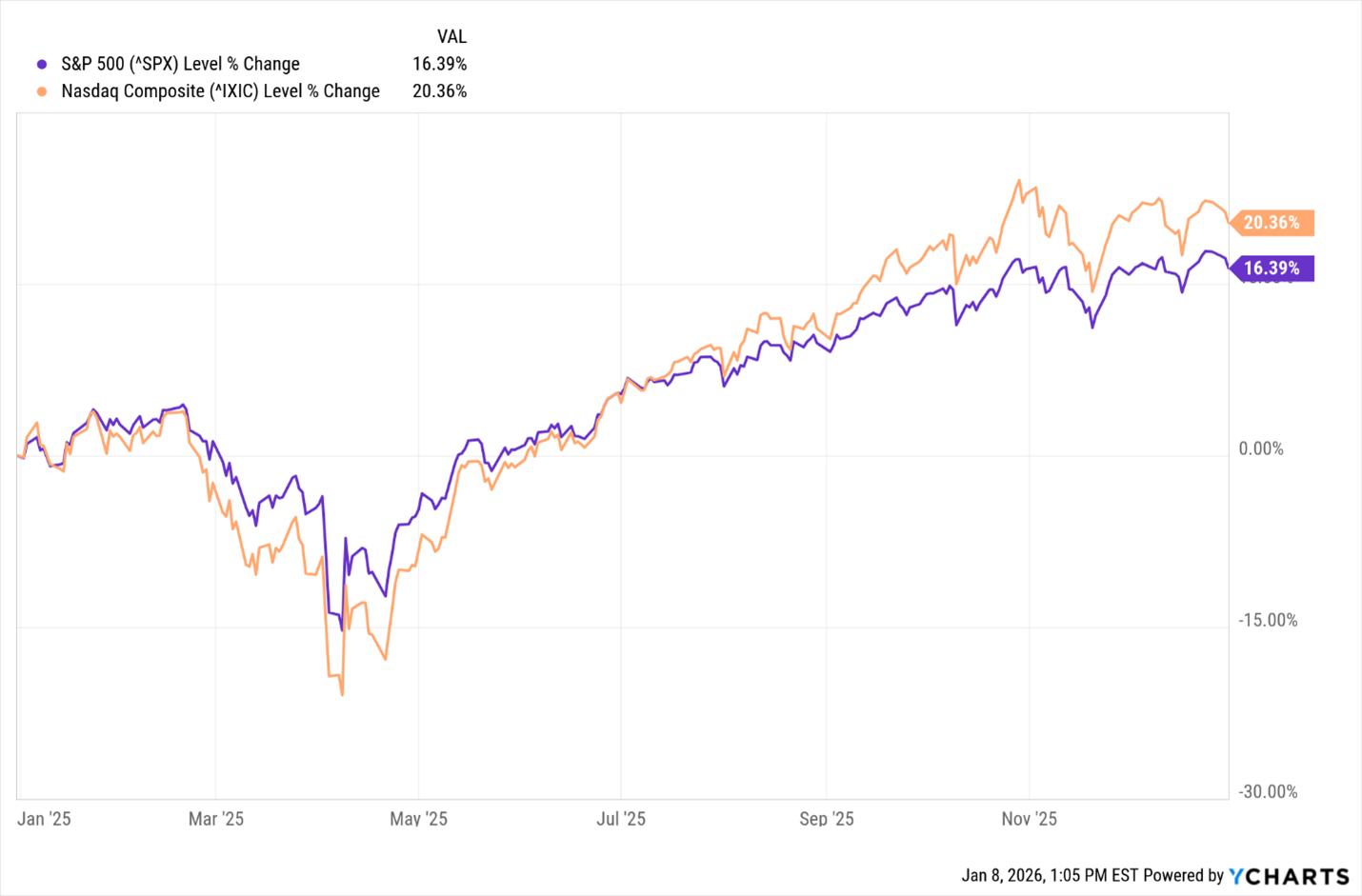

Talk about a powerful one-two punch for the markets in 2025.

First, stocks took a beating early in the year.

They fell broadly on what I called the “Tariff Tantrums.”

But for disciplined investors, that turned out to be a great buying opportunity.

The market didn't just bounce back — it closed the year with gains of more than 16% with the tech-centric Nasdaq ending up more than 20%.

Second, tech dominated the headlines once again.

It's like I keep saying: The road to wealth is paved with tech.

I believe these two factors set us up for a very bullish 2026.

And today I am reaching out to you to give you a look at three sectors that I believe will hand investors excellent gains in the year ahead.

Let me be clear. Some of you may be worried that we could see a sell-off in the next few weeks after some investors take profits following a strong 2025.

But as you will see in a moment, this is no time to be sitting on the sidelines.

There's just too much upside ahead.

With that in mind, let's get started with our profit outlook for the year ahead:

2026 Profit Sector No. 1: Artificial Intelligence

There's no question that AI-related stocks dominated the investing landscape in 2025.

Of course, much of that had to do with the follow-on investment cycle that started with the late 2022 release of ChatGPT.

It ranks as the first true consumer-facing platform and has grabbed more than 800 million weekly users.

Make no mistake. It's still early innings for the broad AI global buildout.

You don't have to take my word for it …

Nvidia’s (NVDA) own CEO, Jensen Huang, said Big Tech is going to have to spend more than $1 trillion in the next few years to meet the huge demand for all things AI.

Much of that will focus on building hundreds of new high-speed data centers that can handle the heavy traffic that AI requires.

And while I still like Nvidia for the long haul, I believe a backend play targeting data centers is a great way to cover the waterfront of AI's data needs.

That's why I continue to recommend Arista Networks (ANET).

You may recall that the firm makes networking hardware and software for large data centers.

Founded in 2004 in Silicon Valley, this company makes high-speed network equipment that can meet AI's demanding needs.

Its data-center grade switches can route information to the right destination in under 500 nanoseconds. That's just 500 millionths of a second!

Over the last three years, the firm has grown per-share profits by 51%.

If we cut that in half to be conservative, we'd still see earnings double in less than three years.

And when earnings double, oftentimes the stock price does, too.

2026 Profit Sector No. 2: Semiconductors

As you might expect, the continuing rollout of AI applications will help spur a boom for the chip sector that already serves as a foundation for our tech-centric economy.

Simply stated, the global tech ecosystem simply must have faster, more robust semiconductors to process the trillions of lines of code that AI applications require.

With that in mind, the new year should see continued strength building on the recovery we saw throughout 2025.

To be clear, we don't have full-year 2025 sector sales at this point.

But the momentum from last year's strong performance sets the stage for even bigger gains ahead.

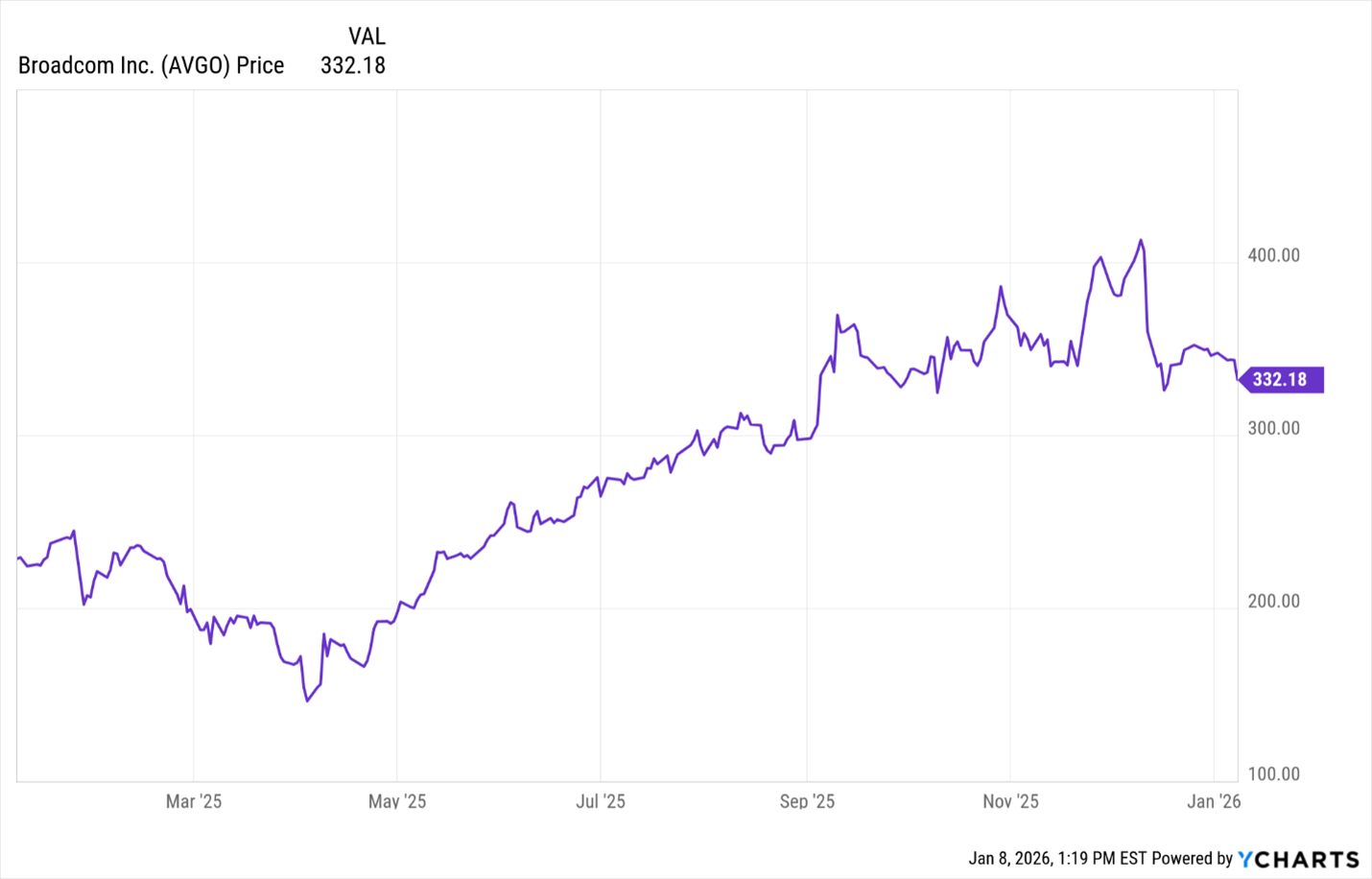

That's why I think investors would do well to take a run at Broadcom (AVGO).

It ranks as a crucial chip firm for the entire global economy.

The chip giant recently unveiled a processor that can be used for AI networking outside of the data centers.

That should expand demand for Broadcom's chips as AI inserts itself around the world.

The new device takes advantage of a big factor for large organizations.

Many offload AI workloads to data centers but also keep some operating internally.

Over the past three years, the firm has grown per-share profits by an average 20%.

At that rate, we'd see a double in 3.5 years.

2026 Profit Sector No. 3: Aerospace & Defense

This field is shaping up to be one a great growth field for 2026 — even if we see peace in Ukraine.

After all, NATO is so mindful of the Russian war machine that it spent $1.6 trillion on defense this year.

It’s on pace to budget that much in 2026.

And let’s not forget how high tech now lies at the center of all modern defense.

And of course, these days that means AI.

Rather than trying to pick a single winner, I prefer a broader approach here.

That’s why I like the Invesco Aerospace & Defense ETF (PPA).

PPA gives us a cost-effective way to own nearly 50 leading companies across the industry.

With one investment, we gain exposure to aircraft makers, component suppliers and advanced electronics firms that are now weaving AI into their operations.

It’s a simple way to capture the sector’s strength without taking on the risk of betting on just one stock.

- The ETF includes firms like Mercury Systems (MRCY), which builds high-end subsystems used in hundreds of defense programs.

- Honeywell (HON) brings exposure to both military and commercial aviation and is actively testing AI platforms that could make flying safer and more efficient.

- Kratos Defense & Security Solutions (KTOS) adds a fast-growing unmanned systems business, including fighter-jet drones designed to work alongside piloted aircraft.

- And Palantir (PLTR) brings in the software backbone that powers modern battlefield intelligence, including AI-enabled systems for ground operations.

Put it all together, and PPA offers broad, balanced exposure to a sector that is gaining momentum.

It’s a straightforward way to participate in long-term growth, while smoothing out the volatility that comes with owning a single stock.

Add it all up, and you can see why I’m so excited for the year ahead.

And with the investments we discussed today, you will get off to a strong start in 2026.

Best,

Michael A. Robinson

P.S. Of the three ways to play my top trends of 2026, two are “Buys” with the third a very high “C+.”

Those ratings give you an excellent idea of long-term potential. For shorter-term growth, you need to check out the latest upgrade around here: Weiss 3.0.

We will be taking down this presentation and your access to it at midnight tonight.

So, this really is your last chance to see what we’re doing with AI and our 10+ terabytes of data.