|

| By Chris Graebe |

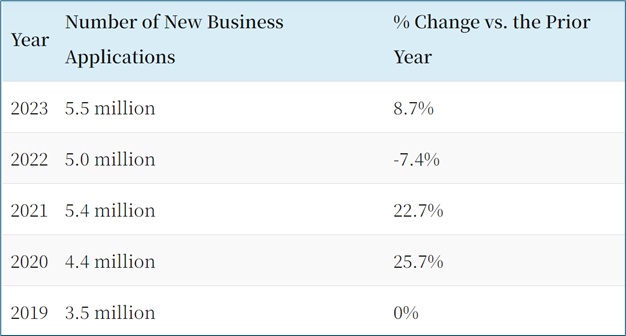

It seems like every Tom, Dick and Harriet filled out applications to form businesses last year.

In fact, a record-setting 5.5 million forms passed through the hands of local, state and federal approvers.

All of that American entrepreneurial spirit resulted in a cautiously optimistic first quarter of 2024 for startups with venture capitalists investing $44.5 billion.

I’m not ready to call it a “boom,” but others have already taken a leap of faith.

That figure was an improvement over Q4 2023, but overall investment dipped year-over-year. That’s okay because I consider the fact that early-stage funding is on an upward trajectory … a bright spot and potential turnaround for funding after a chilly winter.

Another glimmer of hope lies in the fact that four U.S. startups — Perplexity, Bugcrowd, ElevenLabs and Mews — achieved unicorn status in the past quarter, surpassing $1 billion valuations.

This underscores the ability of innovative companies to secure substantial funding.

On a similar note, we saw a slight improvement in M&As with 413 deals completed through March, a 20% increase from the previous year. Some of the largest included:

- GSK (GSK) — formerly GlaxoSmithKline — is acquiring Aiolos Bio, a developer of therapies for patients with respiratory and inflammatory conditions, for $1 billion upfront and up to $400 million in milestone-based payments.

- DraftKings (DKNG) agreed to acquire New York-based lottery app Jackpocket in a cash-and-stock deal valued at around $750 million.

So, while some challenges persist, increased investor confidence, rising valuations and advancements in key technologies all point toward a promising year for U.S. startups.

Keep in mind, though, regardless of how many startups dot the landscape today, the bumpy road to riches throws most of them off course. It’s so rough that, according to the U.S. Small Business Administration, 90% of all startups fail … 10% within the first year.

Since “the earlier, the better,” is one of my mantras in startup investing, knowing what to look for in the greenest of companies is key to picking the best ones at the best time.

If you invest in stocks, you probably have a methodology for weeding out the thousands you don’t want to invest in … and narrowing that list down to those that appeal to you.

I have my own methodology for doing the very same thing in the private-equity markets. It all comes down to the four main factors that I consider when evaluating a deal.

I call it the FIVE strategy. So, F-I-V-E.

Four factors, but I picked the acronym FIVE? Yes! That’s because I aim to see at least a 5x return on any investment that I make.

As I look at these different startups and deals, I ask myself, “Can this company do what I think it can, based on what I’ve seen and heard?” My methodology will help answer that question.

‘F’ for Founder

The founder is a huge part of the equation. I’ve seen founders with ideas, technologies and direction for where they were going, and it just didn’t work.

I’ve also seen when a market wasn’t cooperating and the founder was smart enough, talented enough and experienced enough that they were able to pivot and find a way to make their world work.

Working closely alongside the founder is the team of people in which they’ve chosen to surround themselves.

If they’ve got humility mixed with a little bit of ego when the naysayers show up, they’re able to push through and do what’s necessary.

It’s a fine balance, but do their founders complement each other, or are they wired completely differently than each other?

Are there two or three founders technically adept, but nobody knows how to raise capital or hold meetings with big check writers?

‘I’ for Industry

In what industry do these startups belong? Is it one that’s growing and delivering good multiples, or is it one that’s kind of lost momentum and steam with slowing investments?

It’s also important to know and understand the relevance of an industry today.

If it’s too hard for me to understand, then more than likely I’m probably just going to walk away because that industry is not the industry for me.

‘V’ for Valuation

I said it once. I’ll say it twice: You make your money on a company just like you do in real estate — on the front end.

If you buy the company at the right valuation, that is how you can see a solid potential return on the backside.

Sometimes it turns into a verbal wrestling match. So, when a founder comes to equity crowdfunding, more times than not, there’s a couple portals and platforms out there that will push back on valuation.

But I will say this — typically, the founders pretty much get to decide whatever they want when it comes to their valuation in the crowdfunding world.

And shocker, they all think their company’s worth more than it really is. So, valuation is important.

There are different models and ways you can look at valuation. At the end of the day, though, you want to know how a company calculated its valuation.

‘E’ for Exit Potential

Anytime you’re investing in a company, anytime you want to know what the potential exit looks like, a founder will tell you, “Well, we’re just building now, and we’re not really thinking about an exit.” But as an investor, you should definitely be thinking about it.

When can I get my money back? When can I see a return on my capital?

And what does that exit look like?

You have to determine if this is a pre-revenue company that might fail down the line.

Is this a company that’s going to be focused on gaining millions of users before they ever make one dime?

So, exit potential is very important. It’s something I want to look at, especially when I’m talking about seeing a 5x return.

Bonus X Factor

There’s one other thing I like to consider as my bonus to this strategy: the X factor.

Your gut’s saying, “I see it. It makes sense to me. I want to do it,” or vice versa. You always should listen. Remember, red flags never get smaller. They only get bigger.

It’s okay to pass on a deal, especially if the company doesn’t have an X factor.

Just keep looking for ones that do. And if this truly is the start of a boom, a glut of companies seeking funding will create stiff competition.

Then, private equity investors like you and me will have the pick of the litter, as we watch the weak fall and the strong live up to expectations.

Happy hunting,

Chris Graebe

P.S. AI companies like Nvidia (NVDA) use strategies like my FIVE to do their own due diligence when acquiring private technologies and businesses. In fact, right now, Nvidia is making a $1 trillion pivot that includes looking outside of its own walls for help. You can see all about it here.