What Our Ratings Say About Goldman’s Top Stock of 2026

|

| By Dawn Pennington |

Goldman Sachs (GS) gave the world its top stock pick for 2026 last week.

That pick?

Fellow investment bank Houlihan Lokey (HLI).

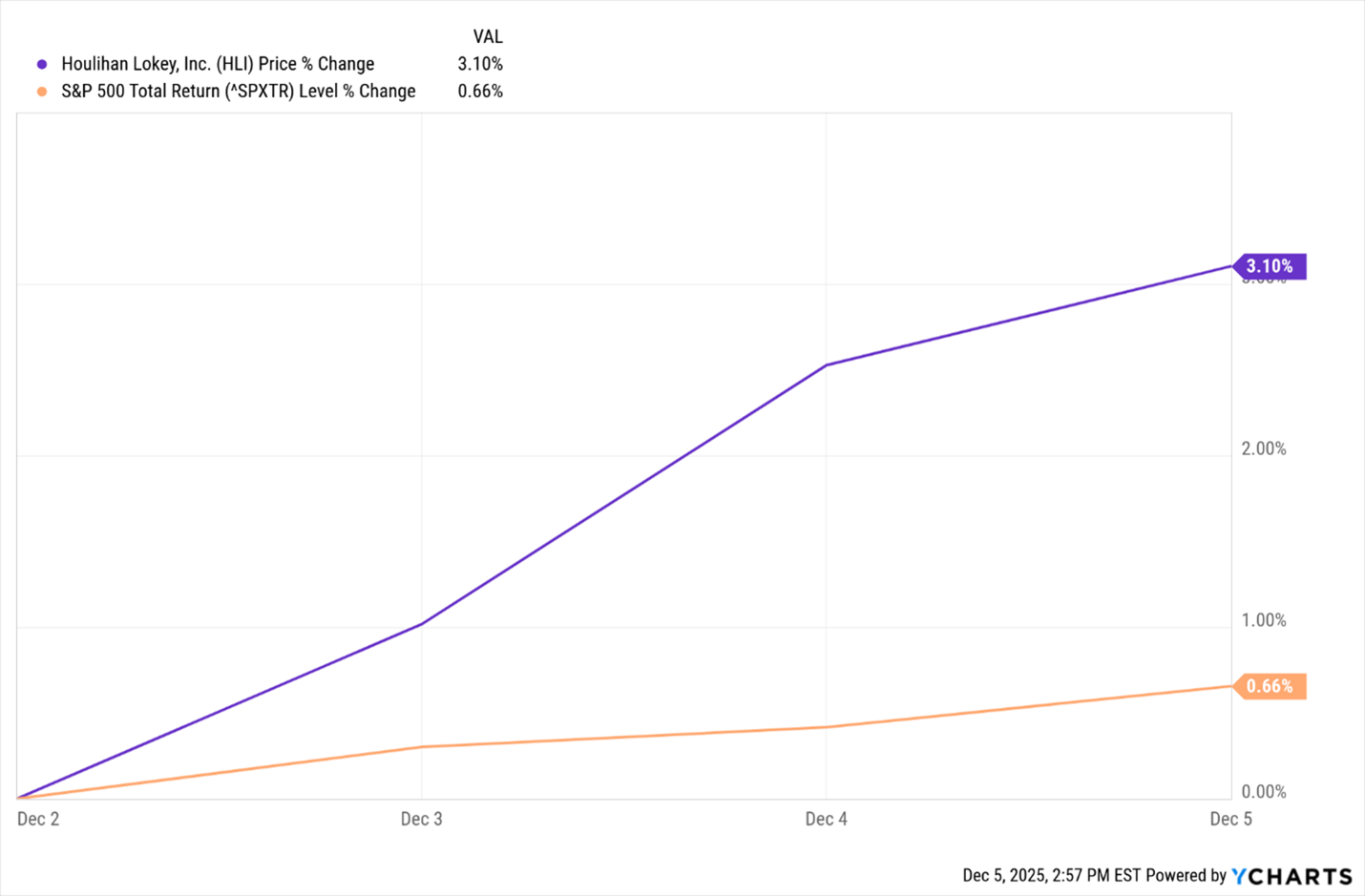

Once that news hit the tape, the stock did this last week.

The two firms are partners as well as competitors on M&A deals.

So, Goldman has a unique telescope into its business.

But maybe that’s not the whole story.

You see, the day after this pick came out, Goldman announced that Houlihan Lokey will be presenting at Goldman’s Financial Services Conference today.

Their close relationship — partners and competitors — got us thinking.

Is this a case of Goldman talking its book … i.e., they already own it and want YOU to jump in and drive up HLI’s shares …

Or is it a bit of a distraction while they buy something else?

Good thing we have the Weiss Ratings. Those let us do a deep-dive into any publicly traded stock in North America.

Here’s what we found when we went looking for answers about Goldman, HLI and more.

The Case for Investment Banks in 2026

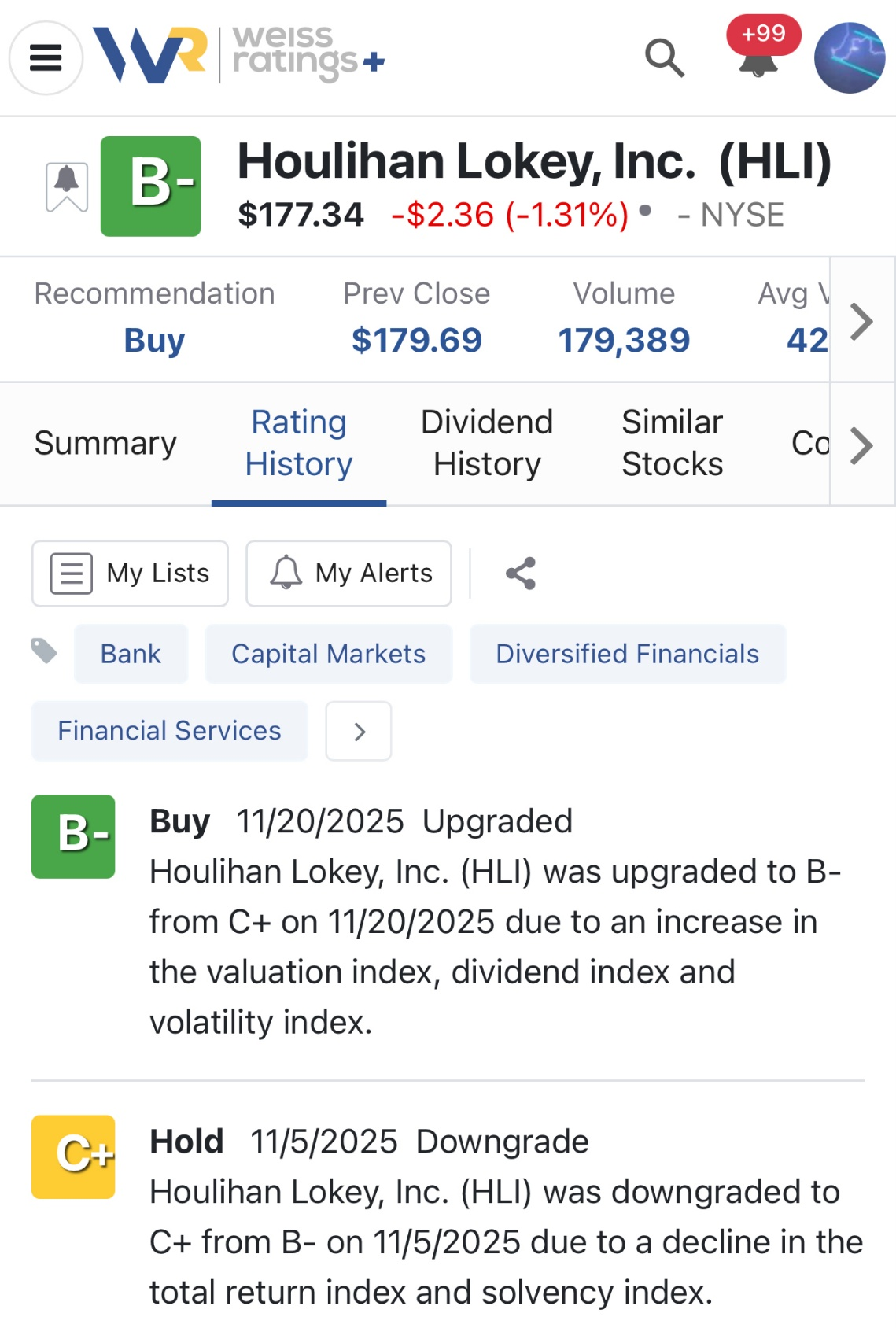

Specifically, I consulted Weiss Ratings Plus.

That’s our premier investment tool. One that gives members the keys to our 10+-terabyte financial database.

That database holds a century’s worth of data. And it gets updated every single day that the markets are open.

Everyone can see a stock’s rating on our website at any given time. So, it can pay to visit WeissRatings.com every day, to see what’s new.

There’s also a much-easier way …

Only Ratings Plus members can see a stock’s Rating History, Dividend History, Financials, etc. … and how they all add up to form a stock’s Weiss rating.

We recently upgraded HLI from a “Hold” to a “Buy.”

So, at least Goldman is seeing the same kind of profit potential we do from its pick.

But why did the giant investment bank target another investment bank in the first place?

Turns out, there is a pretty compelling argument for the kind of services Houlihan specializes in.

It is the largest mergers and acquisitions, or M&A, adviser in the world:

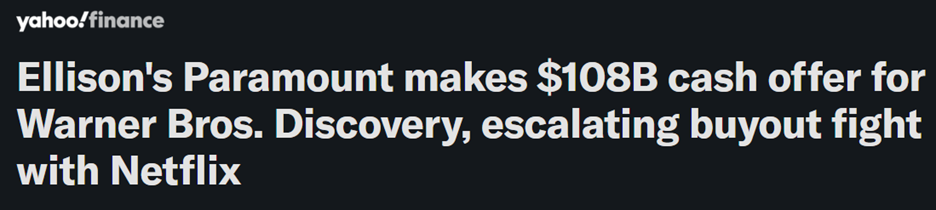

And as we’ve seen with recent M&A activity like Paramount Skydance’s (PSKY) hostile takeover bid for Warner Bros. Discovery (WBD) …

The latter of which had JUST agreed to an $80 billion deal with Netflix (NFLX) …

There’s plenty of money sloshing around in this sector:

Where does Houlihan Lokey fit in?

It doesn’t appear to be working with any of the media companies in this corporate triangle.

But Houlihan DOES handle the most M&A traffic. At least, by number of deals. (Goldman leads in deal value.)

But is HLI the best of the bunch?

Here, we turn to our Weiss stock ratings again.

As it turns out, HLI does rank pretty high among Weiss-rated investment banks.

In fact, it’s only outshined by JPMorgan (JPM), which is currently rated “B+” by Weiss.

The Goldman recommendation of Houlihan, however, focused on one of its other businesses.

That is, HLI is a major player in the deal-restructuring market.

Houlihan doesn’t just work on new M&A deals. It also works with companies that are undergoing bankruptcy.

Those companies come to Houlihan, and a few other specialty investment banks, to help guide them through that process.

Here are the top five deal-restructuring advisers:

Now, that’s interesting to us over here at Weiss.

That’s because, if 2026 comes with any market downturns …

Or we see an increase in corporate debt problems …

This group would be one to watch.

In that list, you see UK-based Rothschild. But there’s also a handful of U.S.-based advisers worth looking into.

Here, Houlihan really does stand out, with the only Weiss “Buy” rating in the bunch!

So, despite the potential for a conflict of interest, Goldman’s top pick passes our scrutiny.

If you’re looking to add a strong financial stock to your portfolio, you might want to consider HLI here.

Especially since some of the air came out of it during yesterday’s downdraft. Shares ended the day on Monday at $177 and change.

That’s about 33% below Goldman’s $237 target for HLI.

Of course, if you want to see how you can do even better than that, I recommend you attend our upcoming live event with Gavin Magor.

Gavin is our director of research and ratings.

And one week from today, he will announce a major upgrade to our Weiss Ratings.

He’s calling it Weiss 3.0.

There’s only one way to see how it carries the Weiss legacy forward.

And that’s to grab your seat for that event here.

It begins promptly at 2 p.m. on Tuesday, Dec. 16.

To your health and wealth,

Dawn Pennington

Editorial Director