Why Today’s Tech Supercycle Is Just Hitting Its Stride

|

| By Dawn Pennington |

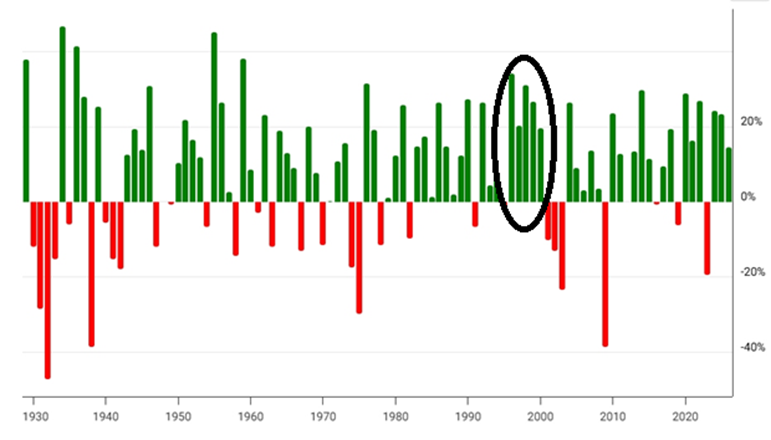

We just wrapped up three back-to-back years of double-digit gains for the stock market.

And 2026 has been no different. Stocks continue to set records.

That said, it’s unusual for the market to have four such years in a row.

The last time that happened was from 1995-99, with gains of 34%, 20%, 31%, 29% and 19%.

That period occurred amid surging computer use and the rise of in-home internet.

Many comparisons have been made between today’s AI boom and the Dot-Com Boom of the 1990s.

Most of those comparisons have focused on the stock market’s returns.

However, the real story remains the fact that we’re in a massive supercycle.

First, let’s quickly look at why that’s SO important …

4 Historical Supercycles

Supercycles aren’t daily occurrences. They occur in stages and can last for years.

In the past 150 years, at least four major supercycles were recorded.

Each one roughly coincided with periods of rapid industrialization in the global economy:

- The first supercycle started in the late 1800s, fueled by U.S. industrialization and the use of oil in manufacturing, shipping and cars.

- The second supercycle started in the 1930s, driven by global rearmament before the Second World War.

- The third supercycle started in the 1960s, driven by the reindustrialization of Europe and Japan.

- The fourth supercycle started in the late 1990s — see those gains above — with the adoption of the internet.

Every one of these led to world-changing investment gains … at least in specific stocks tied most directly to the supercycles themselves.

Think railroads 150 years ago, U.S. companies during the geoeconomic shift in the post-war period, etc.

We are in the “Fifth Supercycle” right now.

As in past supercycles, this is a period of rapid technological changes and surging worker productivity.

And yes, there’s plenty of wealth to be made in the right investments along the way.

In fact, we could be entering the part of the cycle with some of the strongest and most lucrative returns.

Investors simply need to recognize today’s cycle and where it’s headed.

And from there, they need to look beyond the big tech names that have dominated the stock market index for some time.

The Makings of Today’s Supercycle

The current tech supercycle, often called the "AI Supercycle," has several defining characteristics:

Foundational Technology Shift: We're seeing a fundamental shift in how we live and work thanks to generative AI and large language models (LLM).

These tools are becoming core infrastructure, similar to how mobile or cloud computing transformed technology in the 2010s.

This isn't just incremental improvement … but a new computing paradigm.

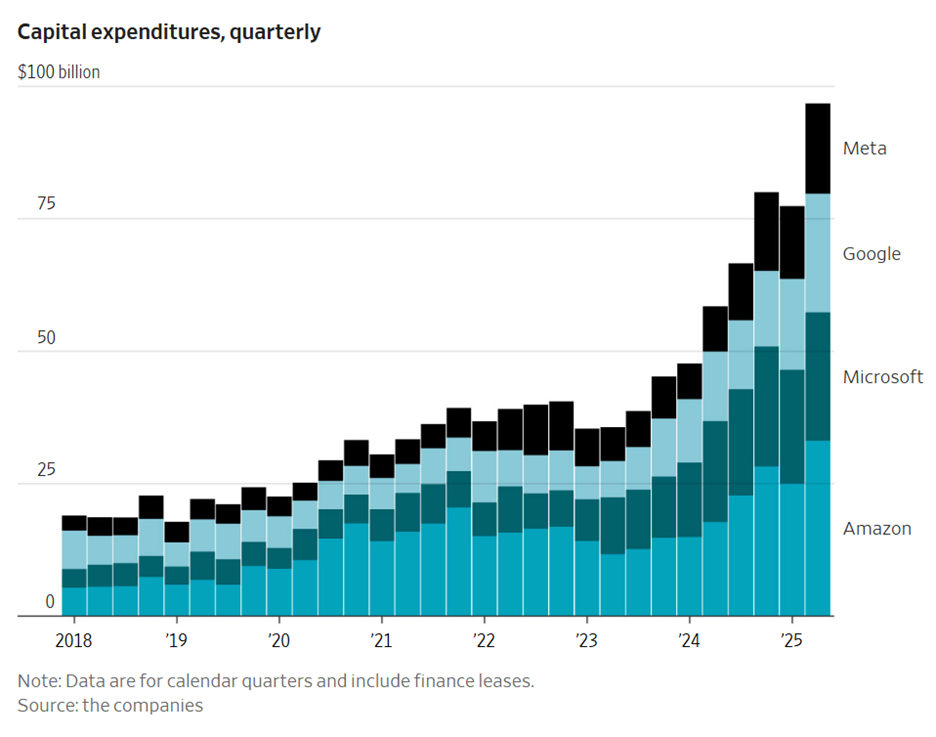

Massive Capital Investment: There's unprecedented capital expenditure in AI infrastructure — data centers, GPUs and energy capacity.

The “Mag 7” companies are spending hundreds of billions collectively on compute infrastructure.

Microsoft alone spent $80 billion on data centers in 2025.

Meta raised its capex spending on AI to $72 billion for 2025 and noted 2026 would be even larger.

Most projections show this spending will continue for years.

Shortages are starting to be seen in critical components such as semiconductors and computer memory chips.

That’s benefitting smaller companies, many of which can see massive growth in the next few years, dwarfing the returns of the Mag 7 plays in 2025.

Broad Application Layer: Unlike previous cycles focused on specific use cases, AI is being integrated across virtually every sector simultaneously.

That includes everything from enterprise software and healthcare to creative industries and scientific research such as researching new drugs.

Whether a company is an “AI play” or not, it can benefit from new AI tools.

That’s a clear analogy to how every company could benefit from computers and the internet during the Dot-Com Boom.

Competitive Dynamics: We're seeing intense competition right now among major AI players such as OpenAI, Anthropic, Google and Meta.

But that’s just scratching the surface.

There are thousands of startups and established companies racing to incorporate AI capabilities. And today’s winners face more intense competition than ever.

Yes, some of these technologies will go by the wayside — remember Netscape? But the improved quality of life will remain.

Energy and Infrastructure Constraints: The cycle is bumping against real-world physical limitations.

That includes power grid capacity, chip manufacturing and cooling systems.

These limitations create bottlenecks that drive further innovation in energy efficiency and chip design.

Regulatory Attention: Unlike some past tech cycles, this one has attracted immediate government and regulatory interest globally.

Regulators have questions about safety, copyright, labor displacement and market concentration arising in real time rather than retrospectively.

That could create more dynamic investment opportunities for companies that can favorably address those concerns.

Productivity versus Employment Tension: There's active debate about whether AI will primarily augment human workers or displace them, with different implications for economic growth and labor markets.

So far, a decline in entry-level jobs at companies shows the displacement — with productivity gains from existing workers showcasing the augmentation.

That goes to show that your job may be in danger. But not all is lost.

Investments aligned with the rollout of AI could create the wealth you need for financial freedom.

That’s why Sean Brodrick is about to release his latest research on this supercycle — the Fifth Tech Supercycle in U.S. history.

Sean will break down how, based on the historical pattern, today’s AI boom is still alive and well — and how some of the best opportunities are ahead.

But you need to attend the virtual event on Tuesday, Jan. 20, at 2 p.m. Eastern.

To make the list and get your link, click here.

To your health and wealth,

Dawn Pennington

Editorial Director