|

| By Tony Sagami |

It was hard work, but the pay was fantastic. I’m talking about my summer job as a longshoreman at the Port of Tacoma docks.

One of the most backbreaking jobs I had was transferring hundreds, maybe thousands, of heavy cases of frozen New Zealand lamb chops and frozen lobster tails from the ship’s cargo hold onto shipping pallets, which were then forklifted onto the trailers of awaiting semitrucks.

This was back in the 1970s, and I was paid $13-something an hour, smashing the $2.65 minimum wage most of my college friends were making.

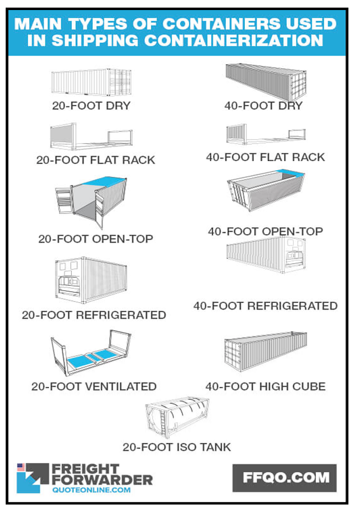

Most of the shipyard unloading and loading jobs no longer exist today because of 40-foot intermodal shipping containers.

Intermodal containers were built to be moved by various forms of transit, able to be easily picked up from ships and dropped on trucks or trains without loading or unloading the contents. Goods moved faster and costs were reduced as fewer workers were required throughout the process.

Click here to see full-sized image.

Before shipping containers, cargo was just put in the hull of ships and had to be offloaded by hand. Moreover, the cargo needed to be sorted by destination. This was a time-consuming, labor-intensive task.

The impact of shipping containers was revolutionary for the global shipping industry and led to explosive growth.

Malcom Who?

Malcom McLean was a high school-educated truck driver from North Carolina and may be one of the most important people you’ve never heard of.

McLean owned a successful trucking company and purchased a steamship transportation business in 1956. What he did was load the entire truck container, along with the goods still inside, onto his ships. His genius was combining two modes of freight: trucks and ships.

He later standardized the size of the steel containers, which could be stacked neatly on ships, as well as trucks and railroad cars.

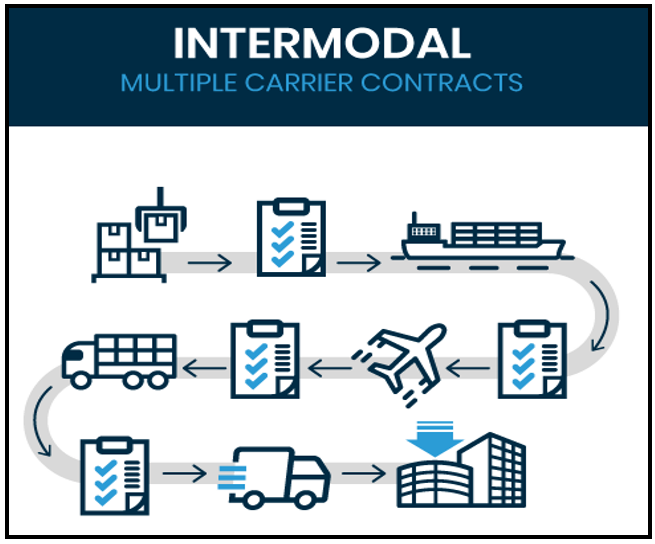

McLean’s standardized shipping containers could be moved easily and seamlessly between trucks, ships and trains. This simplified the global shipping process and revolutionized international trade.

Shipping containers cut the cost of shipping by half … or more … because before containerization, goods had to be unloaded and reloaded at every stop along the supply chain.

Containers can be stacked on top of each other, making it possible to greatly expand the amount of cargo a ship could carry. Without shipping containers, the number of packages and shipments sent would be a lot less than what ships are sending today.

Click here to see full-sized image.

Shipping containers ensure less chance of damage, theft and loss. For example, some of the senior longshoremen used to “accidentally” drop a box of lobster tails, which promptly disappeared into their car trunks.

Standardized shipping containers are one of the most important business innovations in the past 50 years.

Container ships are just one of three major shipping vessels:

1. Bulk carriers are used to transport loose cargo such as grains, iron ore, coal, cement mix, fertilizer and more.

2. Tankers transport liquids like oil, vegetable oil, liquified natural gas and chemical gasses.

3. Container ships carry the finished goods that you and I use every day.

So, how can you profit from the container industry? There are several shipping companies that specialize in container shipping:

• Global Ship Lease (GSL) is a London-based shipper with 65 containerships.

• ZIM Integrated Shipping Services (ZIM) is one of the largest container shipping companies with almost 100 vessels.

• Danaos Corporation (DAC) owns a fleet of 71 modern containerships.

I’m not suggesting that you rush out and buy one of those stocks tomorrow morning, but I want you to remember that global commerce breaks down into two basic functions: makers and takers.

Everything we use from cars and lumber to eggs, tennis shoes and electronics is made by someone. And then those goods must be transported to stores where consumers can purchase them.

My experience is that investor portfolios are filled with makers, but most are light or empty with takers. Don’t let that be you.

All the best,

Tony

P.S. If you enjoyed this issue, check out Resource Trader, which includes tailored picks from my friend and colleague Sean Brodrick. Members of his service are currently sitting on open gains of 16% and 5%!