|

| By Martin Weiss |

When I see all the wild, wild things happening in Washington today, the warnings of two wise men echo in my mind.

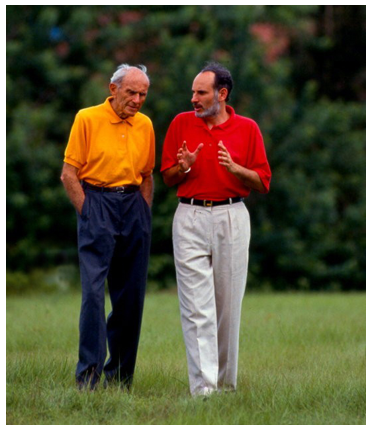

The first was Irving Weiss, my father.

He founded the Sound Dollar Committee and helped President Eisenhower balance the federal budget.

He was a legendary trader, probably the only man in the world who made a fortune by shorting the stock market as it crashed in the early 1930s and …

Then made another fortune by buying blue-chip stocks for pennies on the dollar when the Dow touched rock bottom in early 1933.

I don’t know what he would say about today’s fiscal and geopolitical crises.

|

But before he passed away, I had a quiet chat with him that throws light on the subject.

“Dad,” I said, “you’ve had some amazing successes in your career. Big trading successes. Amazing predictions that came true. But through all those years, what would you say was your single biggest mistake?”

He had to think about it for a few moments. But then, with a twinkle in his eye, he confessed, “The biggest mistake I made in my entire career was that I underestimated the sheer stupidity of our government!”

In other words, he never dreamed that the White House, Congress and the Fed would go as far as they did to …

Bail out banks …

Pump up the money supply …

Crush interest rates and …

Print money.

All in their zeal to manipulate the economic cycle!

All without a clue as to how it would impact the future stability and security of the United States!

“In the short term,” he said, “everyone’s happy and Wall Street cheers. But a day of reckoning will come, and the longer it’s postponed, the worse it will be.”

The second wise man I met had a similar perspective.

I met him in October of 2008. Lehman Brothers had just failed. And I was attending a Wall Street Journal economic forum in Washington, DC.

|

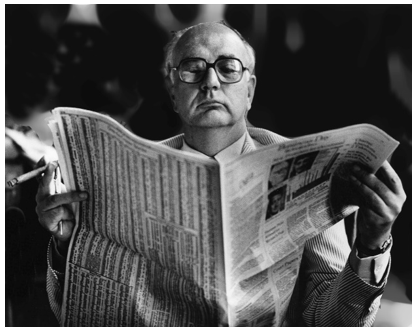

I wandered into the break room. No one was there except one man: Former Fed Chairman Paul Volcker.

We chatted about a mutual friend, and I casually asked him, “What do you think about what the Fed’s doing today?”

He didn’t want to sound critical of the new Chair, but his message was basically similar to my father’s.

“Never in my wildest dreams,” he said, “would I have expected them to do what they’re doing now.”

Like my father, he also underestimated the recklessness — and stupidity — of the authorities.

He also feared a day of reckoning.

But now, with both my Dad and Mr. Volcker no longer with us, I predict that the day of reckoning is near.

When?

Well, based on the latest prediction by the Congressional Budget Office, unless radical changes are made with great haste …

A U.S. government default could happen sometime between July and September of this year!

And it looks like the two wise men were right.

Two men who, in my opinion, had more collective wisdom than virtually any group in Washington today.

Two warnings now coming true!

Two warnings that echo in my mind to this day and tell me it’s time to make some fundamental changes in the way we approach the market.

To learn exactly how I propose to handle the looming dangers, be sure to join me online this coming Wednesday.

I will pull no punches.

I will lay out my vision for the future.

I will share with you a strategy that has had a consistent real-time track record of rapidly building wealth in all market conditions, including big crashes and big rallies.

Just be sure to let me know you’ll be coming with a single click here.

Then, check your email for my confirmation.

Good luck and God bless!

Martin