|

| By Tony Sagami |

He drove a big, white Cadillac with red upholstery and always had a fat cigar in his mouth.

He owned a lumberyard, the only car lot in town and several of the couple of dozen commercial buildings in the small farming town I grew up in.

He kind of looked like Boss Hogg from “The Dukes of Hazzard.” I don’t remember his name, but my father told me that he was the richest man in town.

To a dumb farm kid, he seemed like the richest man in the world.

Who is the richest man in the world? Most people would say Elon Musk, Warren Buffett, Jeff Bezos or Bill Gates.

Nope! The richest man in the world is Bernard Arnault.

Bernard who?

Don’t feel bad if you don’t recognize the name. Bernard Arnault is a French businessperson and the CEO of LVMH, otherwise known as Moët Hennessy - Louis Vuitton, Société Européenne (LVMUY), the largest luxury-products company in the world.

According to a 2022 Bain Luxury Study, the global demand for luxury goods hit $305 billion last year and is expected to reach $320 billion–$330 billion this year.

Even that may be a gross understatement. According to new research from Morgan Stanley (MS), the biggest spenders on luxury goods are South Koreans. In 2022, their total personal luxury goods spending increased by 24% to $16.8 billion.

Click here to see full-sized image.

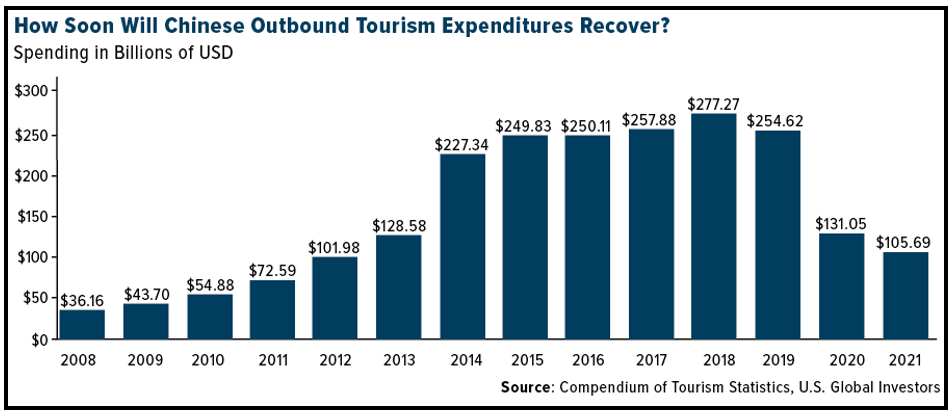

As China reopens, luxury spending by Chinese millionaires will make the Koreans look like penny-pinchers.

The rich are different … and investing in the companies that cater to the wealthy is smart because they are hardly affected by economic slowdowns. They will continue to buy designer clothes, exotic automobiles, top-shelf liquor and jewelry that are worth more than most people’s homes because that’s just what rich people do.

For example, annual champagne sales exceeded $6 billion for the first time ever.

That’s right … $6 billion.

Companies that cater to the rich are making billions. Just ask Bernard Arnault, the new richest man in the world. Investing in catering to the rich certainly worked for him.

You could buy shares of LVMH Moët Hennessy - Louis Vuitton, Société Européenne (MC.PA), which trades on the Paris Stock Exchange and is one of the CAC 40, the French equivalent of the Dow Jones Industrial Average. Or, you can buy it here in the U.S. where each American depository receipt for LVMUY equals 0.2 shares of the Paris shares.

If you’re more of a fund investor, you should take a look at the U.S. Global Investors Global Luxury Goods Fund (USLUX), which holds Hermès, LVMH, Richemont, Estée Lauder and Kering.

I’m not suggesting that you should rush out and buy LVMH tomorrow morning. As always, do your own homework and due diligence beforehand.

But there is no doubt in my mind that investing in companies that cater to the desires of the very rich will make you a lot of money.

All the best,

Tony

P.S. If you enjoyed this issue and would like more picks from me, consider checking out Disruptors and Dominators. Members of my service are currently sitting on open gains of 43%, 41% and 40%!