You Could Have Doubled Your Money on This

|

| By Michael A. Robinson |

Odds are you and I have something very much in common when it comes to a piece of high tech.

It’s a device that I and hundreds of millions of others simply can’t do without.

I use it for AI search, to read the Wall Street Journal every day and to track other news sites.

I often shop on Amazon with it.

I use it to pay to park my car, scan menus, send emails and talk and text.

Of course, I’m talking about my smartphone, which for me is an iPhone Pro.

Here’s the thing. Smartphones are at the center of our lives these days.

There’s just one problem.

They are also magnets for high-tech thieves who want to trick you into giving them access to your data — and your money.

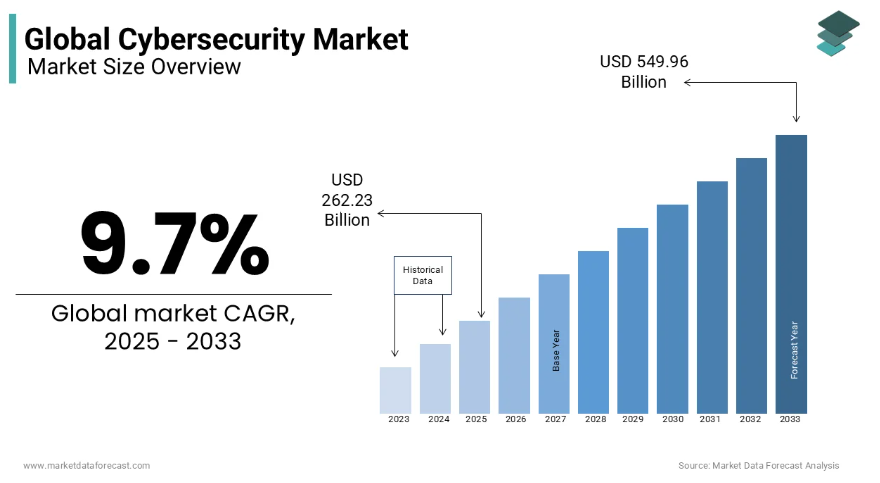

That’s why I’m zeroing in on one tech leader in a sector set to be worth $550 billion by 2030.

Let me show you why this firm is on pace to double its earnings in just over a year …

The Threat Is Real … and Growing

Now then, I’m as cautious about this as I can be.

See, I have a filter to prevent spam messages.

Despite that safeguard, not a day goes by that I don’t get a phishing message.

These are texts that purport to tell me my package is running late or that I have a refund coming … simply “click here” to get your money.

Trouble is, I am far from alone.

The Wall Street Journal recently reported mobile-specific attacks surged 50% in 2024.

We’re not talking about clumsy spam calls. Today’s phone-based fraud uses AI to mimic voices.

They can also craft perfect phishing messages and execute tech swaps designed to steal your digital identity.

These days, the bad guys are getting pretty crafty.

Criminals deploy tools like WormGPT to automate personalized attacks.

They even offer subscription services for aspiring cyber thieves and hackers.

In other words, we’re all in this together.

No wonder researchers at Market Data Forecast say the cyber security field will be worth $500 billion by 2033.

The cost to the global GDP is much higher.

It’s expected to hit $10.5 trillion next year, according to data from the trade journal Cyber News.

Why Identity Is the New Battleground

The fact is most hacks don’t happen through brute force. They happen through identity theft.

And it is quite common in the business world.

Then again, there are millions of targets with smart phones who not only have personal info but also access to their firm’s valuable data.

Hackers look for workers with administrative privileges — what’s called “privileged access.”

If they can trick just one insider, the bad guys get the keys to the entire digital kingdom.

That’s why a field known as privileged access management (PAM) has become the crown jewel of cyber defense.

And there’s one company that stands head and shoulders above the rest.

It has built a platform trusted by the world’s most elite companies.

A Cyber Defense Leader

The firm is CyberArk Software (CYBR), founded back in 1999 by two veterans of Israel’s elite military intelligence units.

Today it’s the global leader in identity security, with a platform that protects both human and machine identities.

That means not just workers and clients, but also bots, sensors and cloud-based tools.

Its client list includes Pfizer, Novartis, AstraZeneca, Qualcomm, Motorola, ConAgra and Hershey. That’s as blue chip as it gets.

Shortly after I first pointed out CyberArk to you last year, it bought Venafi for $1.5 billion.

That helped the company expand into securing the machine-to-machine connections that underpin modern networks.

And it hasn’t stopped innovating.

In 2023, CyberArk launched CORA AI, a hub for identity security that uses generative AI to detect and respond to threats in real time.

CORA doesn’t just stand guard — It can act.

It flags suspicious behavior, resets privileges and even guides IT teams through fixes.

Make no mistake: CyberArk is redefining how companies defend themselves in the AI era.

A Market-Crushing Stock

Here’s where it gets exciting.

CyberArk’s earnings per share soared 63% in the most recent quarter, putting it on pace to double profits in about 15 months.

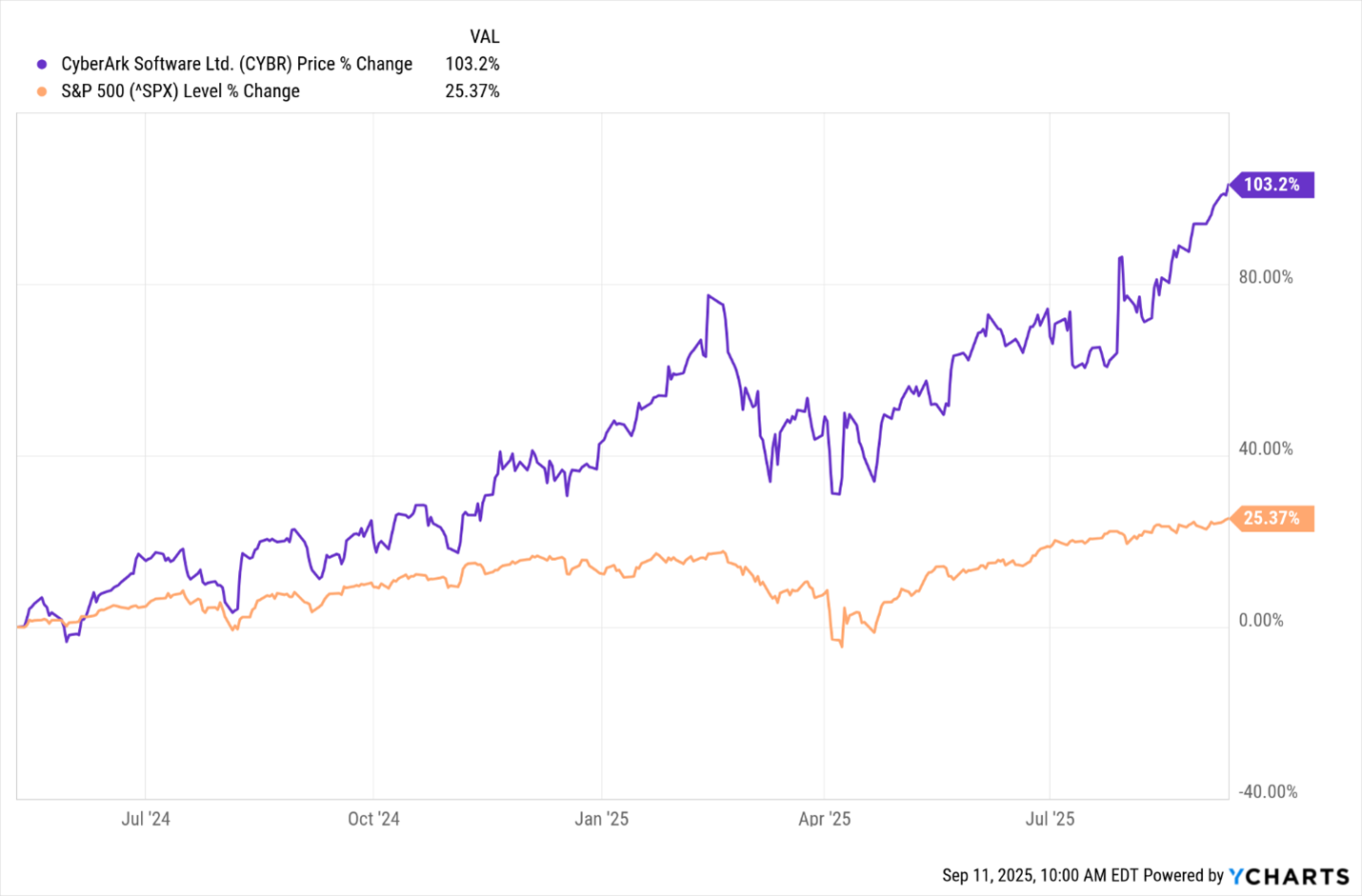

Since I first mentioned CyberArk in May 2024, it has delivered a 103% return, quadrupling the S&P over the same stretch.

And with cyber spending forecasts to hit $550 billion in the next few years, we’re looking at a pretty long runway.

Here’s the key takeaway.

We’re living in a world where cyber criminals are armed with the same AI tools as the good guys.

That makes identity protection the new front line in digital security.

CyberArk is not only defending that line — it’s building it.

With its AI-powered tools, global client list and market-crushing track record, this company is one of the clearest profit opportunities in the market today.

And remember, this isn’t just about playing defense.

For us as investors, it’s about playing offense — turning the rise in cybercrime into a source of long-term wealth.

That’s why I keep telling folks this is a great long-term stock to own.

Best,

Michael A. Robinson

P.S. AI is neither good nor evil. It’s a tool. And as you can see, it is being used by people of all stripes.

But it is also being used by companies of all types, too.

So, to invest in “AI’s Second Wind,” you need to know how to find the right companies that’ll outperform the rest.

Fortunately, we’re offering you the tools to do just that … along with much of the work already done.

If you watch this to the end, you can get the names of three AI stocks set to surge.