|

| By Dawn Pennington |

I hate to be the bearer of bad news, but even “cross-asset” investing is no longer the safe route to take in today’s turbulent markets.

In fact, Bloomberg reported that in August, cross-asset investors — those who tried to diversify away risk by investing in other assets besides stocks — would’ve had the worst monthly performance since 1981!

It’s not just stocks, either. It’s Bonds. Precious metals. Commodities. You name it — they’re all sinking:

- U.S. Treasury notes, when adjusted for inflation, now produce negative returns.

- Gold and silver, former safe-haven assets during inflationary periods, sit near two-year lows.

- And commodities like gasoline, iron ore, rubber and tin are all down double-digits over the past month.

While cross-asset investors have experienced trouble so far in 2022, their cross-asset annihilation is the result of poorly-performing traditional assets across the board.

In other words, they dive headfirst into assets that eventually perform poorly and tank without conducting any research or having much of a strategy.

However, those delving into alternative assets — and going about it the right way — have a different tale to tell.

That’s right … these savvy investors are not only putting the pummeling on pause, but they’re also keeping their portfolios afloat in these choppy markets, all thanks to …

The Alternative Route to Outperforming the Market

Even under fairly normal market conditions, it’s good sense to diversify your portfolio, which broadens investors’ asset and sector exposure while reducing their risk exposure.

But when the market throws curveball after curveball, like it’s been doing so far this year, it becomes a necessity.

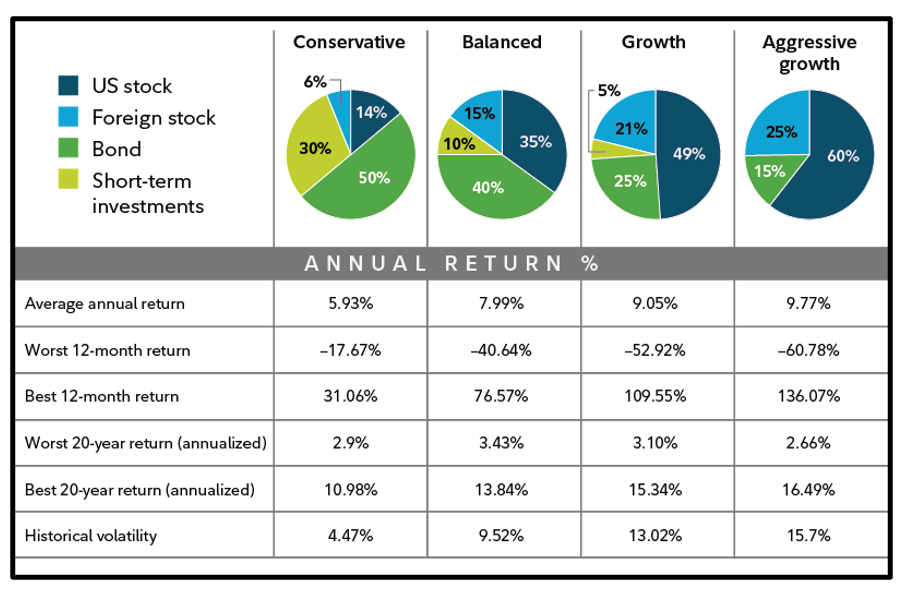

Most investors would do well to have a diversified portfolio, with exposure to large cap stocks, small cap stocks and even bonds.

An example of a starting core portfolio could include some exchange-traded funds with low expense ratios that provide broad coverage of the markets.

Click here to see full-sized image.

The trick, however, is finding exciting new investments ideas that could have the potential to generate very good returns and being able to do so conservatively — for the most part.

It’s all about maintaining a balance of (1) generating good returns and (2) being safe about it and minimizing your risk as much as possible.

Crypto, for instance, is both fairly new and exciting …

Now, I know what you’re thinking — crypto is not conservative. It’s not, but again, it’s how you go about investing in it that makes all the difference.

For example, one strategy would be position-sizing smaller cryptocurrencies. That way, they’re not affecting your total net worth even if they hit zero by the end of the day, which is obviously a worse-case scenario.

Plus, there are the two giants of the crypto universe — Bitcoin (BTC) and Ethereum (ETH) — both of which are here to stay for good.

And if you’re really into the idea of crypto, but don’t want to buy the actual digital currency, you’re in luck. Alternative investments focused on crypto exist, allowing you to instead invest in funds like the ProShares Bitcoin Strategy ETF (BITO), a Bitcoin futures ETF.

While there isn’t a spot Bitcoin ETF based on the actual price of Bitcoin yet, it’s only a matter of time. Once it does happen, you can bet that a lot of money is going to pour into it.

If you want to get even more creative, the thousands of cryptos in the market right now will be joining forces with other sectors in the future. In fact, there are plenty of opportunities found in the metaverse, which has huge reach and a ton of room to grow in the future.

And you’ve most likely heard about NFTs — non-fungible tokens — by now, which are basically cryptographic assets on a blockchain with unique identification codes and metadata used to distinguish one NTF from another.

You guessed it … it’s all tied to the metaverse in a way. According to Entrepreneur.com, “An example of this is the MyMetaverse gaming network, which announced the launch of real estate NFTs to be earned by playing the video game Minecraft, which translates into real estate investment through video games.”

Click here to see full-sized image.

While it may not seem like it, the world of crypto is still in its early adoption stage, especially when it comes to NFTs and the metaverse. But at the same time, all of these really impressive technologies seem to also be moving at the speed of light.

For investors who like to diversify their portfolio and are interested in getting into these new and exciting alternative investments, there are a number of options available. You can basically watch the technology grow and develop along with your returns.

However, if you like to play it a little safer and go with something that passes the test of time, there are a number of asset classes that have been around for decades that offer high returns with low volatility.

This brings me to …

Fractional & Alternative Investing: A Perfect Match

Fractional investing has taken the financial world by storm in recent years.

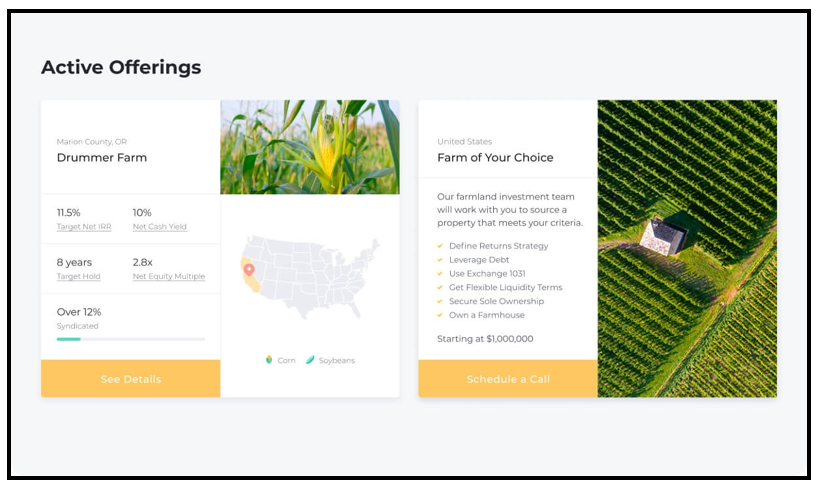

The investing approach allows the everyday retail investor — not just those with ultra-high-net-worth and million-dollar portfolios — to get into those asset classes that fit into the alternative investing category.

It’s where you can invest in public companies, private companies, private real estate, fine art, collectibles and even farmland without needing to break the bank.

Click here to see full-sized image.

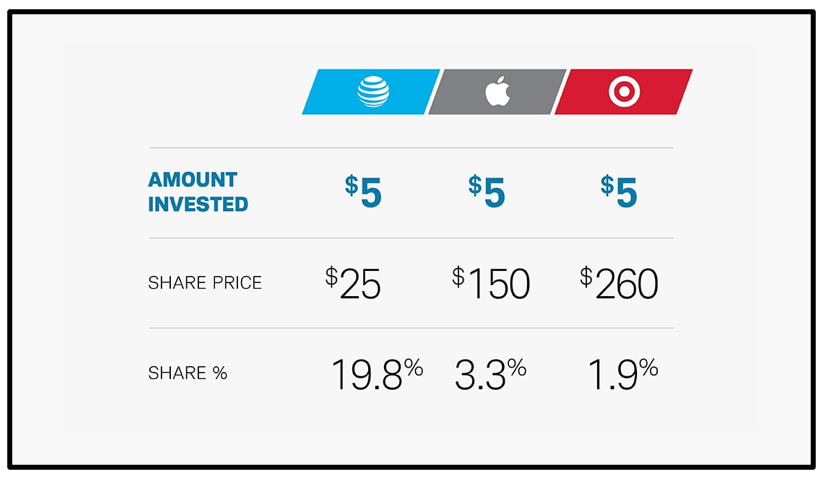

For instance, if you want to invest in a company but its stock price is higher than what you want to pay or can afford, fractional investing lowers that barrier. Instead of buying a whole share, you can buy a fractional share, which is a “slice” of stock that represents a partial share, often for as little as $5.

No matter where you are financially, whether you’ve got that million-dollar portfolio or are just starting out, there’s value in fractional investing because it gives you the freedom to get into various sectors and stocks in a safe, reduced-risk way that won’t hurt your wallet.

Plus, if you’re unsure about a sector’s long-term success but still want to get into it because you see some short-term potential, you can invest an amount that, again, won’t hurt you financially.

If you research about a lot of alternative asset classes that are now offering investors a fractional investing option, you’ll see that some of them have generated enormous returns.

In comparison, cryptocurrencies and other fractional investments in publicly traded companies have generated more conservative returns, but they don’t inflict the pain of big market downturns on investors’ portfolios as significantly and perform very well over the long term.

Bottom line: This all plays into the current safety angle and how to cushion your portfolio as much as possible against current market volatility.

With the right research and strategy, these alternative investments can not only reduce the risk in your portfolio but also increase your returns. That’s a win-win.

One last thing …

A big bear has crashed the market party. And Martin shows you how to treat it like an invited guest. In a new 33-minute video, he reveals a five-step strategy for selecting the weakest large-cap stocks and transforming their declines into major profit opportunities.

The most profitable trade could have turned $10,000 into $230,000 in a single day, while the LEAST profitable could have turned $10,000 into $51,600. Even the AVERAGE gains among these could have turned a $10,000 initial investment into $78,100 in just three trading days.

See how you can put this strategy to work in your own account as soon as today by clicking here.

To your wealth,

Dawn Pennington

Editorial Director