The Dollar’s Quiet Breakdown Prepares to Accelerate

The U.S. Dollar Index ($USD) just hit its lowest levels in four months. While it’s grabbed some headlines, most investors still aren’t paying attention to the bigger picture.

After peaking above 99 in early January, the index has quietly slid about 1.6%, closing last week around 96.3–96.5.

On its own, that move might not look dramatic. But zoom out, and the dollar is down over 10% year-over-year.

That’s a major devaluation for a global reserve currency.

This kind of sustained weakness only shows up at structural turning points in the international monetary system.

And that’s exactly where we are now.

It’s worth noting that a weaker dollar isn’t always a bad thing. At least, not on the surface. In fact, many administrations have deliberately welcomed a declining dollar as a way to boost U.S. exports and rebalance trade flows.

A cheaper dollar makes American goods more competitive overseas. It helps exporters and multinationals’ earnings.

But this decline is proving to be more worrisome, given its fundamental drivers.

What’s Driving the Dollar’s Breakdown?

Several pressure points are converging at once.

Here are the four main ones:

Foreign capital is rotating out.

- China, Japan, Saudi Arabia, Belgium and Switzerland are quietly reducing U.S. Treasury exposure.

- The petrodollar system is showing cracks.

- Global investors are reallocating toward commodities, emerging markets and other currencies.

Safe-haven demand is moving into gold.

- With gold recently pushing through $5,000 and silver hitting multi-year highs, capital is fleeing fiat, particularly the dollar.

Rate divergence is a growing risk.

- If the Fed begins easing while other central banks hold or tighten, the yield advantage that once propped up the dollar evaporates.

Geopolitical instability is accelerating.

- From Middle East flare-ups to U.S.–China tensions to growing skepticism about U.S. fiscal policy, investors are hedging dollar risk with global diversification.

Technically, $USD failed to break above the key 100 level and is now grinding lower.

It’s sitting just above major support at 96.

If that level breaks, a move toward 93.50 — the October 2020 (pandemic) lows — is back on the table.

This is not noise. It’s not a routine pullback.

This is a structural unwind of dollar supremacy.

Digging Deeper into the Dollar’s Decline

This isn’t just about the U.S. dollar.

This is about America’s financial foundation cracking under pressure.

As of December 2025, U.S. national debt reached a record $38.4 trillion.

Not projected. Not theoretical.

That’s what’s on the Treasury’s books right now.

In just 11 months, the U.S. added $2.3 trillion.

That’s nearly $200 billion per month. Even as global capital markets started backing away from our debt.

The backup is visible in Treasury auctions, Fed reports and global balance sheets.

More importantly, it’s following a historical pattern …

A four-stage cycle that’s preceded the fall of every global reserve currency:

- Ascension. Capital floods in. Innovation, finance and trade thrive.

- Overextension. Military expansion. Domestic spending. Exploding debt.

- Silent Exodus. The insiders rotate out quietly. No press releases — just reallocations.

- Collapse. The reserve currency loses global status. Inflation spikes. Confidence breaks.

Spain. The Dutch Republic. Britain. France. All superpower countries have followed this script.

Each lost their reserve status within 36 months of capital flight accelerating.

Now It May Be America’s Turn

Foreign central banks are selling Treasurys.

Even the Federal Reserve had been reducing its through quantitative easing. But now, the Fed is increasingly forced to buy its own debt using printed money.

That’s not sustainable.

That’s terminal velocity.

With America’s total debt load — including corporate, household and student loans — above $38 trillion …

That’s 110% of GDP.

For context:

- Spain defaulted at 200%.

- The Dutch collapsed at 250%.

- Britain lost reserve status at 130%.

And yet, most U.S. investors are still parked in traditional buy-and-hold portfolios filled with dollar-denominated assets that may be structurally compromised.

This Isn’t the End of Buy-and-Hold Investing

But it is the end of blind trust in U.S.-denominated assets.

If your portfolio is heavily concentrated in U.S.-centric equities and bonds, it’s time to reassess.

Not abandon but adapt.

The old rules are being rewritten.

This environment will favor investors willing to do the extra work to stay ahead of structural decline and defend against dollar erosion.

Inflation is not just a CPI print anymore. It’s embedded in capital flight, reserve shifts and global diversification.

Defend Yourself Against the Dollar’s Decline

The hard-asset strategies I’ve outlined remain essential. Demand for gold, silver, platinum and real assets continues to accelerate.

These aren’t fear trades — they’re mathematical hedges against the dollar losing purchasing power.

But now, we must go further.

Foreign Bond Funds & Non-Dollar Assets

Non-dollar-denominated foreign bond ETFs offer a powerful tool for portfolio defense.

These assets diversify political and currency risk. Especially when tied to countries with lower debt-to-GDP ratios and stronger fiscal policies than the U.S.

Look for funds that hold Swiss francs, Norwegian kroner or Singapore dollars — currencies backed by relative fiscal discipline and real reserves.

Defense Stocks: A Bullish Breakout Within a Bearish Shift

As the dollar weakens and geopolitical risk rises, capital is rotating into national security sectors.

Defense spending isn’t optional; it’s strategic.

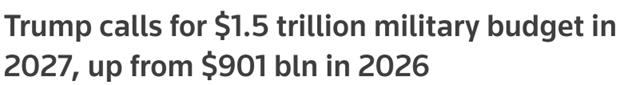

Despite spiraling debt, the Trump administration recently announced its intention to increase military spending by as much as 50%.

One easy way to gain exposure to the potential growth in the industry as a result of this projected spending increase is available through high-Weiss-rated stocks.

Your Best Offense Is a Top Defense Stock

The iShares U.S. Aerospace & Defense ETF (ITA) holds a world-class portfolio of major contractors and aircraft manufacturers.

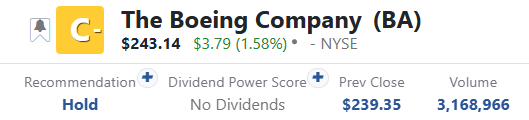

Now, you could pay this “Hold”-rated fund’s fees and get performance that’s weighed down by any laggards.

Or you can bring its list of holdings over to Weiss Ratings Plus and go shopping for high-Weiss-rated defense stocks.

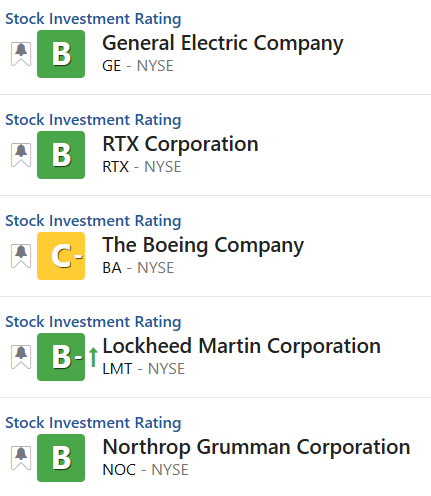

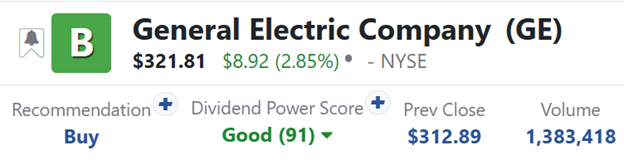

ITA’s top five holdings are General Electric (GE), Raytheon (RTX), Boeing (BA), Lockheed Martin (LMT) and Northrop Grumman (NOC).

All are breaking into new bull markets while much of the tech sector stumbles.

Most have a “Buy” Weiss stock rating.

Though you’ll see from the green arrow next to Lockheed that it was recently upgraded to a “B-” from “Hold.” And Boeing is currently a “Hold.”

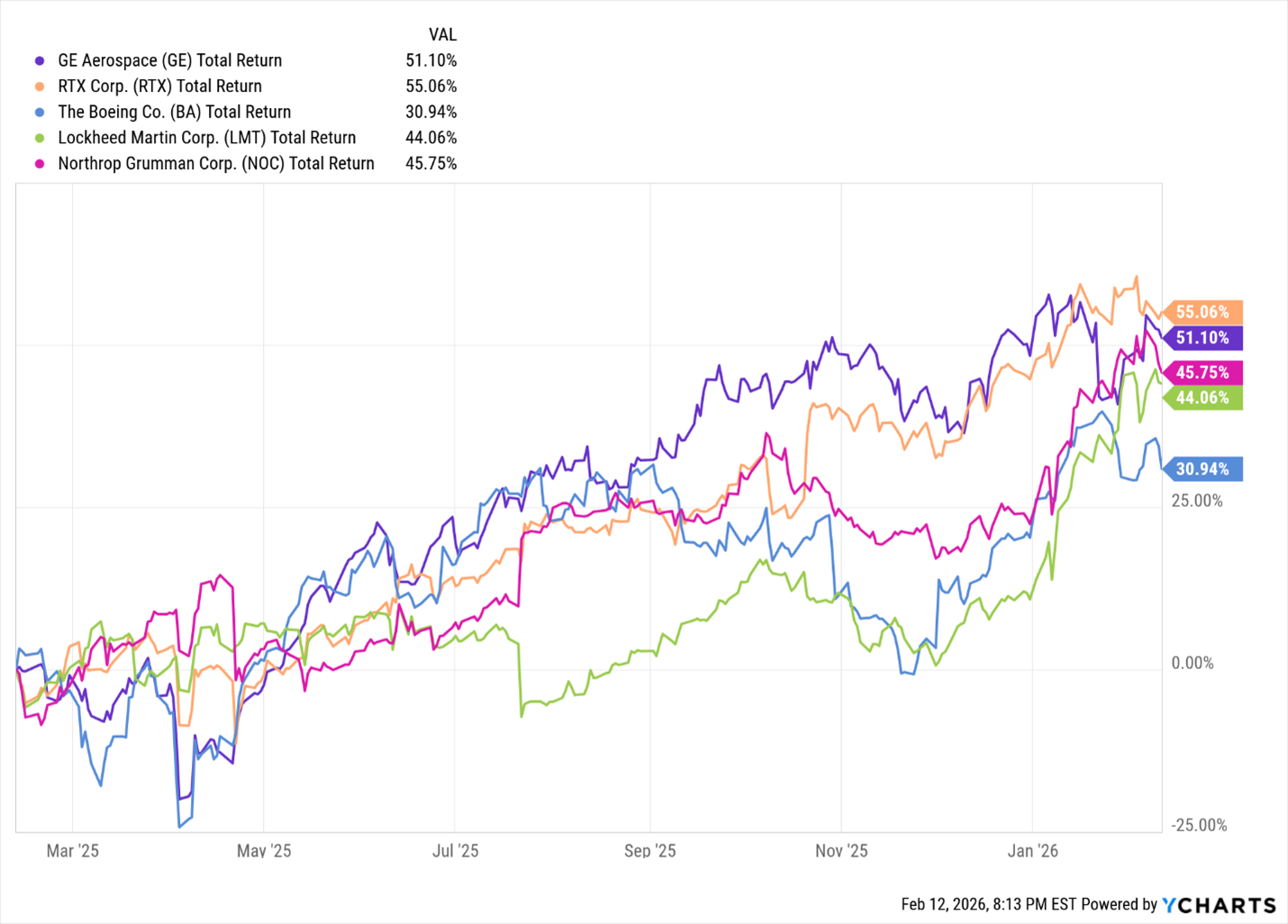

Lockheed and Boeing also gained the least in this group over the past 12 months.

Over the past year, RTX returned 55%, GE gained 51%, Northrop ran up 45%, Lockheed gained 44% and Boeing rose 31%.

Do they have more room to run?

We’d be surprised if they didn’t.

With a proposed 10%+ increase to the U.S. defense budget in FY2027 …

This sector isn’t just a hedge.

It’s a growth engine.

You Can’t Spell ‘Growth Engine’ Without GE

General Electric had a historic 111-year run in the Dow Industrials until 2017.

More impressive, it’s paid a dividend for the better part of 120 years, with exceptions for the financial crisis and restructuring.

GE reinstated its dividend since 2021 and has since raised it.

In fact, it just announced a 47-cents-per-share payout for shareholders of record as of March 9.

That’s up 11 cents from its last quarterly payment of 36 cents.

Does that sound like something you’d want to invest in?

Don’t give me your answer yet.

Not until you see this month’s new release for Ratings Plus members.

Introducing: The Dividend Power Score

This week, the entire Weiss Ratings website got a facelift.

Especially the pages of dividend-paying stocks, which now feature a Dividend Power Score.

GE, for example, has a Dividend Power Score of 91 out of 100.

How did we arrive at that number?

We use three weighted factors:

- Consistency — an uninterrupted and reliable history of dividend payments.

- Payability — things like what percentages of free cash flow and earnings are being sent out in the form of dividends.

- And Dynamic Growth — a strong likelihood for quicker stock price appreciation.

So, knowing about GE’s recent dividend-paying streak …

Along with the big boost it just got …

And seeing its score above 90 …

Can tell you a great deal about a potential investment in this stock.

Now let’s compare GE’s Dividend Power Score of 91 to the other top defense stocks we talked about earlier:

- Northrop: 85

- Lockheed: 81

- RTX: 74

Meanwhile, Boeing doesn’t pay a dividend at all.

While anyone can see our upgraded website, only Ratings Plus members can see a stock’s Dividend Power Score.

Clearly GE has the highest Dividend Power Score of this group, at 91.

That’s just above the minimum 90 threshold for picks in our brand-new Weiss Income Multiplier publication.

Yet, after running our proprietary model and getting its results …

GE didn’t meet our other strict criteria to join the first round of recommendations that we released today.

Here’s how you can get your hands on those brand-new picks.

Why? Because editors Nilus Mattive and Mandeep Rai only target picks with the potential to pay out more than someone puts in.

They also only target companies that should see both dividend increases but also stock price increases.

They call it the Infinite Income System.

They worked closely with Dr. Martin Weiss to create it.

Martin’s even using his own investment dollars to buy these stocks.

Click this link now to see how this Infinite Income System works.

With the value of your dollars going lower, this is an ideal strategy to meet this moment. See if you agree.

In Summary

The decline of the dollar isn’t tomorrow’s problem.

It’s already unfolding; it’s not going away.

Is the fate of the U.S. and its currency sealed?

Not necessarily, though it will take fiscal responsibility and actions which have not been displayed by leadership in decades.

You don’t need to panic, but you do need to act.

This is a market environment where passivity will punish investors and flexibility will reward them.

History has already shown us what happens when empires overextend and currencies lose global trust.

The signs are here, again.

So, no … this isn’t the end of buy-and-hold investing.

But it is the beginning of a new era — one that favors those willing to reposition, reallocate and protect their capital in smarter ways.

Start there, because the next stage isn’t optional.

To your success,

Dallas Brown

Publisher