Unlock Rating History — Your Key to Predicting Stock Moves!

See the entire ratings history of any stock — exactly when it was upgraded or downgraded, and precisely how the ratings changed over time.

Spot critical trends before the market does. Identify patterns, understand past performance when economic shifts happened and confidently assess future moves. Don’t invest blindly — unlock Weiss Ratings Plus today and get access to Ratings history to start making consistently smarter, more profitable investment decisions.

Unlock Rating History Now

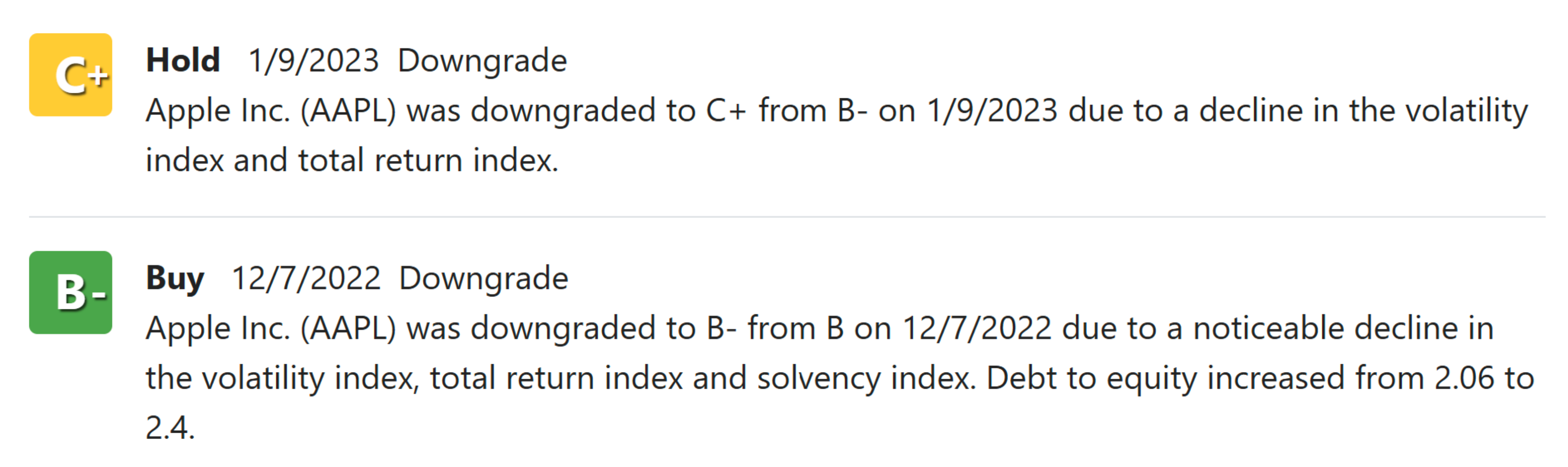

Sample of Rating History from Apple Inc. (February 2025):

Unlock Rating History Now